The consumption of blueberries is rapidly evolving in Italy as well, and the growth in consumption is a clear indicator of this trend.

Consumer behavior shows a growing interest in this product: the dynamics of the purchase process describe buyers who are increasingly attentive to blueberries, which are growing in popularity and making their way into the fruit baskets of Italian families.

However, blueberries are a relatively new product for Italian consumers, and their introduction into purchasing habits has followed different models depending on the socio-demographic conditions.

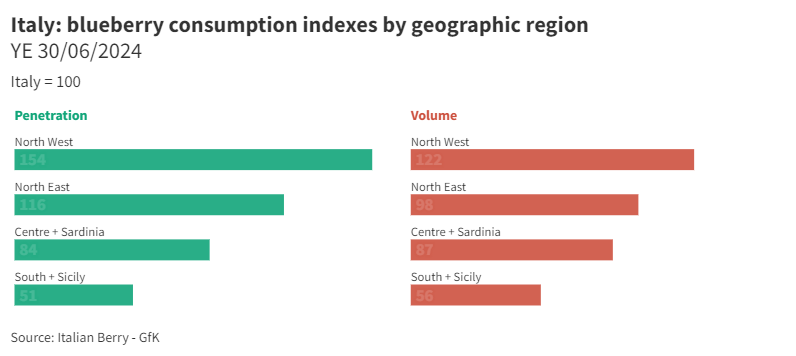

According to the latest Italian Berry - GfK survey (YE 06/2024) geographical distribution, socio-economic class, family size, age of the purchasing manager, and urban context clearly determine the purchasing behavior of blueberries in Italy. The biggest differences are recorded depending on the geographical area and socio-economic class, but other factors also play a significant role.

North-West leads the way

Geographical areas are the factor that most influences the distribution of blueberry consumption in Italy.

The North-West performs well above the national average both in terms of penetration (number of purchasing families compared to the total number of families) and quantity (volume per household per year).

Penetration in this area is indeed 54% higher than the national average, exceeding 40%. This places the North-West very close to the highest penetration levels globally, where countries like the UK and the USA exceed 50%.

In contrast, penetration levels are very low in the Center and Sardinia (23% penetration compared to the national 28%) and in the South and Sicily (14% compared to the national 28%).

Geographical location also creates a strong divide in terms of consumption per family unit.

While the national average consumption is 1.58 kg per family unit, the North-West reaches almost 2 kg (1.93 kg), while the South and Sicily area is well below one kilogram per family per year (0.88 kg). In other words, families in the North-West consume more than twice the blueberries consumed by families in the South and Sicily annually.

The North-East has a penetration rate (32%) higher than the national average, while the quantities consumed are slightly below the Italian average (-2%).

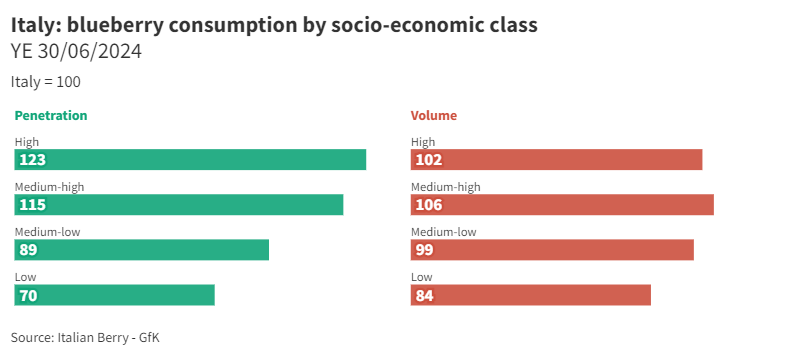

Socio-economic class influences penetration

Socio-economic class is an important factor in the penetration of blueberries in Italian families, while it plays a more marginal role in the quantities purchased per family unit.

The penetration of consumption refers to the percentage of families that purchase blueberries. High penetration indicates that blueberries are widely accepted and consumed, while low penetration may suggest economic, cultural, or awareness barriers.

Specific socio-economic factors

Families belonging to higher socio-economic classes may be more likely to consume blueberries for various reasons:

- Economic availability: Blueberries can be relatively expensive compared to other fruits, so families with higher incomes are more able to afford them.

- Nutritional awareness: People with higher education levels are often more informed about the health benefits associated with consuming blueberries, such as antioxidant and anti-inflammatory properties.

- Healthy lifestyles: Families with a higher socio-economic status may be more inclined to follow balanced diets and include blueberries in their daily nutrition.

Barriers for lower socio-economic classes

On the other hand, families with lower incomes may face several barriers:

- Cost: The high price of blueberries can make them less accessible.

- Limited awareness: Less exposure to information about the benefits of blueberries can reduce the propensity to purchase.

- Spending priorities: Families with limited budgets might prioritize cheaper, more basic foods.

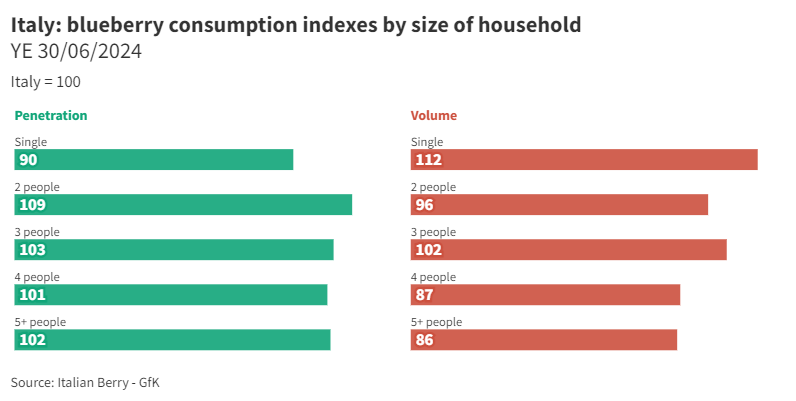

Large families, small consumption

According to Istat (2023), "families in Italy, stable compared to the past two years, are 25 million and 700 thousand and are made up of 2.3 members on average." Single-person households, constantly increasing, make up a third of the total (33.3%); couples with children, once the most numerous family type, are 33.0%."

Southern Italy and the Islands have the highest incidence of large families (respectively, 7.3% and 5.2%). The concentration of single-person households is highest in the northern regions, particularly in the North-West (36.0%) and the Center (35.2%).

The majority of families, 62.8%, are made up of a single family unit; these are mainly couples with children, making up 33.0 percent of the total families, while one in ten families is a single-parent unit, predominantly single mothers (8.2%).

For the Italian blueberry consumer, family size does not significantly influence penetration, but it has a negative effect on consumption: the larger the family, the lower the annual consumption.

What could be the reasons for this inverse correlation?

- Food budget: Larger families need to manage a larger food budget. As a result, they may have to reduce the quantity of blueberries purchased to allocate resources to other basic foods needed for all members.

- Cost of blueberries: Considering that blueberries can be relatively expensive, larger families might purchase smaller quantities to reduce expenses.

- Consumption distribution: In larger families, the amount of blueberries consumed per person might be lower compared to smaller families, where each member can consume a larger share of the total purchased.

Therefore, a family of 1-2 people might afford to consume blueberries more frequently and in larger quantities, as the cost is distributed among fewer people. Conversely, a larger family, despite being able to purchase blueberries, might do so in smaller quantities or less frequently to balance the overall food budget.

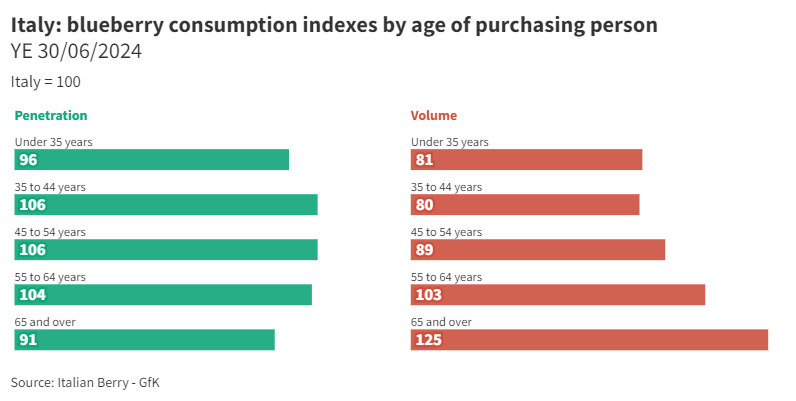

Blueberries in Italy are not a young person's fruit

Blueberries in Italy are known across different age groups, and the differences in penetration (percentage of buyers out of the total) do not vary significantly with the age of the purchasing manager.

However, the age of the purchasing person has a direct influence on the quantities purchased per family unit.

As the age of the purchasing person increases, so does the annual consumption.

On average, Italian purchasing families buy 1.58 kg of blueberries a year. If we analyze the distribution by age, the range goes from 1.26 kg for those under 44 years old to almost 2 kg for those over 65. Buyers between 55 and 64 have purchases similar to the overall Italian average.

Blueberries preferred in metropolitan areas

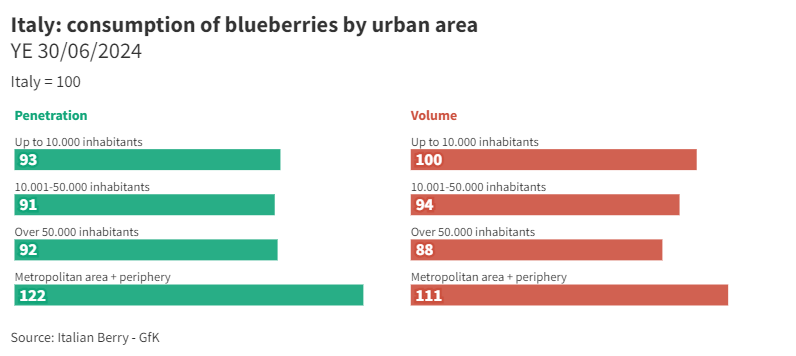

The penetration and consumption of blueberries in Italy is significantly influenced by the urban context of residence. Metropolitan areas and their suburbs register peaks in both penetration (22% higher than the national average) and volume purchases (+11%).

Smaller urban areas, however, record results below the Italian average in both penetration (with a gap between 7% and 9% compared to the national figure) and quantity purchased.

Large urban environments favor greater interest and consumption of blueberries, probably due to a greater availability of the product, greater awareness of health benefits, and a greater propensity to purchase fresh fruits compared to smaller urban contexts.

The GfK panel survey is conducted using the HomeScan methodology, with a tool that allows optical reading of EAN codes as well as integrating the survey with other essential information (Channel, Brand, Receipt information, specific questions to the purchasing manager). The survey is conducted continuously and therefore allows the study of purchasing behavior evolution over time, providing a comprehensive interpretation of the behavior of Italian families.