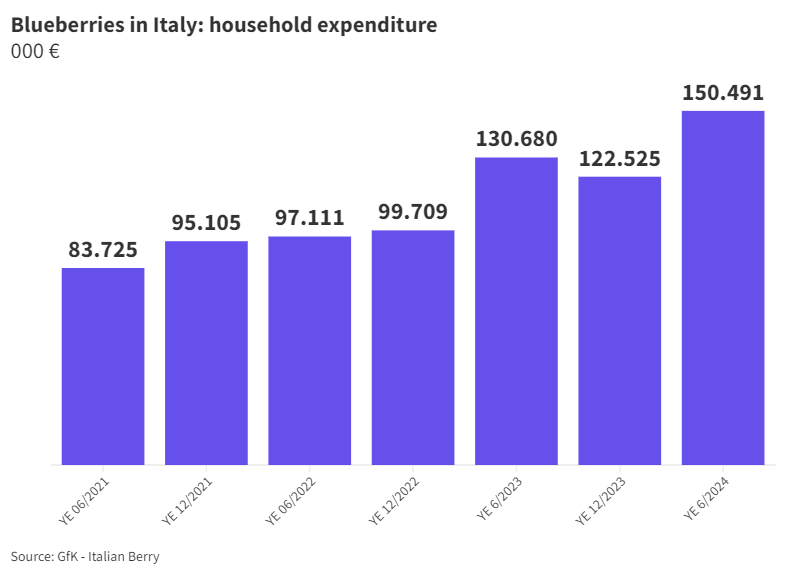

Household purchases of blueberries in Italy have increased by 15.1% over the past 12 months. The market value has indeed risen from €130.7 million to €150.5 million. The data is current as of 30/06/2024 and collected by GfK for Italian Berry from a representative panel of Italian households.

This confirms a trend that has led to an 80% increase in blueberry spending over the last three years, from spending at €83 million back in June 2021.

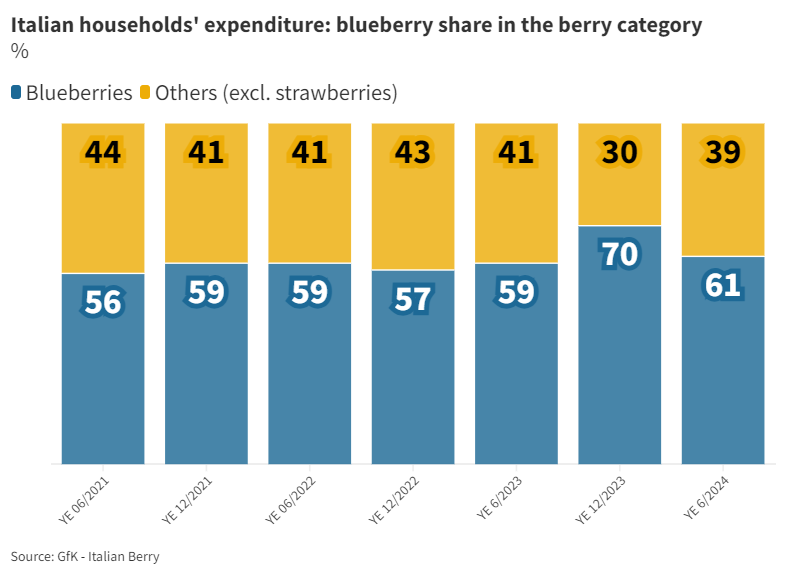

Blueberries represent a growing share within the basket of berries for Italian households: the volume share is 65% and the value share is 61%.

Over the past three years, there has been a gradual shift in preferences among Italian households, with an increasing preference for blueberries over other berries.

Growing Number of Buying Households

The increase in spending on blueberries by Italian households is driven by several factors. The most significant in the last 12 months have been penetration and the number of buying households.

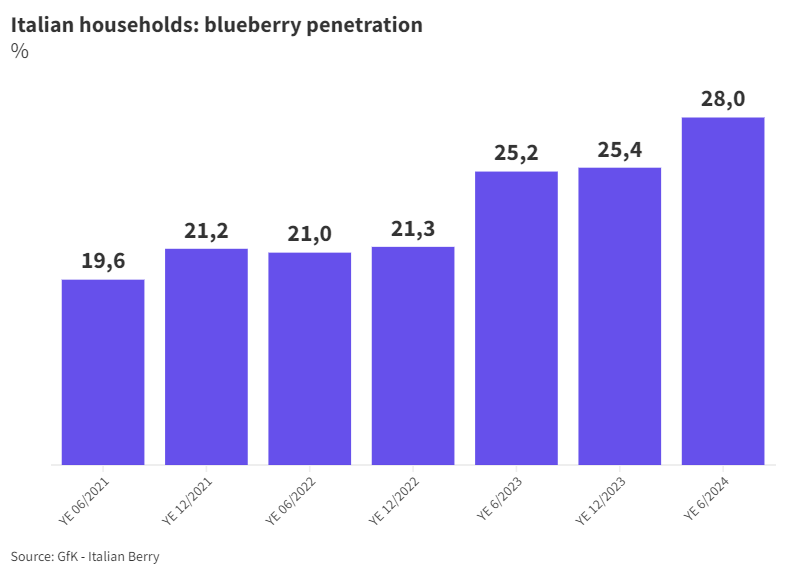

Penetration at 28%

Penetration (the number of households purchasing blueberries at least once a year) has reached 28% in Italy over the last 12 months. This figure has consistently grown in recent years and is a particularly important indicator as it measures how blueberries are becoming part of the shopping basket for an increasing number of households.

Overall, it can be assumed that penetration has not yet exhausted its upward potential: on one hand, the Italian blueberry buying base has steadily grown in recent years, starting from 16.5% in 2020 and exceeding 20% in 2021. On the other hand, a 50% penetration target is reasonable, which has already been reached and surpassed in several countries, including the United States, the United Kingdom, Poland, Germany, and the Netherlands).

More than two-thirds of buying households (68%) show a higher propensity to purchase and consume blueberries twice or more during the year, with a stable trend over the past two years. The repeat rate indicator places blueberries at the highest level within the berry category, leading the second place, raspberries, by 15 percentage points.

Increasing Consumer Base

An increase of 2.4 percentage points in penetration adds to a 1% increase in the total number of Italian households, which, as of the end of June 2024, stands at 25.8 million (compared to 25.6 million in the previous 12 months).

Overall, the number of Italian households consuming blueberries in the past 12 months has grown from 6.4 million to 7.2 million, with a net increase of 694,000 households (+12.3%).

Average Prices Above €13/kg

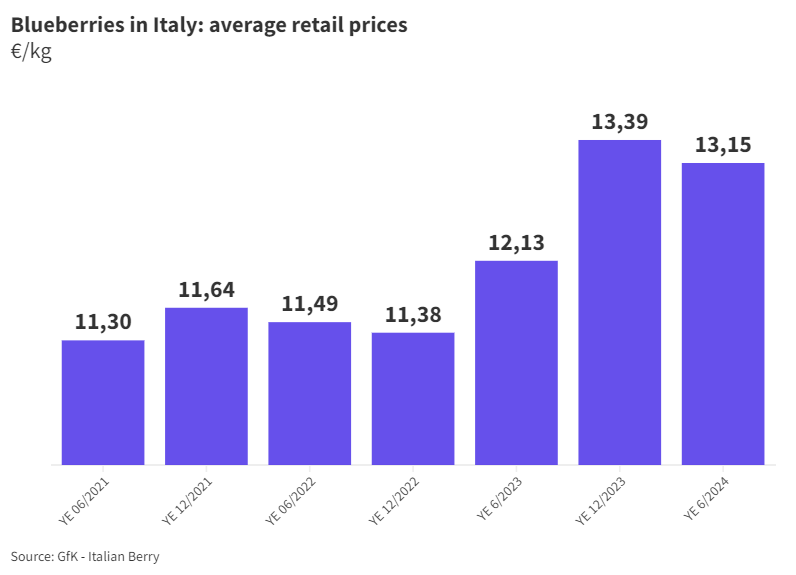

While according to Istat, prices for food, household, and personal care goods have increased at rates lower than 2% in June 2024 compared to the previous 12 months, the average price of blueberries has risen by 8.4% compared to the previous 12 months. It now stands at €13.15/kg, slightly below the historical high reached in 2023 (€13.39/kg).

Over the past 3 years, the average retail prices of blueberries have increased by an average of 5.2% per year, which is significant considering that in 2020 they were €10.72/kg.

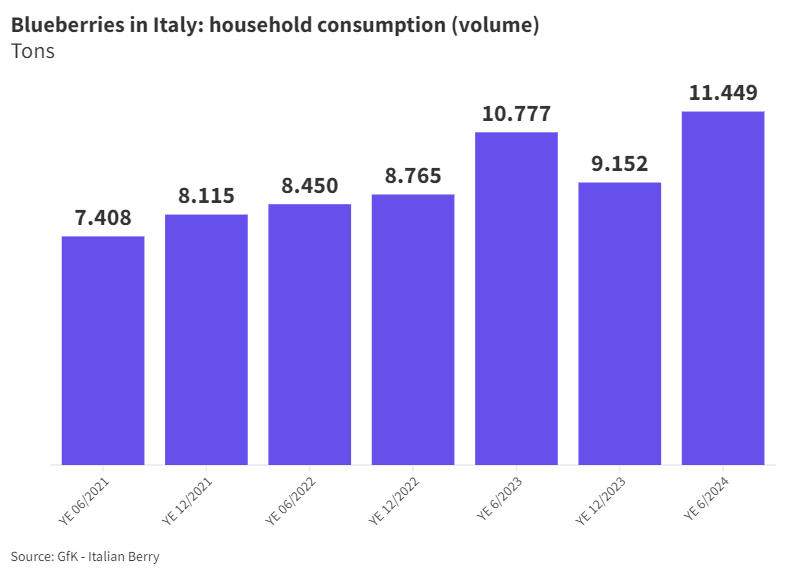

Purchased Quantities Also Increasing

The price increase (+8.4%) alone does not justify the increase in spending on blueberries by Italian households (+15.1%): an important component is also a 6.2% increase in quantities, which have risen from 10,776 tons to 11,448 tons over the past 12 months. This amount corresponds to over 330,000 packages of 125g or 42 tons per day purchased by Italian households.

The GfK panel survey is conducted using the HomeScan methodology, which involves an optical reading of EAN codes and integrates the survey with other essential information (Channel, Store, Receipt Information, specific questions to the purchaser). The survey is conducted continuously and thus allows for studying the evolution of purchasing behaviors over time, providing a comprehensive view of Italian household behavior.

Image by Ri Butov from Pixabay