According to the latest Italian Berry - GfK survey (YE 06/2024) in the past 12 months, 7.2 million Italian households have purchased blueberries at least once, with a penetration rate of 28%. This means that currently, there are 18.5 million households that do not purchase blueberries. On the other hand, among the purchasing households, over a third (68.1%) have bought blueberries at least twice.

What are the characteristics of these households and how do they behave in the purchasing process?

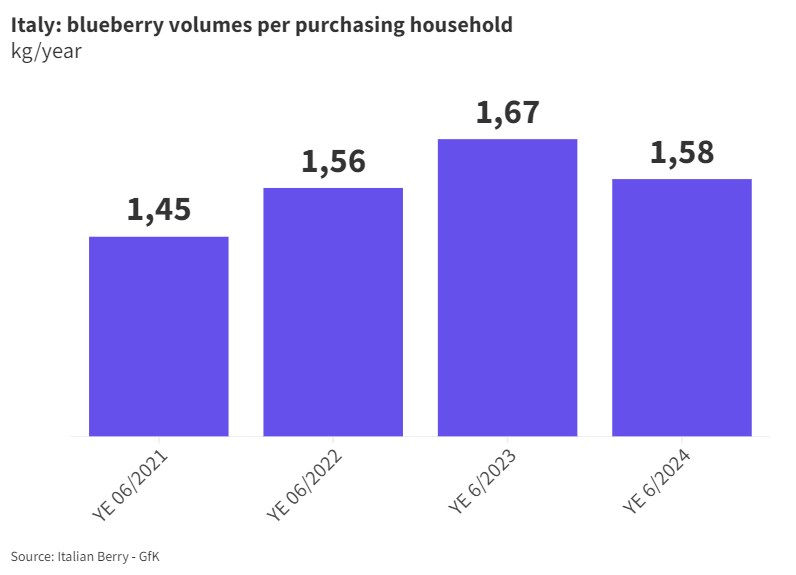

Exceeding 1.5 kg per year

From a quantitative point of view, the purchasing household has bought an average of 1.58 kg of blueberries in the past 12 months. The average quantity purchased per household has been gradually increasing in recent years.

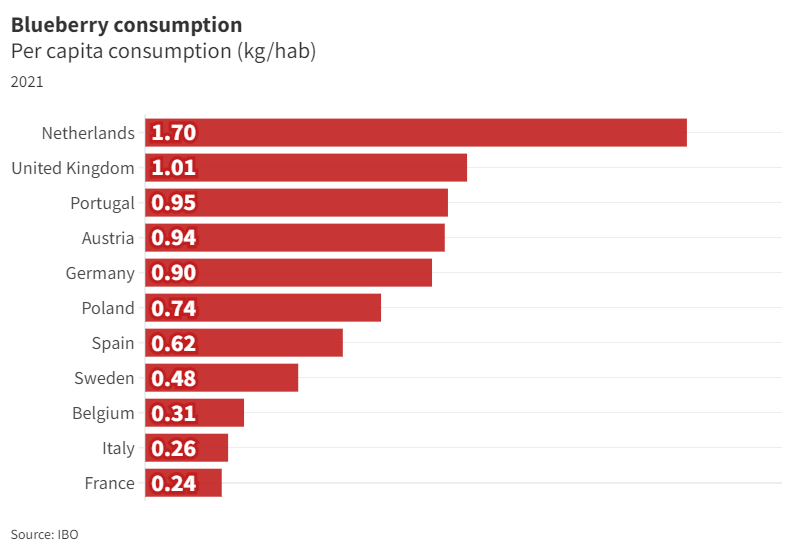

With an Italian population of 58.8 million, the estimated per capita consumption is 194 g. According to data published in 2023 by the International Blueberry Organization, this figure places Italy at the bottom of the European consumption rankings, with the Netherlands and the United Kingdom exceeding 1 kg per capita, while several countries with various sizes and traditions of berry consumption, such as Portugal, Austria, and Germany, are well above 500 g.

In general, in Italy, berries and blueberries have not been the subject of institutional promotion campaigns (as in the United Kingdom and Poland) nor a particular focus from supermarkets (as in the Netherlands and Germany), and this can explain the poor results achieved in the Italian market.

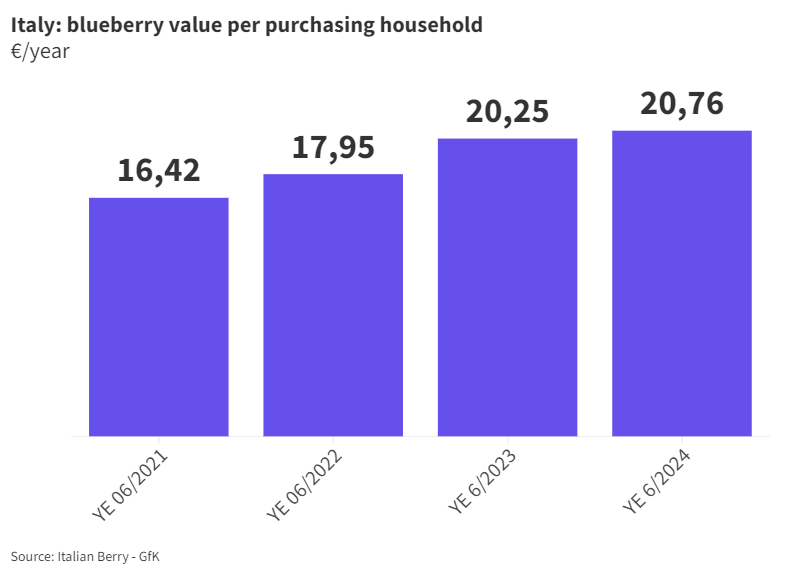

Annual expenditure over €20

The annual expenditure on blueberries by Italian households has exceeded €20 in the past 12 months, with a slight increase compared to the previous period (+2.5%) and a 26% increase over the past 4 years.

The annual expenditure on blueberries (€20.76) is almost double that of raspberries (€11.23) in the period from 01/07/2023 to 30/06/2024.

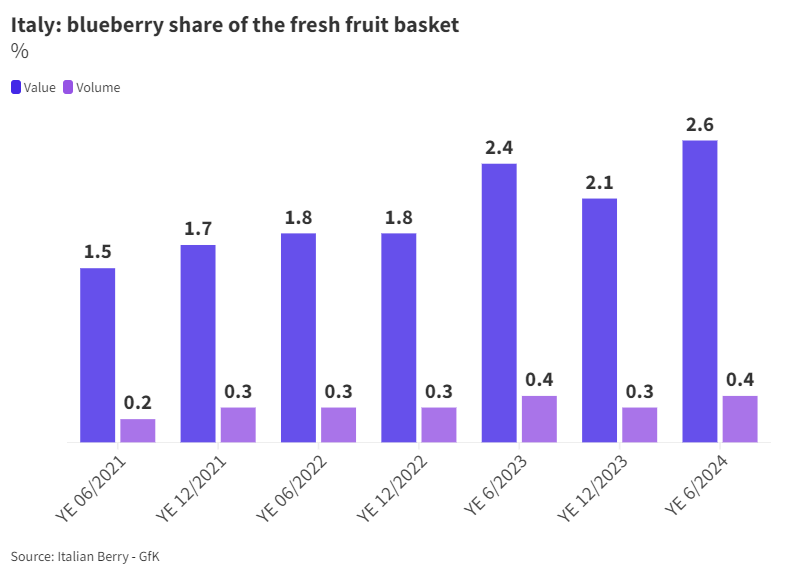

Blueberries in the fruit basket

While fresh fruit consumption is decreasing (-12% in quantity over the past three years), blueberry consumption is increasing, capturing a growing share of household spending on fresh fruit.

In the past three years, the value share has increased from 1.5% to 2.6%, with a percentage increase of 73%.

During the same period, the quantity share has doubled, rising from 0.2% to 0.4% of the total fresh fruit expenditure of Italian households.

Shopping blueberries every two months

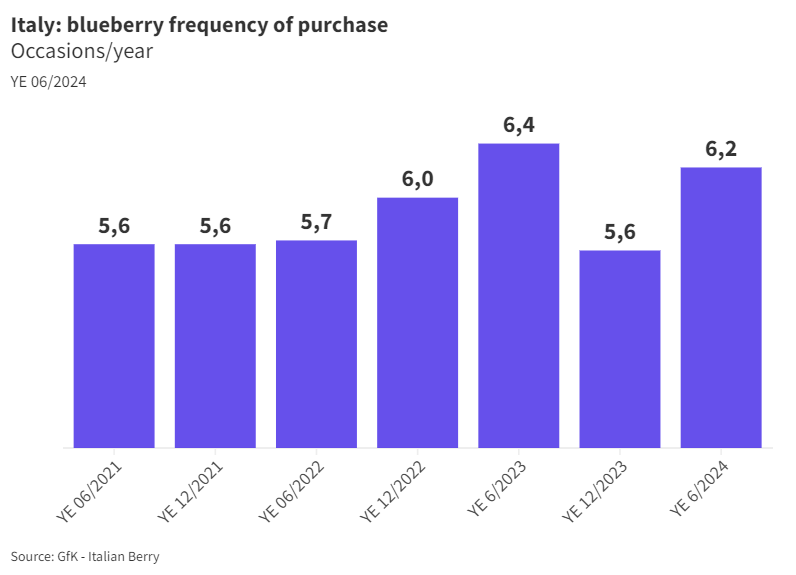

Another indicator of the growing interest of Italian consumers in blueberries is the purchase frequency, which measures consumer loyalty. Customers who purchase frequently are usually satisfied with the product or service and tend to prefer it over competing products.

The purchase frequency of blueberries by Italian households has increased from 5.9 occasions per year to 6.2 purchase occasions in three years, with a generally increasing trend over the period.

In other words, while fruit is purchased every week (51.6 times a year), blueberries are purchased on average every two months. Thus, households that buy blueberries put them in their shopping cart only once out of every eight fresh fruit purchases.

The reference format is 250 g

We have seen that the annual purchase is 1.58 kg: this means that, with a purchase frequency of 6.2 times per year, the Italian consumer buys an average of 250 g each time. This can mean that they typically buy two 125 g baskets or one 250 g basket.

In general, it can be stated that the 125 g format is not the best for the purchasing habits of the Italian consumer. Formats larger than 250 g are generally too big for the current habits of the average Italian consumer.

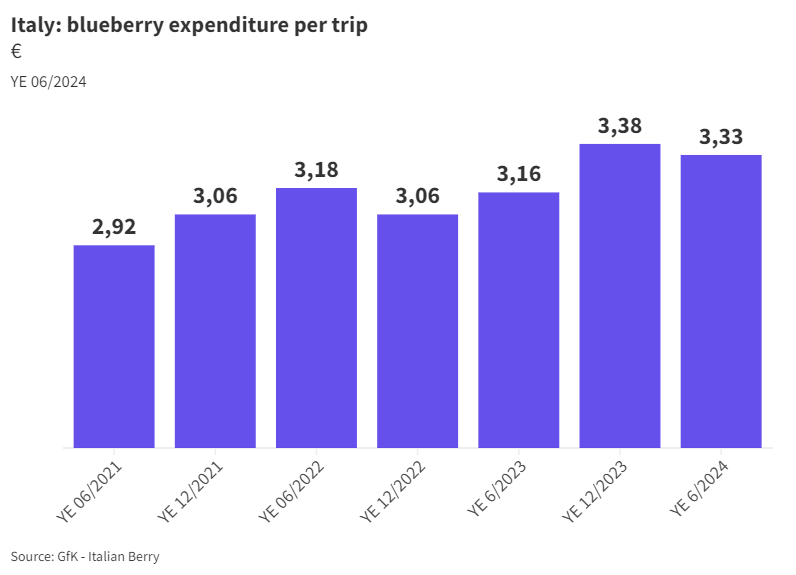

The average expenditure per trip exceeds €3

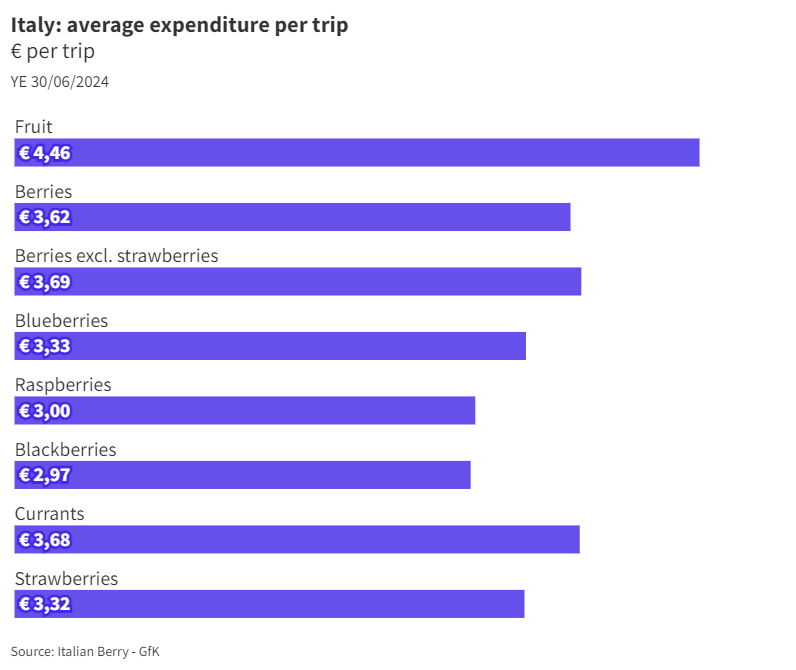

In the past three years, the average spending on blueberries per purchase act by Italian households has been around €3, with a tendency to increase.

This compares to an average receipt of €4.46 for fruit purchases and is similar to that of strawberries (€3.32).

The GfK panel survey is conducted using the HomeScan methodology, which allows the optical reading of EAN codes as well as the integration of the survey with other essential information (Channel, Brand, Receipt Information, specific questions to the purchase manager). The survey is conducted continuously, allowing the study of purchasing behavior evolution over time, providing a complete picture of the behavior of Italian households.