According to a recent report by The Grocer, in 2025 blueberries overtook apples in the UK fruit department revenue ranking, exceeding £750 million in retail spending.

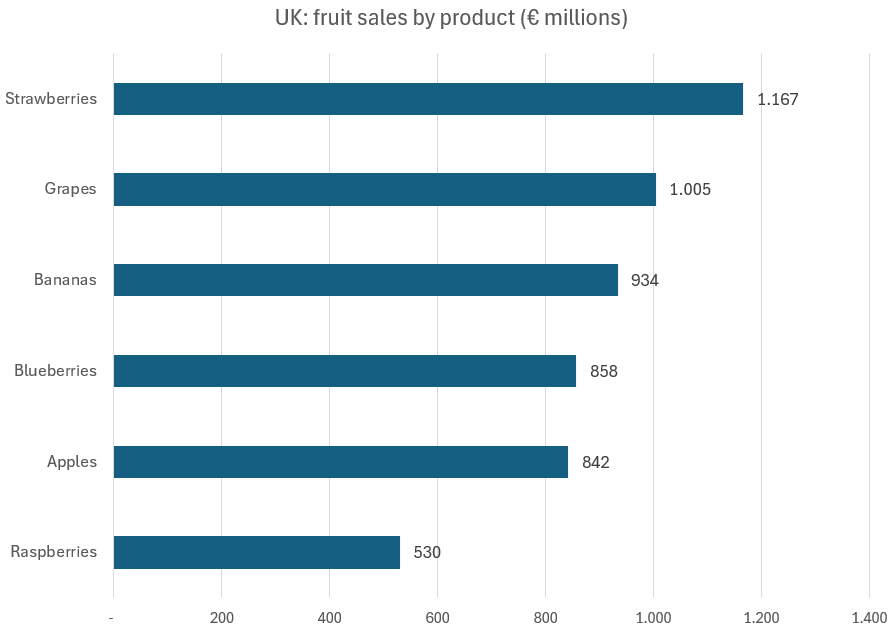

At the top of the fruit category, which overall is worth almost £7 billion, the queen of berries is confirmed: the strawberry. Driven by a spring and summer marked by record-breaking high temperatures and low rainfall, strawberries recorded growth of 13.9%, surpassing £1 billion in retail turnover (NIQ data, 52 weeks to 9 September 2025) and strengthening a leadership position already held in 2024.

The growing weight of berries in the fruit department

Adding strawberries and blueberries to raspberries, which alone are worth £465 million, brings berries to 32% of total fruit category turnover in the UK. Even without considering blackberries, which have a smaller impact than raspberries, these three products increased from £1.98 to £2.24 billion, representing overall growth of 13%.

Berries and strawberries therefore made a decisive contribution to the performance of the fruit department, which grew overall by 9.1%, growth that falls to 4.9% when blueberries, raspberries and strawberries are excluded.

The possible next overtake: blueberries versus bananas

At this pace, it is plausible to expect that the next “overtake” by blueberries could even come at the expense of bananas, which currently generate £881 million, just 7.5% more than blueberries. Another year of double-digit growth could be enough to lift blueberries onto the podium of the most purchased fruits by British consumers, especially as bananas are showing much more modest growth rates (+1.9% in 2025).

Within the berries category, blueberries stand out for the highest growth rates (+15.6%), with momentum running at twice the speed of raspberries.

Strawberries as undisputed leaders and the comparison with grapes

For strawberries, the record growth of 2025 was not decisive in securing first place, which the UK’s most loved fruit holds firmly, with a lead of more than £142 million over the runner-up, grapes, which reached £881 million in turnover (+9% compared with 2024).

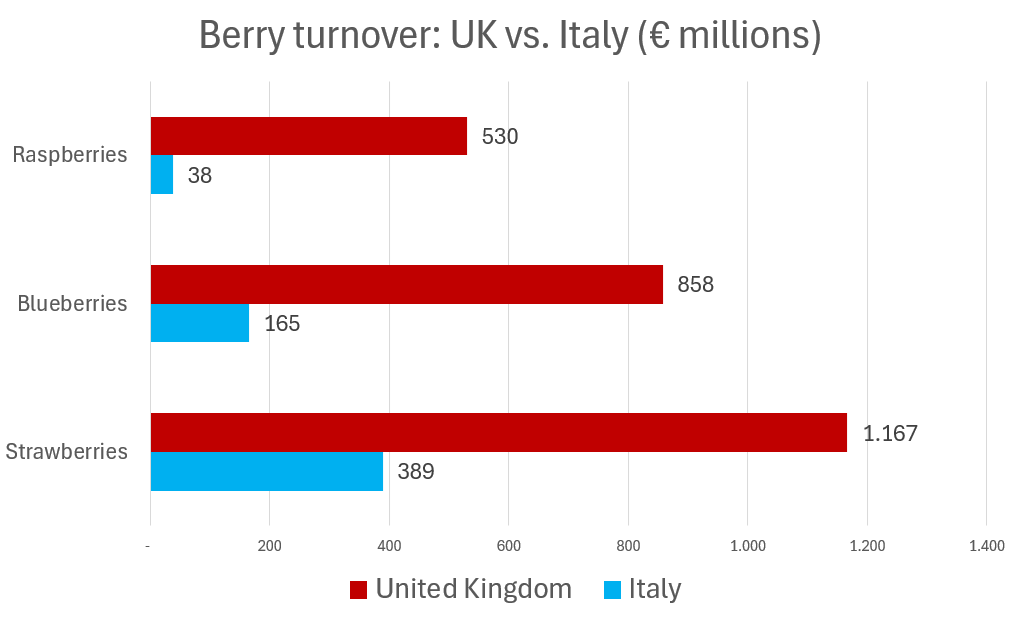

The gap with Italy: numbers that speak for themselves

These figures highlight a significant gap compared with Italian consumption. With a population of 59 million compared with the UK’s 69 million, category consumption in Italy is substantially lower.

Strawberry turnover in the UK is around three times higher than in Italy, blueberry turnover is five times higher, while for raspberries the gap is even wider: the UK sells fourteen times more raspberries than Italy.

Blueberries: the greatest growth potential for Italy

In other words, in the UK strawberries are sold year-round at volumes comparable to those recorded in Italy only in the February–May period, while in less than one month the British market sells more raspberries than are sold in an entire year in Italy.

Looking at the dynamics and characteristics of the Italian market, it is precisely blueberries that show the greatest growth potential. The results of the UK market therefore provide an encouraging signal for future consumption performance in Italy as well: a target of doubling consumption over the next five years appears far from unrealistic.