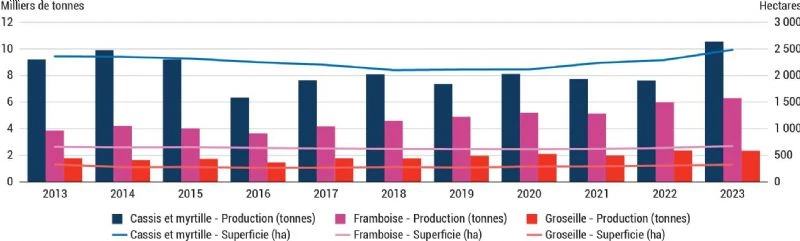

In a global context of increasing production and trade, French production, available mainly between May and September, has remained relatively stable (Figure 5). Blackcurrant and blueberry—grouped in the Annual Agricultural Statistics—remain in the lead, with 8,600 tons harvested on average over the past three years, around 6,600 tons of which are currants destined for processing into liqueurs, syrups, etc.

Estimated French blueberry production is therefore close to 2,000 tons. Raspberry production has shown signs of growth over the past five years, currently reaching an average of 5,800 tons, about 20% of which is for processing.

Finally, redcurrant production remains the smallest, with about 1,000 tons for the fresh market and a similar amount for processing.

Figure 1: Evolution of French red berry production

Figure 1: Evolution of French red berry production

Source: Agreste – Annual Agricultural Statistics

Rising imports

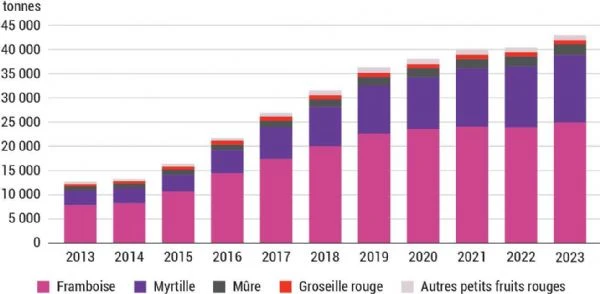

Although French production struggles to show significant growth, French imports, similar to those of Europe as a whole, have shown a sharp increase over the past decade (Figure 6).

Since 2013, the volume of French red berry imports has almost quadrupled, reaching over 40,000 tons in 2023. However, the overall increase in French import volumes has slowed somewhat since 2020.

Figure 2: Evolution of French imports of fresh red berries

Figure 2: Evolution of French imports of fresh red berries

3-year moving average – Source: French Customs

Raspberry remains by far the top red berry imported by France, with nearly 25,000 tons, mainly from Spain (41%) between November and June, Portugal (23%) from May to October, and Morocco (22%) from November to May.

Main imported fruits

Blueberry is the other main red berry imported, currently at nearly 14,000 tons, mainly from Spain (47%) between April and June, and from Morocco (26%) between March and May, but also from Portugal (7%) between June and August, as well as from Peru and Chile (10%) from October to February.

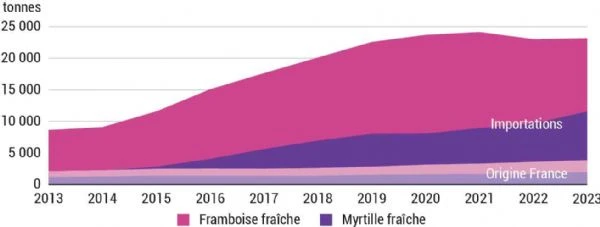

The growth of the French fresh red berry market is therefore mainly due to the increase in imports, given that domestic production has remained relatively stable.

This mechanically leads to a decline in the share of French supply in the market (Figure 7). For raspberries, this stands at an average of 17% between 2021 and 2023, down 8 points from ten years ago. For blueberries, it is also at 17%, compared to 64% in 2014.

Figure 3: Evolution of market size and share of French supply

Figure 3: Evolution of market size and share of French supply

3-year moving average – Source: CTIFL from Agreste-SAA, French Customs

Household purchases

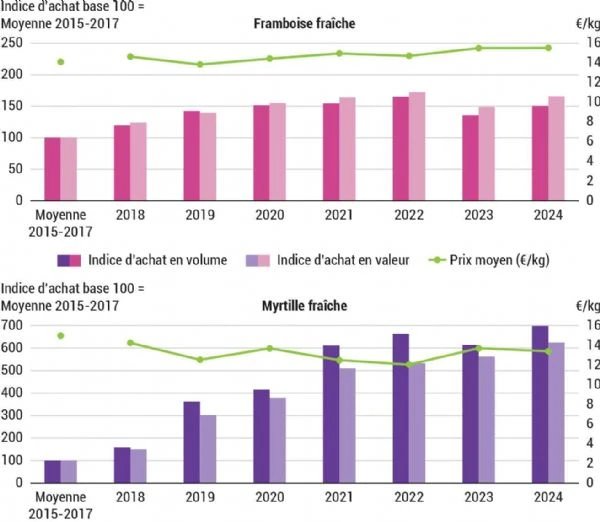

In a French fresh fruit and vegetable market where household purchase volumes have been falling for the fourth consecutive year, the red berry category—led by raspberry and blueberry—stands out for its upward trend in purchase levels.

In the case of raspberry, this growth is measured between 2015 and 2024 at an average annual rate of 6.2% in volume and 7% in value, compared with –1.6% in volume and +1.9% in value for fruit in general.

The growth in raspberry purchases is all the more notable as it has occurred in a context of a rising average price—the increase in purchases in value is indeed slightly higher than that in volume.

The growth in raspberry purchases is mainly due to a steady expansion of the customer base (percentage of purchasing households). This rose from 18% in 2015 to a peak of 28% in 2022.

Blueberry purchase trends

As for blueberry, the growth in household purchases is more recent and even more pronounced. The blueberry customer base reached 16% in 2023, compared with just 5% on average between 2015 and 2017.

The increase in blueberry purchases has therefore occurred at an impressive average annual rate between 2015 and 2024—nearly 28% in volume and 26% in value—while the trend since 2015 has been toward a decrease in the average purchase price.

However, the growth in red berry purchases was interrupted in 2023, in a context of particularly high food inflation.

For raspberry, purchase volumes fell sharply year-on-year (–17%), accompanied by a drop in the customer base for the first time in over ten years (–2 points, to 26% of purchasing households).

Rebound in 2024

The decline in purchases was more moderate in value (–13%), thanks to a rise in the average price (+5%). For blueberry, purchases also saw an unprecedented drop in volume (–8%).

This decline was less severe than that seen for raspberry, thanks in particular to a renewed expansion of the customer base (+0.5 points, to 16% of purchasing households).

For 2024, the question was whether the growth in red berry purchases would resume after a temporary pause, or whether this market would show signs of having more durably reached a saturation point.

The 2024 data, however, pointed toward the more optimistic scenario. Indeed, raspberry purchases recorded a sharp rebound, both in volume and in value (+11%), supported by a customer base that reached a record level (28.8% of purchasing households).

For blueberry, this rebound was even stronger in volume (+14%) than in value (+11%), bringing purchases to their highest level ever recorded (Figure 8).

This recovery in household purchases paves the way for new development prospects for the red berry market in France.

There is indeed room for growth, especially when comparing the apparent per capita consumption in France—below 500 g per year—to levels observed in Northern Europe: over 1.5 kg in Germany and the UK, and more than 2 kg in the Netherlands.

Figure 4: Evolution of French household purchases

Figure 4: Evolution of French household purchases

Source: Kantar; processing: CTIFL

Source: ctifl.fr