Fruit Attraction was an opportunity to bring together the main operators of the global blueberry supply chain and discuss the prospects for the sector.

A panel gathered Steve Magami (CEO, Agrovision), Hector Lujan (CEO, Hortifrut), Vicente Jemenéz (CEO, Surexport), and Theo Lombard (Anlo Farming & Investment) to analyze the key factors driving the short-term development of blueberry consumption.

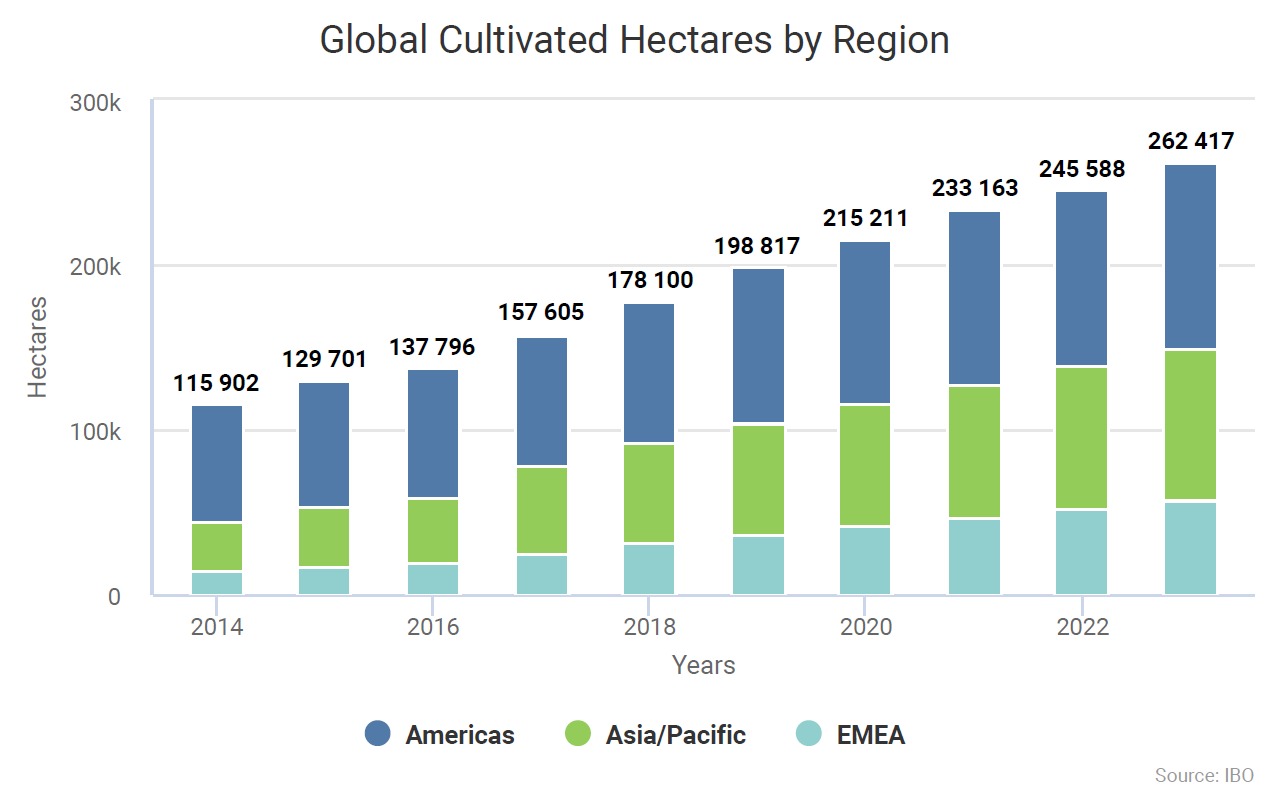

Blueberry cultivation growth rates have quickly increased the area to 260,000 hectares, growing tenfold in the past 20 years and doubling between 2014 and 2024.

Taste qualities as a key growth factor

The key to sustaining this growth has been identified as the taste qualities, which is also proving to be a key factor in opening new markets.

There are still vast areas of the world where blueberry consumption is almost non-existent, such as China and India, two markets with over 1.3 billion consumers: in these countries, consumption is initiated and developed with premium products from the middle-upper and upper segments of the market, where 5% of consumers can generate 80% of sales.

This potential alone would be enough to provide an outlet for the blueberries currently in production and those that will be available in the coming years.

Growth in Western markets

In addition, markets like the Italian one, which are more price-oriented than quality-oriented, continue to grow steadily over the years without showing signs of fatigue: for example, household spending in Italy has almost doubled in the last three years (+81%, Italian Berry – GfK data).

Similar dynamics, with consumption growth not driven by quality, are being recorded in many European countries, including Germany and the Netherlands.

However, true sustainability of growth must be built on solid foundations. According to the operators gathered in the IBO (International Blueberry Organization, a non-profit organization working for the global development of the blueberry supply chain), the entire sector must raise its quality standards, not just the most innovative operators.

Purchase experiences and sales impacts

It is indeed a common experience that, in most purchasing occasions in retail outlets, the blueberry consumer still has unsatisfactory purchasing experiences; this creates uncertainty and discourages repeat purchases.

A disappointed consumer suspends blueberry purchases for about 7 weeks, and this can indirectly impact other origins, varieties, and producers. These follow each other in the calendar and are affected positively or negatively by the higher or lower satisfaction of consumers.

However, the continued growth in demand should not lead producers to make decisions based on easy enthusiasm.

Successes and difficulties in Latin America

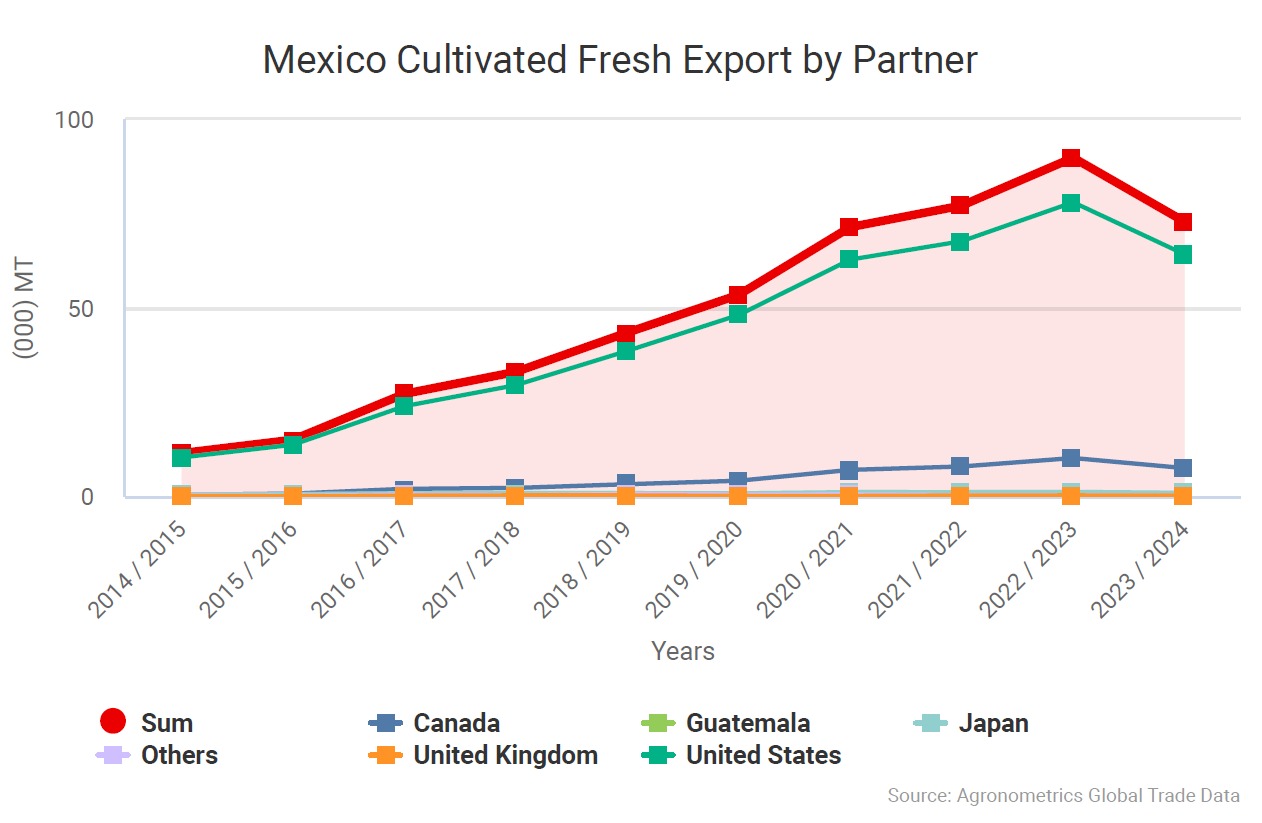

Even in an expansion situation, there will be winners and losers: a striking case is Mexico, which, despite its proximity to the United States, one of the world's largest blueberry markets, saw its exports drop from 80,000 tons to 66,000 in one year, with prospects of falling to 60,000.

Another case is Chile, which, after helping to create a global blueberry market, has been struggling heavily in recent years with the competitive push from Peru, undermining the competitiveness of the Chilean supply chain, which until five years ago firmly held the leadership in Southern Hemisphere exports.

Future prospects

The picture may be mixed when looking at individual production or national realities, but among operators, there seems to be consensus on the overall prospects: the sector as a whole is growing and will continue to grow.

Indeed, some have gone so far as to say that there is no visible limit to the global expansion of blueberry consumption on the horizon.

This favorable trend does not overlook the fact that the challenges are many and significant: realizing this rosy scenario will require great ability to identify, resolve, and manage major challenges and critical issues, many of which are already evident and are already heavily impacting operators.

But this is the other side of the coin, another story that deserves a separate chapter.