The 2024 season closes with exceptional figures for the production of strawberries, blueberries, and raspberries in the United States, with significant increases in volume and quality, according to data published by the United States Department of Agriculture (USDA).

Strawberries: record volumes and stable prices

In 2024, U.S. utilized strawberry production reached a record 3.22 billion pounds (about 1.46 million tons), marking a 12% increase compared to 2.87 billion pounds (about 1.3 million tons) in 2023. Growth was driven mainly by California and Florida, which reported record-high harvested acres. California alone accounted for 90% of national production.

About 2.62 billion pounds (over 80% of the total, about 1.19 million tons) were destined for the fresh market, while 604 million pounds (about 274,000 tons) went to processing. Grower prices for fresh-market strawberries remained stable, with a slight increase of less than 1%, reaching $1.43 per pound (about €3.10/kg). In contrast, processing strawberry prices fell 6% to 41.3 cents per pound (about €0.89/kg).

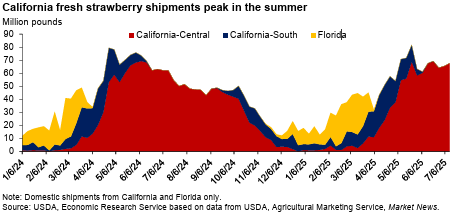

In 2025, U.S. strawberries continue to be available year-round. Florida ensures supply in winter, while California dominates in summer. By mid-July 2025, domestic shipments were slightly below the same period in 2024, yet still above 2023 volumes. Fruit quality was judged good, especially in the Santa Maria and Watsonville/Salinas areas, thanks to favorable weather conditions.

Blueberries: strong production growth

2024 set another record for U.S. blueberries, with total utilized production (including cultivated and wild) estimated at 880.3 million pounds (about 399,400 tons), a 21% increase compared to 725.7 million pounds (about 329,000 tons) in 2023.

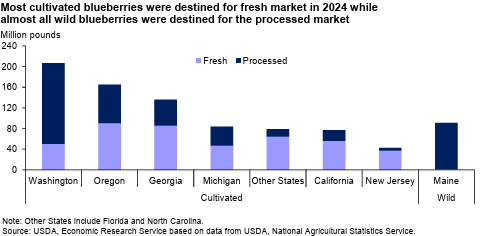

Cultivated blueberries accounted for 90% of the total, 789.5 million pounds (about 358,100 tons), with 55% destined for the fresh market. The main producing states are Washington, Oregon, and Georgia, together covering nearly two-thirds of cultivated production. Maine’s wild blueberries made up the remaining 10% (90.8 million pounds, about 41,200 tons), almost entirely destined for processing, primarily freezing.

In 2025, over 90% of domestic blueberry shipments are concentrated between April and August, peaking in July. By mid-July, shipped volumes were lower compared to the same period in 2024, with declines in Georgia and Florida due to unfavorable weather events. In California, production started in February in the Oxnard area, peaking between March and April, while in the Central Valley the season peaked in May. In the Pacific Northwest, the season began in June with excellent quality, thanks to favorable pollination conditions.

Raspberries: production stability and shipment growth

Utilized raspberry production in 2024 stood at 180.6 million pounds (about 81,900 tons), with California leading production among states (102.1 million pounds, 57%, about 46,300 tons). About 53% of the crop was destined for the fresh market, while the remaining 47% went to processing.

Average grower prices for the fresh market were $4.13 per pound (about €8.94/kg), down from the previous year. Processing raspberries also saw a drop in average prices, settling at $0.93 per pound (about €2.01/kg).

In 2025, about 85% of fresh raspberry shipments are concentrated between May and October, peaking in June and July. By mid-July, shipped volumes exceeded those of 2024, driven by Southern California. Fruit quality was rated good. Frozen raspberry stocks peak between July and August: nearly two-thirds are stored as IQF (individually quick frozen), while the remaining quantities, in bulk or concentrate form, represent lower-value products.

A look ahead

2024 stands out as an exceptional year for U.S. berries, with encouraging prospects for the 2025 season despite some climate-related challenges. Expanded acreage, improved farming techniques, and favorable weather conditions in many key areas contributed to higher quality and crop volumes. The focus now shifts to market trends and the industry’s ability to adapt to upcoming climate and logistics challenges.

Source: Weber, C., Wakefield, H., & Wechsler, S. (2025). Fruit and tree nuts outlook: July 2025 (Report No. FTS382) U.S. Department of Agriculture, Economic Research Service.