The latest YouGov Shopper – Italian Berry data (Italy, December 2025) show a clear shift in how berries are bought at retail in Italy: compared with fruit overall, berries (including strawberries) and even more so berries excluding strawberries are becoming an increasingly modern-trade-driven category, with the center of gravity moving further toward supermarkets and discounters. At the same time, between 2024 and 2025 specialist produce retailers, traditional retail, local markets and online channels all lost ground.

For fruit overall, the channel split in 2025 changed only slightly and redistribution across channels remained limited: the system is holding, but the slow migration continues toward formats associated with higher purchase frequency and value-for-money (supermarkets/discounters).

Berries shifting toward supermarkets and discounters, specialists losing share

For berries (berries and strawberries), movements are more pronounced than for fruit total.

In 2025, supermarkets + discounters together accounted for 76.6% of the category’s value (up from 73.8% in 2024, +2.8 pp) and 75.2% of volumes (up from 72.9%, +2.3 pp). This is a clear concentration signal: the category’s “center of gravity” moves even more toward where there is traffic, turnover and promotional pressure.

Meanwhile, specialist and traditional channels are declining. Berries are increasingly a “routine grocery shop” category (supermarkets/discounters) rather than an “expert purchase” or “neighborhood proximity” category. This reshapes competition: assortment, continuity, promotions and shelf execution become even more decisive.

Berries excluding strawberries: the trend is even stronger

In the segment covering only berries excluding strawberries (blueberries, raspberries, blackberries and redcurrants), the dynamic is even clearer: supermarkets significantly increase penetration, with the share of buyers rising from 61.8% to 67.4%, while also increasing both volume and value shares.

Discounters are no longer “just volume”: they are consolidating value as well, with share increasing by two percentage points to reach 23.0%.

Greengrocers remains at the margins

Traditional retail continues to play a marginal role in berries: fewer buyers (from 5.9% to 5.7% in 2025), declining quantities (from 3.2% to 2.3%) and a falling value share (from 2.7% to 2.1%). Within this channel, independent greengrocers and local street markets split spending shares roughly evenly.

These percentages are very different from fruit total, where traditional retail attracts over 32% of buyers and generates around 15% of turnover.

Online is still not taking off

E-commerce channels attract only 4.5% of buyers (down from 5.6% in 2024), generating just 1.7% of volume and 1.8% of value. In 2025, e-commerce therefore lost both shoppers and efficiency, performing well below the channel average.

Strong channel focus

While Italian consumers buy fresh fruit across an average of 3 channels (including hypermarkets, supermarkets, discounters, convenience, online, specialists and others), berry purchases are far more targeted and concentrate in 1.5 channel types (for two-thirds of buyers, essentially supermarkets and discounters). Similar values (1.8 channel types) are observed when strawberries are included.

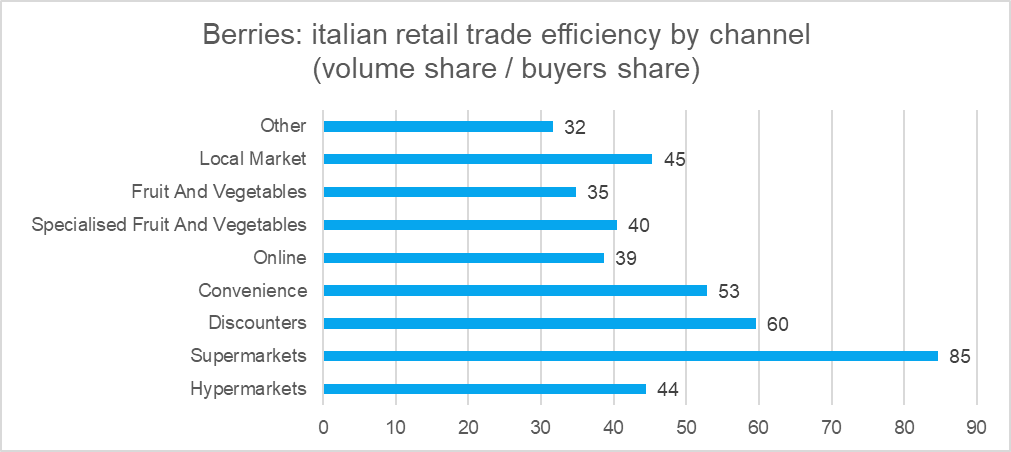

Supermarkets remain the most efficient channel in translating buyer presence into actual purchases. Convenience ranks second; discounters and hypermarkets sit in a mid-efficiency band, while e-commerce and specialist retail are at the bottom. These last two attract few shoppers, who also buy relatively less than in other channels.

Strategic implications for operators

- Channel strategy: prioritize supermarkets and discounters

Growth (and defense) increasingly depends on these channels: you need an offer calibrated for price/pack, repeatable quality standards and promotional support. - Assortment and “value engineering”

The rising discounter share—especially in berries excluding strawberries—signals pressure on entry price, “efficient” packs and formats that lower the purchase barrier (without compromising perceived quality). - Specialists and markets: repositioning is required

Decline does not mean “the end of the channel”, but it does require a different role: true premium, origin/territory, storytelling, services (ready-to-eat, curated selections, distinctive varieties) and, above all, differentiation from GDO shelves. - Online: not (yet) the category’s growth driver

Berries lose share online both with and without strawberries. This should be read pragmatically: online can work for specific occasions, but today it does not drive overall category growth.