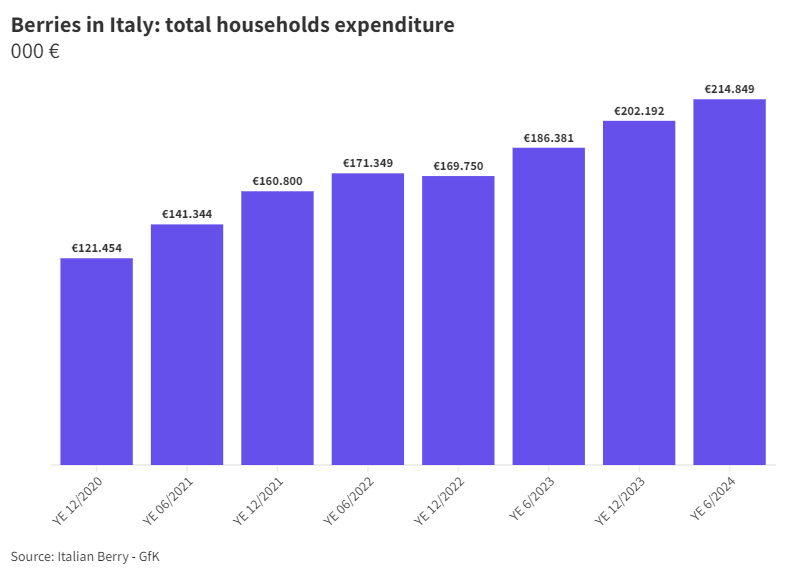

The Italian berries market is worth over €214 million according to the latest GfK - Italian Berry data updated on 30/06/2024 and referring to blueberries, raspberries, blackberries, and red currants (excluding strawberries).

Spending up by 50% in three years

Therefore, consumption continues to grow, increasing by 15.3% in value over the last 12 months. Growth over the last three years from 2021-2024 has exceeded 50%: on 30/6/2021, total household purchases in Italy amounted to €141 million, and in three years, they increased by €73 million.

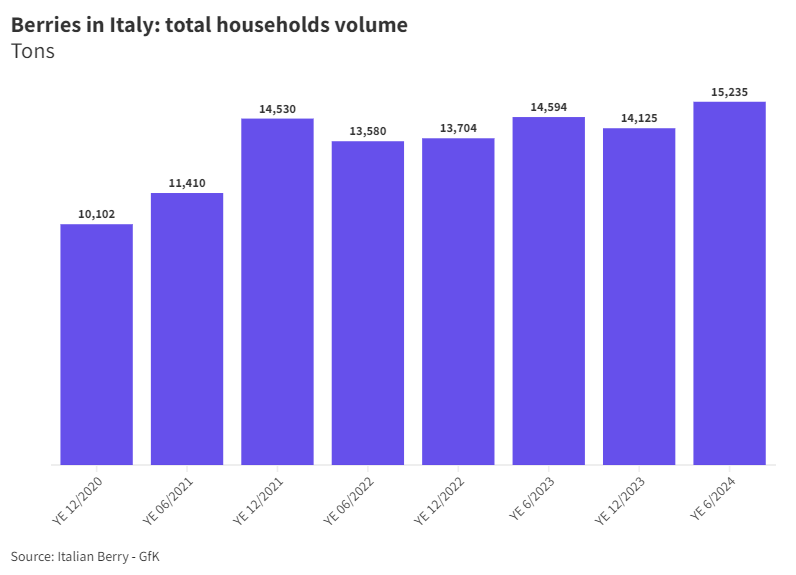

Quantities grow but more slowly

The berries market in Italy also grows in volume, with a 4.4% increase, bringing the market from 14,594 tonnes to 15,235 tonnes in the last 12 months.

Quantities have grown at a slower rate compared to total revenue: over the last three years, the total increase has been 33%.

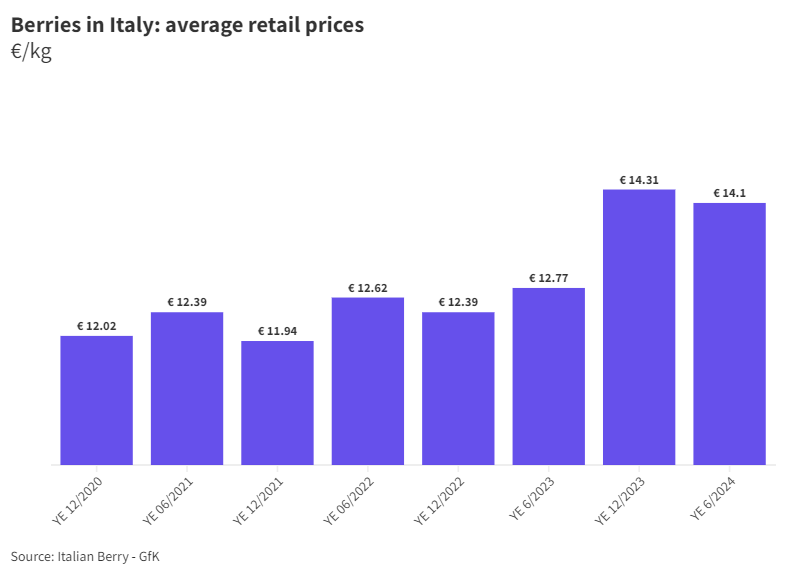

Average prices on the rise

The average price of the berries category has seen a steady increase in recent years, rising from €12.39 in 2021 to €14.10 in 2024. In the last 12 months, average prices have increased by 10.4%, a rate well above the inflation rate reported by Istat for the same period, which for food, household, and personal care goods was 1.4%.

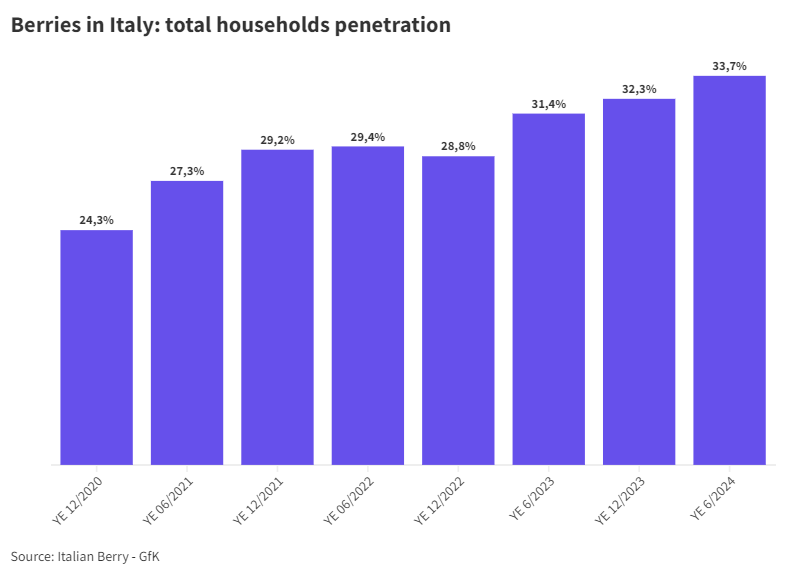

Consumer base reaches 8.7 million

The number of Italian households that purchased berries at least once a year is 8.7 million, an increase of 8.6% compared to the previous 12 months. Since 2021, the buyer base has increased by about 1.6 million families.

Penetration over 33%

For the first time in Italian consumption history, penetration has exceeded 33%, meaning one in three families buys berries at least once a year. Penetration has increased by 2.4 points in 12 months.

However, the percentage of repeat-buying families, those purchasing at least twice, remains relatively stable at around 68%.

Purchase behavior

The Italian purchasing family's behavior for the berries category can be summarized as follows:

Overall twelve months

- Quantity: on average, the purchasing family bought 1.75 kg of berries in the last 12 months, a decrease of 3.9% compared to the previous period.

- Value: the spending per purchasing family increased by 6.1% to €24.64 in the last 12 months. The increase over three years is more than 24%.

- Purchase frequency: on average, they buy berries 6.7 times a year (a little more than once every two months), a decrease of 1.2% compared to the previous 12 months.

Per trip

- Quantity per trip: the average purchase per trip is 260g, down from the peaks of 2021 when it was 310g.

- Spending per trip: the average spending per trip is €3.69, an increase of 7.4% compared to the previous 12 months.

Penetration profiling

- Penetration continues to have a strong geographic connotation, with the North-West having penetration rates 48% higher than the national average and the South-Sicily with penetration rates about half the national average.

- The socio-economic class has a significant impact on penetration: high-class families have penetration rates 26% higher than the national average, and penetration decreases with lower socio-economic classes.

- The number of family members and the age of the person responsible for purchases have a smaller impact on penetration.

- Families living in metropolitan and suburban areas have penetration rates 21% higher than the national average.

Quantity profiling per family

- Families that buy above-average volumes live in the North-West (+23% compared to the national average) and are composed of singles (+6%).

- The age range of the person responsible for purchases influences the quantities bought, with older buyers purchasing more.

- Families living in metropolitan areas and those in towns with fewer than 10,000 inhabitants have above-average volume purchases.

The GfK survey is conducted using the HomeScan methodology, utilizing a tool that allows optical reading of EAN codes, as well as integrating the survey with other essential information (Channel, Retailer, Receipt Information, specific questions to the shopping person). The survey is carried out continuously, enabling the study of the evolution of purchasing behaviors over time providing a comprehensive interpretation of the behavior of Italian households.