The International Blueberry Organization (IBO) has published an analytical overview of the production and export of blueberry in the countries of the American continent.

Summary

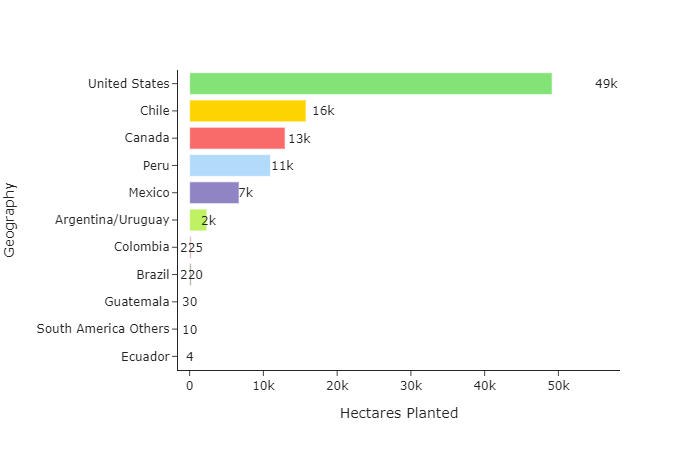

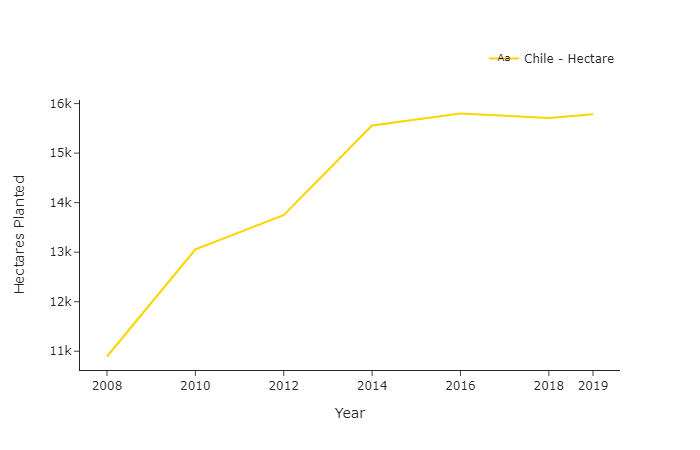

HECTARES PLANTED

The United States and Canada remain the leading players in terms of production with 62,000 hectares of blueberries planted.

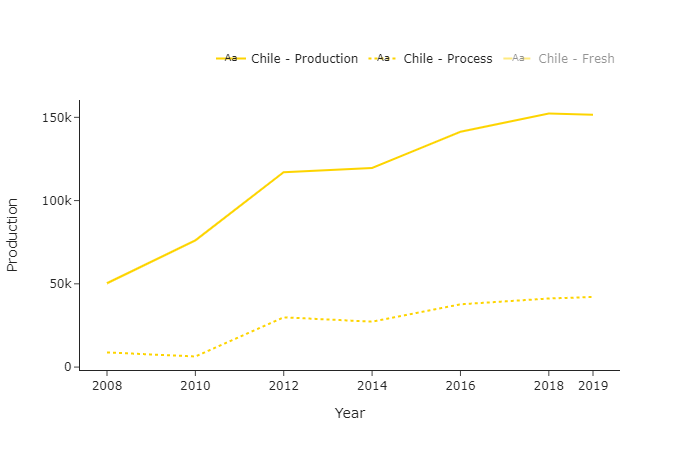

PRODUCTION

The production of blueberry in North America (almost 400,000 tonnes) is mainly destined for processing (frozen in the first line): in the United States, fresh blueberry represents 44.5% of production, in Canada 57.5%. In South America, the percentages for processed products are significant only in Chile (27.8%), while they are statistically non-existent in Peru and negligible in the other countries,

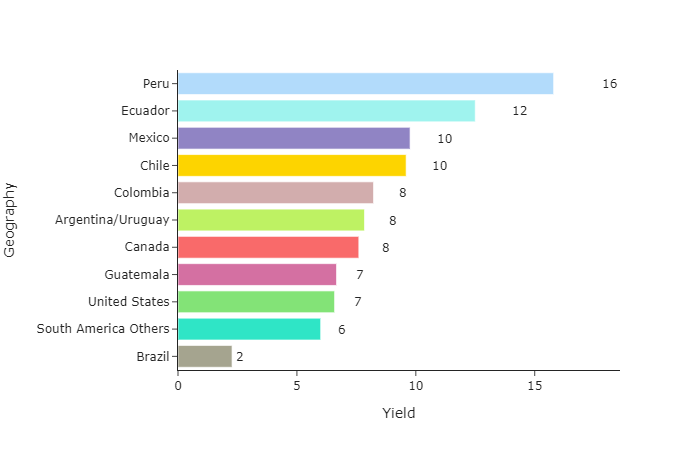

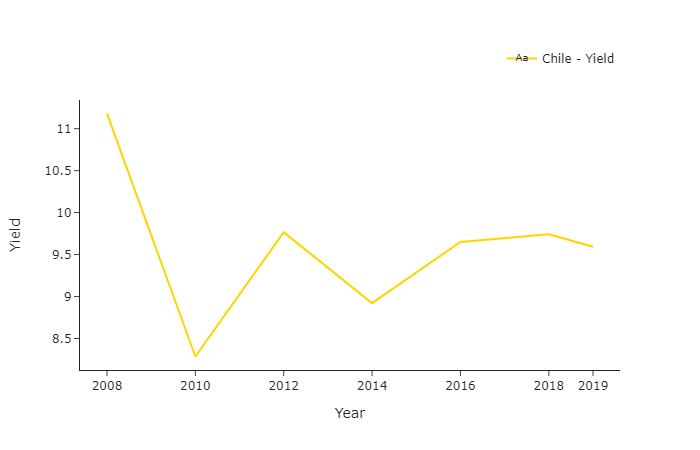

YIELDS

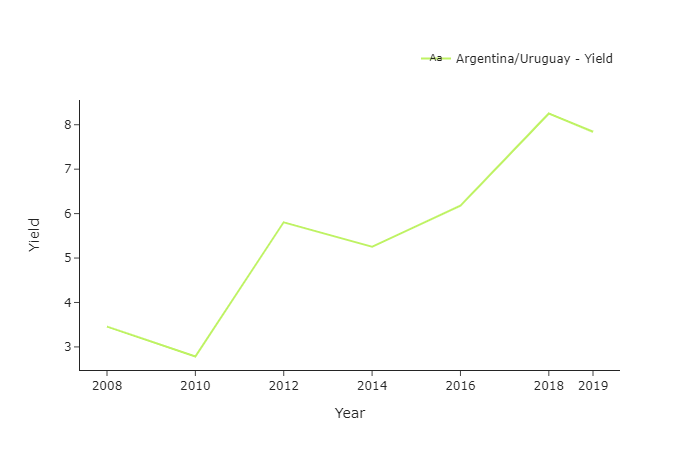

Yields per hectare vary considerably between producing countries: Peru leads the list with 16 tonnes, while Ecuador, Mexico and Chile also rank above 10 tonnes per hectare. Yields are lower in Canada (8 t/ha) and the USA (7 t/ha).

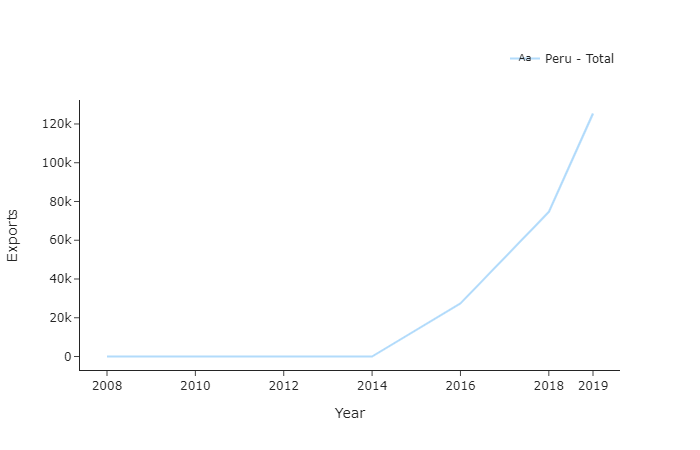

EXPORT

In terms of exports, the balance of power shifts: Canada and the United States drop off the podium, which is occupied by Peru (for the first time at the top of the list), Chile (historic leader in exports of blueberry from the southern hemisphere) and Mexico (with 96% of exports to the United States).

South American countries are therefore the most important in international trade: even in Europe, Peru, Chile and Argentina account for the lion's share of imports of blueberries from overseas.

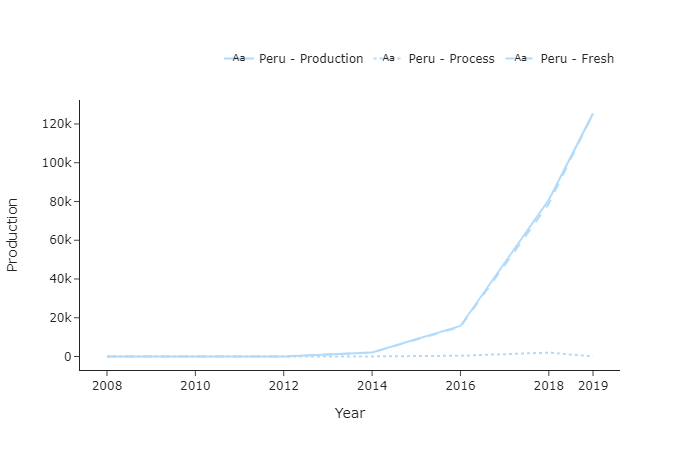

PERU

Peru's blueberry sector has achieved significant growth in recent years. A total of 12,950 tonnes had been exported in the 2015-16 campaign, compared to 120,100 tonnes exported in the 2019-20 campaign, consolidating its position as the main exporter of fresh blueberries in the world, and growth of around 40% is expected for this campaign (around 170 thousand tonnes).

For this season the peak week is estimated to be week 42 with just over 11,000 tonnes. From week 34 to week 49 shipments are expected to exceed 5,000 tonnes each week.

In terms of destinations, 50% of the volume is expected to be shipped to the US, 28% to Europe, 6% to the UK, 15% to Asia and 1% to other destinations.

About 5% of the total volume is expected to be organic. The Peruvian season extends from May to March.

CHILE

The effects of the Covid-19 health crisis are still difficult to project. There will undoubtedly be an impact on the world economy and changes in consumer habits that in some cases may become permanent behaviours. There will be significant challenges, but also opportunities. The food industry and particularly the fresh fruit industry, despite the new conditions and restrictions, has continued to work to maintain food supply both locally and to external markets.

The blueberry industry is going through major changes and there is a new game board that reflects the new competitive landscape and becomes more present on the market every season.

The Chilean industry of blueberry is adapting to the new scenario in which the increase in supply is already present and higher volumes of various origins are present in practically all markets. The Chilean industry is adapting to the new market conditions where quality, consistency and productivity have new minimum requirements.

Thefocus is on quality and productivity, not volumes. In terms of varieties, there is a restructuring revolution. A lot of acreage has been renovated and we are starting to see more and more varieties that are more productive, have a good post-harvest and the good flavour that characterises Chilean blueberries . The industry has already realised that there are varieties that simply have no place in the current competitive scenario.

This season as never before, the Blueberry Committee has worked with its members and producers to agree on the new competitive landscape and the actions needed to deal with it, in terms of variety, but also in terms of orchard, harvest and post-harvest management. Many have already adapted and positive results have been seen, allowing them to continue diversifying into export markets.

In the 2019-2020 season, Chile exported 110 thousand tonnes offresh blueberries worldwide, just 2% less than the previous season. Following a successful promotional strategy to develop and diversify export markets, shipments to Asia grew by 20%, in Europe the growth was 8% and North America had 11% fewer shipments than the previous season, which also had a lower volume (-9%) than the 2017-2019 season.

With these numbers, the United States remains the main export market for fresh blueberries from Chile with 50% of the volume, followed by Europe with 33%, Asia with 15% and Canada with 2%. As for organic blueberries , they account for 14% of fresh exports and are growing by 16%, with Europe being the fastest growing export region with 41% growth, followed by North America with 10% growth. The United States remains the largest market for organic fresh blueberries with 73% of the share, Europe with 23% and Canada with 3%.

Although total shipments of fresh blueberries to the US were down for the second year in a row, organic blueberries continue to grow in this market, 23% over the 2018-2019 season and 10% over the 2019-2020 season. For the upcoming season, a systemic approach will allow growers in the Ñuble and Biobio regions, two of the largest growing regions at blueberries, to maintain their organic status when exporting to the US market.

In terms of processed products, Chilean blueberries exports in 2019 reached 44,200 tonnes, of which 18% were organic. The United States remains the main market with 32% of the total volume. Interestingly, shipments of frozen organic products to the US accounted for 70%.

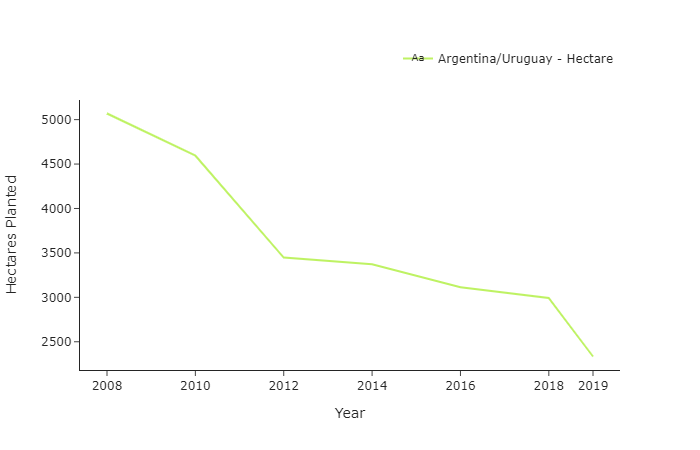

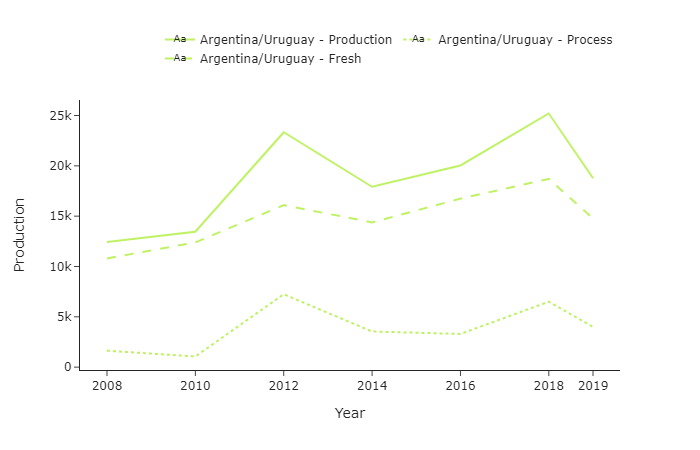

ARGENTINA/URUGUAY

The pandemic has turned the world upside down. We are still in the middle of the hurricane and we still don't know how it will end. The pandemic has changed the importance of different aspects of life. Health has come to the fore and what better way to achieve it than through healthy eating. blueberry is one of the fruits with the best image of health. The numerous advertising campaigns about its benefits are now paying off. Not only has its health seal contributed to its success, but also other qualities such as its exquisite taste, its eye-appealing deep blue colouring, its convenience (small size, individual portions, ease of transport) and its multiple consumption possibilities. For all this, the blueberry industry in Argentina is facing a great opportunity, both in export markets and locally.

Theproduction of blueberries in Argentina has gone through several cycles, going from explosive growth, to retraction, relocation of production regions, reorganisation of companies, varietal replacement, the need to incorporate new technologies, etc. Our industry was based on the principle of starting as early as possible, for which it planted early varieties, looked for early regions and gave priority to air transport. But the emergence of very strong competitors in the same commercial window forced a radical change in strategy. There has been a shift towards higher quality production, thanks to the good climate and the implementation of genetically new varieties.

Argentine blueberry is distinguished by its special flavour, and is sought after by gourmet buyers, who have niche markets. But for the industry to be globally competitive, many challenges remain, such as increased varietal substitution, a shift to sea transport, increased productivity, reduced local costs and the incorporation of more advanced technologies.

Another point being worked on is the incorporation of new technologies, such as tunnels, which would reduce the effects of the weather and ensure a constant supply of quality fruit to foreign markets. Argentina is strongly committed to becoming a superior quality, consistent and reliable supplier. The intention is to explore more deeply the markets that appreciate the taste of Argentinian blueberries .

Another segment of the sector that is advancing rapidly is organic production. In 2019, 15% of exports were organic. In the current season, the aim is to double this share. Again, the pandemic is helping this form of production to become more important. Consumers are looking for healthy living, have turned to the more natural and many prefer to buy organic fruit instead of conventional.

The outlook for the next campaign on COVID 19 is difficult to define, it will depend on global quarantines.

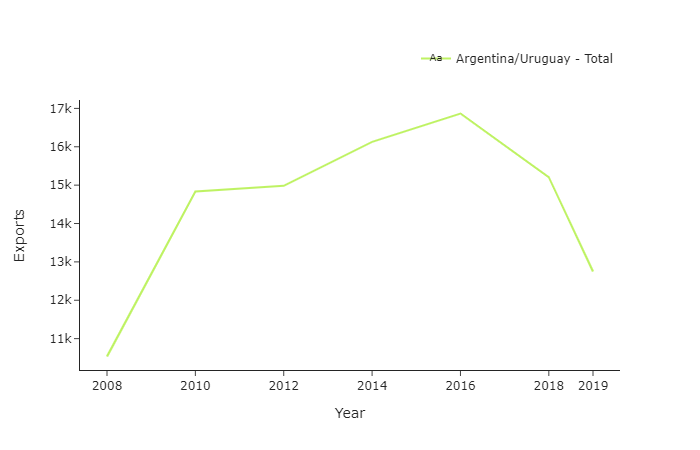

Argentina is a major player in the global market, exporting blueberries for over 20 years. Its geographical location gives it the advantage of having a counter-seasonal harvest, which means that it can supply during periods of low production in northern hemisphere countries. For this reason, the main destinations are the United States, which accounts for 60% of total exports, followed by continental Europe and the United Kingdom with 30%, and Canada and Asia, which together account for 10% of shipments. In recent years, Argentine exports have stagnated at around 15,000 tonnes, representing 10% of the total supply of blueberries in the August to December 2019 trade window.

The 2020 season of blueberry begins in Argentina with the start of the blueberries season, with production zones implementing strict health and safety protocols and an industry working closer than ever towards common goals.

The differentiation strategy will continue and will be based on three pillars: taste, organic production and social responsibility. For the fourth consecutive year, the Argentinean blueberry sector is running the promotional campaign 'Taste the Sweetness & Enjoy the Difference' to highlight the sweet taste of the Argentinean fruit which, being produced in areas with 'cold hours', has a distinctive flavour that differentiates it from the rest of the suppliers. A further factor is the growing trend in organic production, which this year will account for a third of the total volume produced.

In an increasingly competitive world where decent work is often not valued and purchase is determined by cost, Argentina has national labour, social and health and safety laws that are models worldwide. In 2015, Argentina signed up to the Sustainable Development Goals set by the UN, among which goal number 8 is the promotion of sustainable economic growth with decent work and the prohibition and elimination of child labour as one of the main factors to be met. In addition to implementing these International Guidelines and promoting triple impact production, ABC is part of the Business Network Against Child Labour and is governed by the National Plan for the Prevention and Elimination of Child Labour and the Protection of Child Labour.

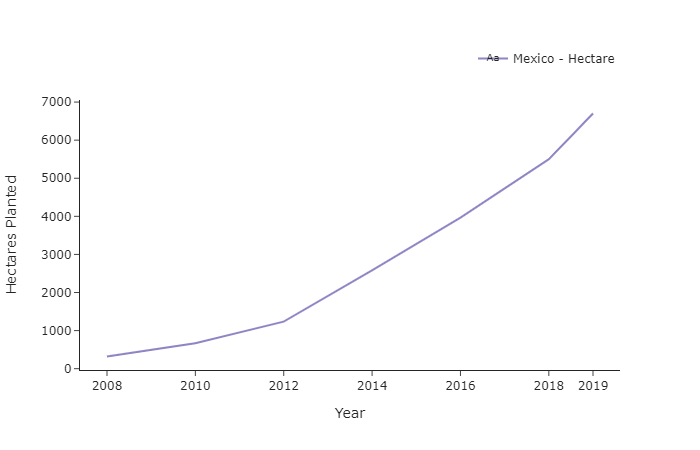

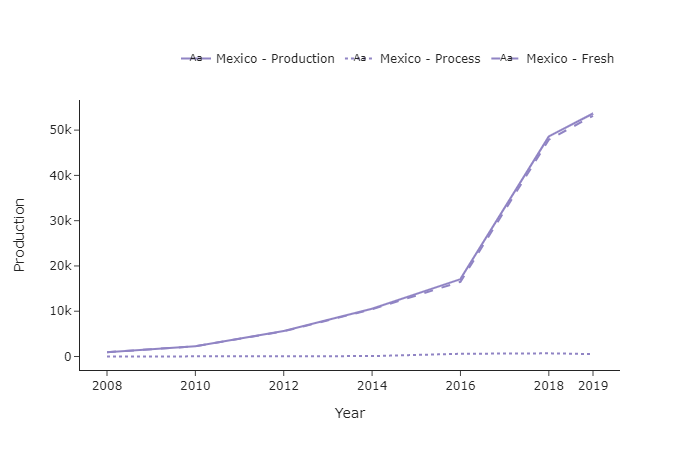

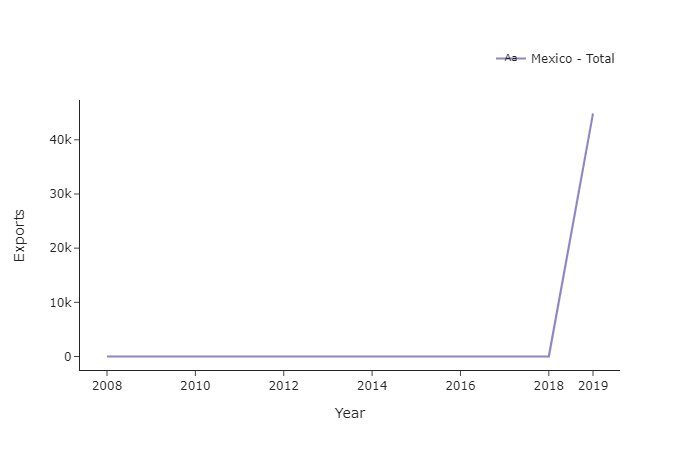

MEXICO

During the 2019/2020 season, Mexican blueberries exported a total of 53,139 tonnes to the world with a value of US$355,209,887, North America accounting for the highest percentage of these exports with 96% of the total volume exported, totalling 51,495 tonnes.

The area recorded for the season was 5,500 ha in active production.

The main producing states:

- Jalisco remains the main producer.

- Michoacán is the second largest producing state.

- Sinaloa has projected strongly in recent years and is expected to overtake Michoacán in the coming years.

- Guanajuato and Baja California are significant producers.

For this new 2020/2021 season, there are approximately 7,408 hectares of Aneberries member farms and an estimated 500 more from non-member farms.

According to the growth rate (10%), an export volume of about 58,453 tonnes could be expected, with 85-90% of the volume associated with Aneberry (51,856 tonnes) based on average planting (5,050 plants/ha) and average yield (7 tonnes per hectare).

Source: IBO