“The berry consumer has evolved significantly and continues to evolve. They are attentive to the fruit, and their awareness is growing. They are looking for crunchy blueberries, flavorful and healthy. The fact that they are Italian is no longer enough,” reflecting on recent years of berry consumption and looking ahead, Matteo Bortolini, director of Sant’Orsola, sees much room for growth in Italy. Growth is possible both in terms of blueberry-growing areas and in terms of consumption.

Five years after the Blueberry Business Day, the first Italian B to B event in which Sant’Orsola participated, according to Bortolini “we still can’t meet the demand for blueberries in Italy with the supply.”

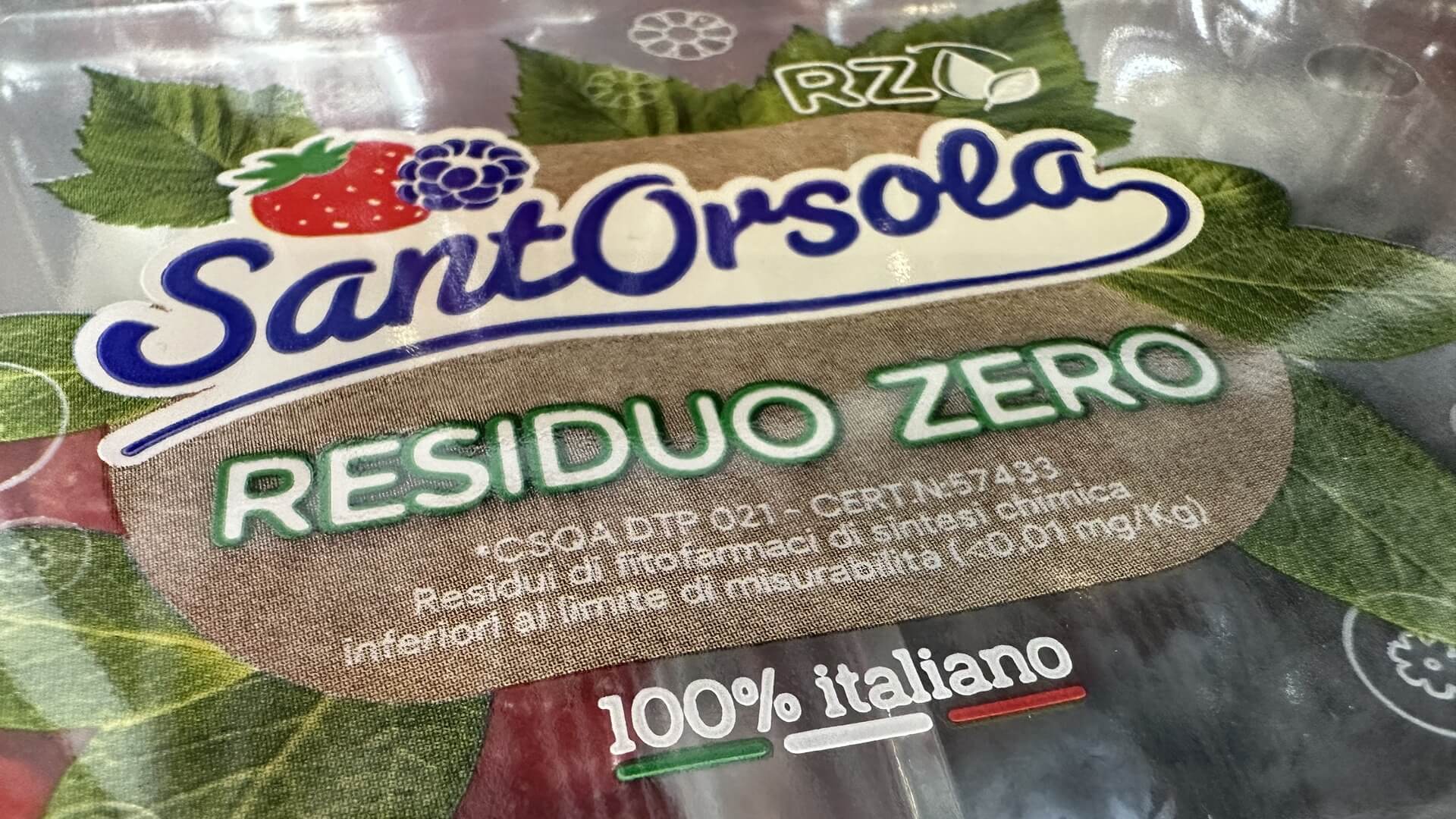

Sant’Orsola, founded more than 40 years ago in Trentino, is one of the leading Italian players in the berry industry, with 2023 revenue for berries, strawberries, and cherries amounting to 65 million euros, 11.57% more than in 2022. Looking only at blueberries, which account for 30/35% of production by quantity, last year Sant’Orsola producers harvested 1,300 tons. The production base now includes 750 agricultural entrepreneurs, spread across Italy.

Investing in blueberries pays off

“I don’t think it can be said about many other crops, like blueberries, that you can invest confidently knowing that in the future, blueberries won’t disappoint,” Matteo Bortolini told us.

He then explained: “I see growth that will never match the increase in consumption in Italy. You shouldn’t be afraid to invest in a blueberry plantation if done properly. The cost per hectare is significant, ranging from 130-150 thousand euros per hectare, but if you choose to be supported by an organization like ours, as a producer, you can weather even bad weather seasons.

Sant’Orsola offers its producer members all the know-how, there’s technical assistance, and we support the new member from the very beginning, from the design of the plantation. It goes from variety selection to commercialization. It’s an investment that should not be taken lightly because it has to last 12-15 years, but if done ‘smartly,’ it pays off.”

Blueberry 2024, “a season with smaller calibers”

Speaking of bad weather, the 2024 season, despite the rain, went well for Sant’Orsola: “It was a good season overall. There was a critical moment in mid-June when we had the rainy season. However, those who had a covered plantation and were well-organized did not suffer from it. A season with smaller calibers due to the heat, but the volumes were there,” the Cooperative’s director told us.

Sant’Orsola produces in Italy starting in January, with the first harvests in Sicily, and continuing northward until the end of September when production closes in Trentino. “National production is still insufficient. In the past – Bortolini specified again – imports were concentrated in the off-season, but today we import year-round.

As for blueberries, in particular, until two years ago, Peru was the main supplier. However, 2023 was a difficult season for Peru.

Today, emerging countries such as South Africa, Namibia, and Zimbabwe are gaining ground. This is the period when origins are multiplying, and the shortage of product is reflected in prices.”

The share of the different distribution channels

As for the market outlet for Sant’Orsola’s blueberries, about 60% is destined for large-scale retail, while 40% goes to wholesale fruit and vegetable markets.

The Trentino cooperative’s blueberries are sold almost exclusively in the Italian market: “Exports now account for 2-3%, mainly concentrated in Germany. Our reference market is national. Over time, we have seen that, among berries, blueberries have experienced the fastest growth. They are practical to consume, easier to handle, and other berries are more delicate, while blueberries last longer in the fridge.”

And here are some of the reasons for the success of blueberries in recent years.

Blueberry, an increasingly segmented market

Matteo Bortolini is convinced that the blueberry market is becoming more segmented: “We see it, for example, with packaging. The types and sizes have increased, ranging now from 100 grams to 500. There are consumers who always choose paper packaging – he explained – because they’ve decided to go plastic-free. They choose paper even though some products, like raspberries, last less time in the fridge if packaged in paper.

We also use paper, but today there are technical tools to ensure that even plastic is just as sustainable. We only use Rpet, recycled plastic, and our suppliers have controlled and certified supply chains. I don’t see why this type of packaging should be considered less ethical than paper.”

Segmentation also involves the calibers requested: “Consumers love large calibers, but for example, pastry shops need smaller blueberries to fill pastries and cakes. This is why, when doing varietal innovation, one should not overemphasize a single characteristic. We’ve learned that when you exaggerate one characteristic, you risk losing others.”

Barbara Righini