The diversification of markets by the Peruvian industry is yielding results, as there has been an 18% growth in new destinations compared to the 2022-2023 season.

According to the latest report from Problueberries, the leading industry body for Peruvian blueberries, the 2023-2024 production campaign in its 10th week (until Sunday, March 10) has reached a total of 221,184 tons, corresponding to a decrease of -22% compared to the 2022-2023 campaign and -30% compared to the industry's initial projection on July 5, 2023, although only -2% compared to the last projection made by the industry on January 29.

Breaking down these figures, conventional blueberries reached 198,842 tons, which is equivalent to -21% compared to the previous season, while organic blueberry production reached 22,342 tons, implying a decrease of -36% compared to last season.

Irregular Campaign

The data clearly demonstrate that the 2023-2024 blueberry production season in Peru has been an irregular campaign full of complexities, both climatic and agronomic with respect to the crop, and also commercial, because as a consequence of the lack of fruit in the markets, prices were very attractive for the industry.

As an example, in week 10, Peruvian shipments of fresh blueberries to international markets were 1,464 tons, a figure that represents a decrease of 25% compared to week 9. However, these volumes are equivalent to an increase of 30% compared to week 10 of the 2022-2023 campaign.

United States

Or as in the case of the United States, which is the main destination for Peruvian blueberries, with 55% of the volumes, equivalent to 123,233 tons until week 10, although this figure is -20% below the 2022-2023 campaign. However, in week 10, shipments to the United States registered 1,217 tons, 50% more compared to week 10 of the previous campaign, broken down into 78% to the port of Philadelphia, 14% to the port of Hueneme, and 9% to the port of Miami.

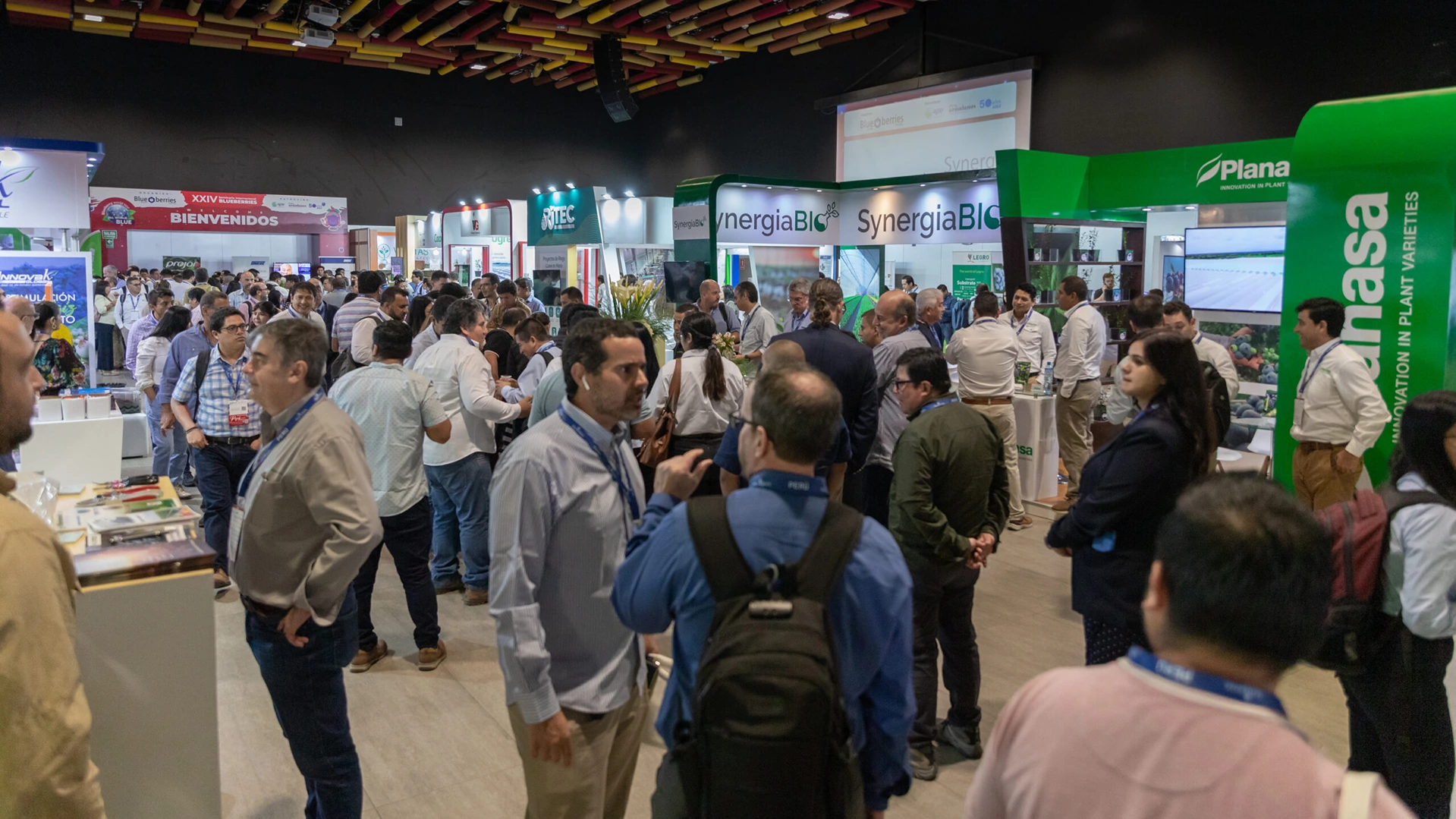

Photo by Alesia Talkachova

Source: Agronometrics