Although still in the early stages of development, raspberries and cherries stand out for their proven potential in international markets, where major exporters like Chile and Mexico have already paved the way.

(Agraria.pe) Following the success of blueberry exports, Peru is now seeking the next product to set a new benchmark and further consolidate the country's position as a fruit supplier.

Many crops are still in their infancy; among the most promising are raspberries and cherries, whose commercial potential has already been demonstrated by key players such as Chile and Mexico.

Raspberry development

Raspberries appear to be the fruit that has made the most progress in recent years. The first cultivation attempts in Peru date back to 2009, while the first export trials began in 2018, with around 16 tons shipped.

There were further attempts, but the fruit’s delicacy caused various logistical issues. Producers would prefer to export fresh raspberries due to higher profitability, but given current limitations, the focus is shifting toward frozen products.

The initial mistake seems to have been the choice of the Heritage variety, the most widespread in the world, but too fragile for fresh export from Peru, as it requires highly specialized logistics knowledge to ensure proper preservation.

Currently, there are between 50 and 60 hectares of raspberry crops in Peru, with an estimated annual growth rate of around 15%, as the sector gains expertise.

Obstacles and opportunities

Farms are concentrated in areas with adequate temperature fluctuations, such as Arequipa, Cajamarca, Huacho, Huarochirí and Cañaris. The average production cost is about 79,000 soles (around €19,500) per hectare.

However, the import of genetic material and seeds is still very limited due to the lack of phytosanitary protocols. These procedures are currently under negotiation with major supplier countries, such as Chile and the United States.

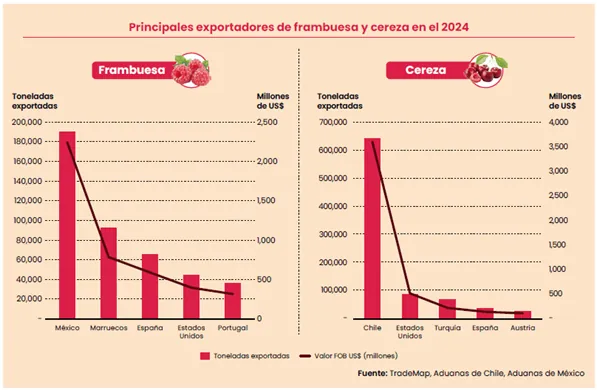

The commercial value of this fruit is more than evident: in 2024, around 530,000 tons were exported worldwide, worth $4.8 billion (about €4.4 billion).

An impressive figure, especially when compared to blueberries — Peru’s most profitable agro-export product — which has a market value of around $6 billion (about €5.5 billion), but also faces much higher competition than raspberries.

The role of the state

Demand is high in countries like the United States, Canada, major Western European economies, and even in Asia. Moreover, Peru has a competitive advantage: with the introduction of new varieties, the country's commercial window could extend throughout most of the year.

Despite a significant pause in export attempts, efforts are now underway to strengthen the domestic market. The second major push is focused on exporting frozen raspberries, at least until the necessary knowledge, resources, and logistics chains are in place for fresh exports.

The state is also playing an active role, with demonstration plots in Huaral aimed at attracting potential investors, especially those with experience in similar crops such as strawberries.

The cherry challenge

As for cherries, the situation is more complex. Production is still in a much earlier experimental phase compared to raspberries.

Major efforts are underway to introduce this crop, and there is already a wide range of genetic material available to identify the most suitable varieties for the region. However, conditions have proved more challenging than expected, as Peru is located at warmer latitudes compared to successful producers like Chile.

This presents an obstacle, as cherries require a minimum number of chilling hours, which are not met in many established agricultural areas of the country, such as the Peruvian coast. For this reason, experiments are concentrated in specific valleys.

Outlook and investments

Interest in the success of this crop is very high. In 2024 alone, around one million tons of cherries were exported worldwide, with a market value of nearly $6.5 billion (about €6 billion).

Chile holds about 49% of the global market, so although competition is significant, it is not as intense as for other products.

Currently, the main importer of cherries is China, with nearly 56% of the market, and Chile is its leading supplier.

If Peru manages to produce this fruit on a large scale, it could compete directly — also thanks to the logistical advantage of the port of Chancay, which offers a direct route to China.

For this reason, efforts continue, and major companies such as Camposol, Complejo Agroindustrial Beta, and Agrícola Andrea are conducting various trials in regions like Ayacucho, Arequipa, and Áncash.

Moreover, the state has promised to further facilitate the import of genetic material in the short term, hoping that large-scale exports could begin within two years.

This would represent a historic breakthrough for Peru as an agro-exporting power, given the high profitability of this crop.

Text and image source: Agraria.pe