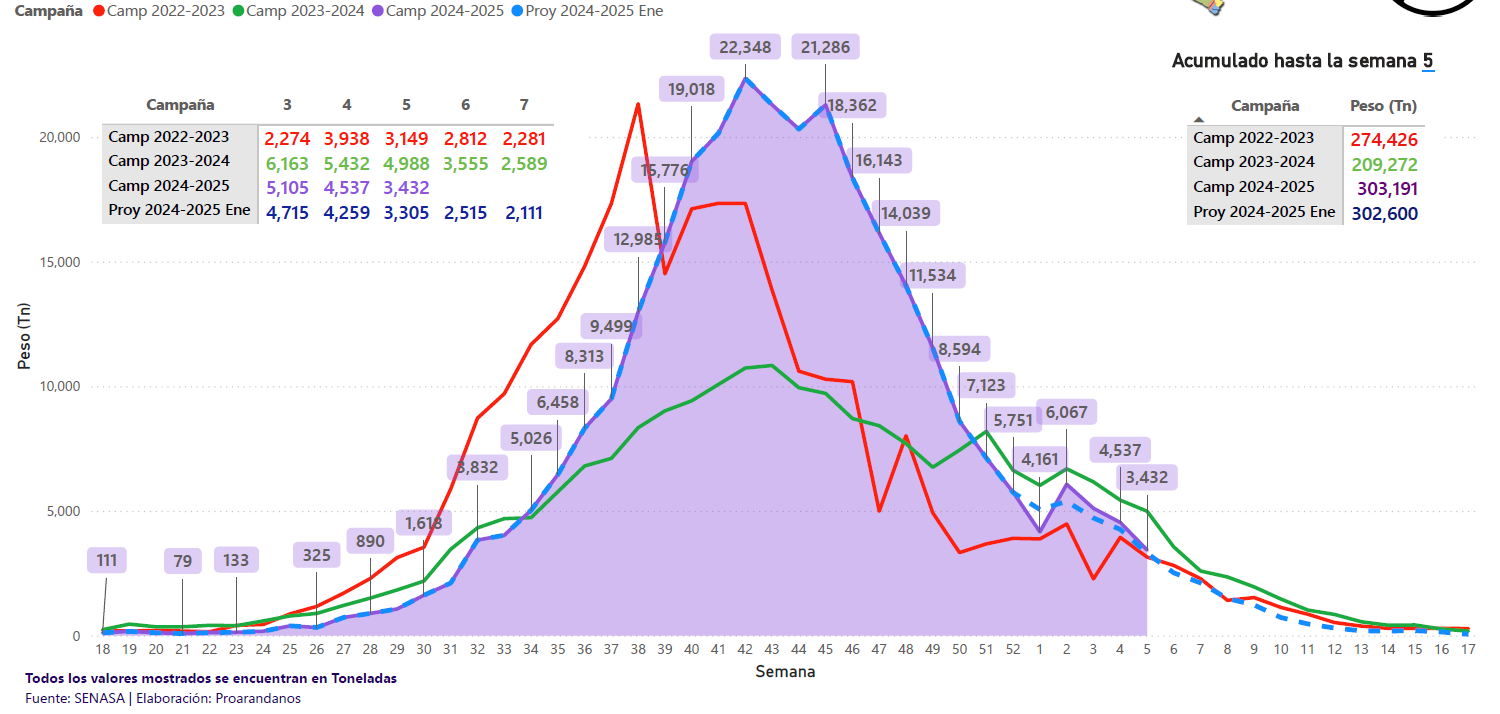

The Peruvian blueberry industry continues to consolidate its role in the global market, with a significant increase in exports compared to the previous campaign. As of week 5 of the 2024/25 season, the total volume exported reached 303,191 tonnes, marking a growth of 45% compared to the 2023/24 campaign.

| Type | 2024-25 | Var. vs. 2023-2024 | Var. vs. forecast |

|---|---|---|---|

| Total | 303.191 | 45% | 0% |

| Conventional | 270.061 | 44% | 0% |

| Organic | 33.130 | 57% | -0% |

| Week 5 | 3.432 | -31% | 4% |

Exports are divided into:

- 270,061 tonnes of conventional blueberries (89% of the total)

- 33,130 tonnes of organic blueberries, up 57% from the previous year

Despite the strong growth compared to last season, the current volume is in line with the export forecast for 2024/25, which estimated a total of 302,600 tonnes.

Main destinations

The United States is confirmed as the main destination market for Peruvian blueberries, followed by Europe, China and the United Kingdom.

- United States: 164,299 tonnes exported, an increase of 43% compared to 2023/24

- Europe: 74,365 tonnes (+53%)

- China: 37,050 tonnes (+43%)

- United Kingdom: 15,127 tonnes (+19%)

- Other markets: 12,350 tonnes, up 64%.

In terms of logistics, sea transport was the main means used, accounting for 99% of exports.

Regions and varietieis

The Peruvian region with the largest export volume is La Libertad, which accounts for 51% of the total with 155,762 tonnes. It is followed by Lambayeque (23%), Ica (11%), Lima (7%) and Ancash (5%).

The main varieties exported include:

| Variety | % |

|---|---|

| Ventura | 47% |

| Biloxi | 17% |

| Sekoya Pop | 8% |

| FCM12-045 (AtlasBlue) | 4% |

| Sekoya Beauty | 4% |

| Otros | 20% |

| Total | 100% |

Main exporters

The main blueberry exporters of the 2024/25 Peruvian season are (updated week 5):

| Esportatore | Quantità (ton) | Quota |

|---|---|---|

| CAMPOSOL S.A. | 41.692 | 14% |

| HORTIFRUT - PERÚ S.A.C. | 32.383 | 11% |

| AGROVISION PERU S.A.C. | 27.811 | 9% |

| COMPLEJO AGROINDUSTRIAL BETA S.A. | 22.611 | 7% |

| AGRICOLA CERRO PRIETO S.A. | 14.558 | 5% |

| DANPER TRUJILLO S.A.C. | 11.779 | 4% |

| AGROBERRIES PERU S.A.C. | 11.096 | 4% |

| BLUEBERRIES PERU S.A.C. | 10.335 | 3% |

| HASS PERU S.A. | 9.595 | 3% |

| AGRICOLA SANTA AZUL S.R.L | 8.264 | 3% |

| LARAMA BERRIES S.A.C. | 7.815 | 3% |

| BOMAREA S.R.L. | 7.540 | 2% |

| FAMILY FARMS PERÚ S.R.L. | 6.000 | 2% |

| AGROFUTURA COMPANY S.A.C. | 5.793 | 2% |

| EXPORTADORA FRUTICOLA DEL SUR SA | 5.701 | 2% |

| AQU ANQA II S.A.C. | 5.605 | 2% |

| HFE BERRIES PERU S.A.C. | 5.263 | 2% |

| SOCIEDAD EXPORTADORA VERFRUT S.A. CERRADA | 5.016 | 2% |

| SOCIEDAD AGRICOLA DROKASA S.A. | 5.002 | 2% |

| INKA’S BERRIES S.A.C. | 4.265 | 1% |

| Altri | 55.068 | 18% |

| Totale | 303.191 | 100% |

In the organic segment, Agricola Cerro Prieto S.A. stands out as the leading exporter, with 13,169 tonnes (40% of the organic total).

Europa account for 25% of Peruvian blueberry exports

Europe accounts for 25% of total Peruvian blueberry exports until week 5/2025. With an increase of 53% over the previous season, Europe grew more than the overall export.

| Destination | Quantity (ton) | % | Var. % vs 2023-24 |

|---|---|---|---|

| US | 164.299 | 54% | 43% |

| Europe | 74.365 | 25% | 53% |

| China | 37.050 | 12% | 43% |

| United Kingdom | 15.127 | 5% | 19% |

| Other | 12.350 | 4% | 64% |

The largest exporters to the European market were Camposol and Beta; the top 5 exporters to Europe account for 56% of the total exports; the quantities exported to Europe are therefore more concentrated than the overall total: in fact, at the level of total exports, the top 5 exporters only hold 46%.

| Esportatore | Quantità (ton) | Quota % |

|---|---|---|

| CAMPOSOL S.A. | 12.458 | 17% |

| COMPLEJO AGROINDUSTRIAL BETA S.A. | 11.263 | 15% |

| DANPER TRUJILLO S.A.C. | 6.955 | 9% |

| HORTIFRUT - PERÚ S.A.C. | 6.040 | 8% |

| AGROVISION PERU S.A.C. | 4.641 | 6% |

| Altri | 33.007 | 44% |

Weekly export trend last 4 campaigns

Data: Proarandanos