At this year’s Macfrut in Rimini, our team at Agronometrics was invited by Thomas Drahorad of Italian Berry to present a market snapshot of Italy’s blueberry industry—situating it within the broader European and North African context and highlighting both domestic trends and trade dynamics.

Here’s a breakdown of the main insights we shared:

From regional roots to national growth

Originally centered in Piedmont since the 1960s, blueberry cultivation now spans much of northern and central Italy, with growing interest in southern regions like Sicily and Calabria.

Traditional cultivars like Brigitta Blue are being replaced by newer genetics; there is a concentrated presence of early varieties like Duke in the North. In Sicily, the focal point for low-chill production, at least 90% of plantings are still the open Ventura variety—but breeders from Spain and the USA are trialing new genetics.

Italy’s geographic and climatic diversity allows growers to stretch the harvest season from early spring in the south to late summer in the north. Still, most production is concentrated from May to July, with a peak in June.

Compared to the heavyweights of Europe and North Africa—Spain (80,000 MT), Poland (62,000 MT), and Morocco (56,000 MT)—Italy’s production of 11,000 MT in 2023 placed it 8th in the region.

However, the country has seen consistent growth: from 614 hectares in 2015 to 1,670 hectares in 2024—a 172% increase.

Even more notable is the 300% growth in production over the same period, from 3,000 to 12,000 MT. This suggests rising productivity, likely thanks to better genetics, modern systems, and regional diversification.

Domestic demand outpaces exports

In 2015, 37% of blueberries were exported. By 2024, that number had fallen to just 25%, signaling the growing strength of the domestic market.

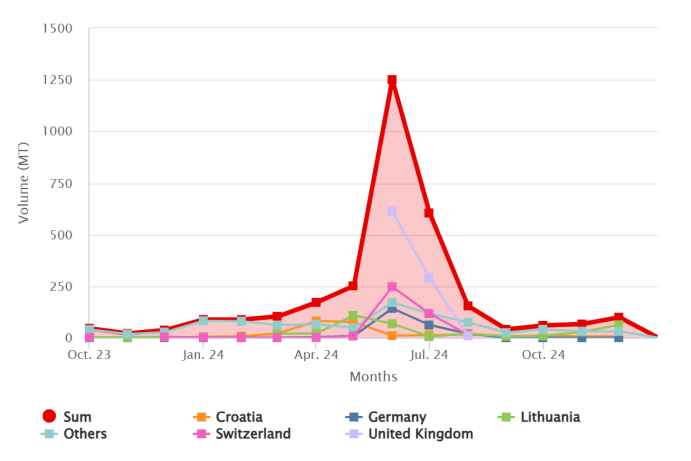

Italy’s main export destinations are:

- UK (912 MT)

- Switzerland (391 MT)

- Lithuania (350 MT)

- Croatia (260 MT)

- Germany (237 MT)

Fresh export from Italy: a short season, but potential to expand

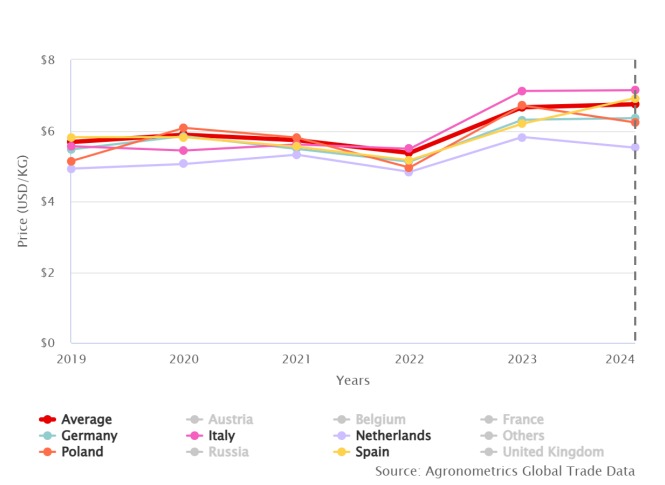

Despite its modest volume, the Italian blueberry export industry was valued at nearly €20 million in 2024. The average FOB export price of $7.14/kg (approx. €6.58/kg) outperformed the European average ($6.74/kg ≈ €6.21/kg), with only Spain coming close at $6.92/kg (≈ €6.38/kg).

Blueberries outperform other Italian fruits by value

When compared with more established Italian fruit exports like apples, kiwifruit, oranges, and strawberries, blueberries still represent a small share. But their value per kilogram—€7.23/kg in 2024—far exceeds that of strawberries (€4.27/kg), kiwifruit (€2.35/kg), and other traditional crops.

This high unit value is already pushing some growers—especially in kiwifruit—to convert orchards to blueberries, following years of setbacks due to diseases like PSA. Given the data, this trend is likely to continue.

Imports: a key piece of the puzzle

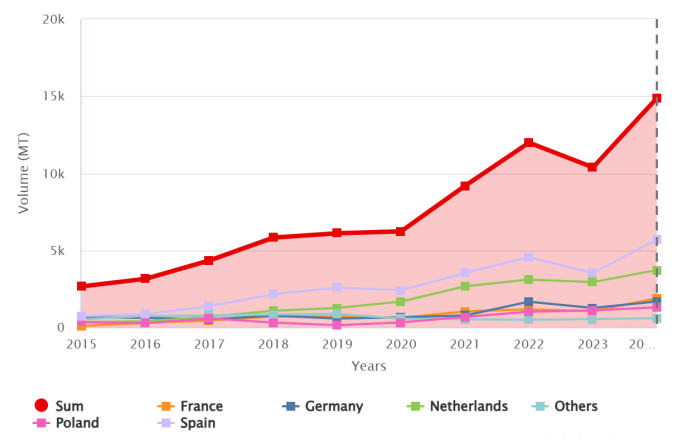

While Italy is growing more blueberries than ever, it still imports more than twice what it produces. In 2024, imports hit 15,000 MT—outpacing domestic production and highlighting the shortfall in local supply.

Main sources of imports include:

- Spain (5,700 MT, including fruit from Morocco)

- Netherlands (3,714 MT, largely re-exports from Peru and Chile)

- France (1,884 MT, mostly Spanish/Moroccan fruit)

- Germany and Poland (domestic and re-exported fruit)

Italian fresh import by year

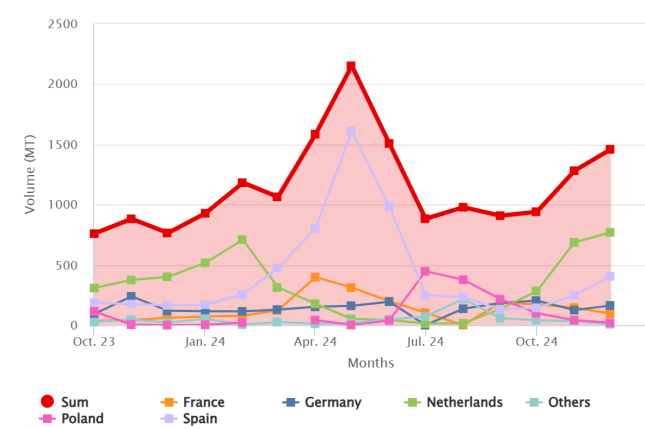

Import peaks occur in May, just before Italy's own harvest ramps up. Imports then dip sharply in July, during the peak of the domestic season—showing that imports and domestic production are often complementary rather than competitive.

A seasonal market with strong summer demand

Consumption in Italy appears closely tied to seasonal trends. Most blueberries—whether imported or local—are consumed in spring and summer. This seasonal demand is visible in import data, which shows a consistent May peak, followed by a sharp drop in July.

During the brief Italian export window in June, shipments—especially to the UK—are at their highest. Interestingly, this export peak coincides with a temporary dip in imports, giving local producers a brief window of limited competition.

Imports by months: Higher imports during the Northern Hemisphere season

Future outlook for the industry

Italy’s blueberry industry is on a steady upward path—growing in area, production, and value. Though it lags behind regional giants like Spain and Poland, Italy’s unique climatic diversity, improving techniques, and strong domestic demand provide a solid foundation for future growth.

At the same time, Italy remains heavily reliant on imports to meet consumer demand, highlighting both challenges and opportunities for expansion.

As growers adapt to climate risks and shifting market conditions, blueberries are emerging as a high-value alternative to traditional fruit crops—particularly in regions pivoting away from struggling sectors like kiwifruit.

With the right investment in genetics, infrastructure, and marketing, Italy is well-positioned to further strengthen its role in the European blueberry landscape—growing internal consumption, boosting local production, and improving its export capabilities.

Source: Agronometrics

Berry AreaThis article is part of a series dedicated to Berry Area in co-operation with Macfrut 2025. This content is in support of the event which will take place May 6-8, 2025 in Rimini Expo Centre, where the Berry Area stands as a reference point for all those seeking innovative solutions for the production and marketing of berries. 👉 Learn more about the Berry Area at this link. |