This is an abstract from the 2024 IBO Report. Click here to download the full report

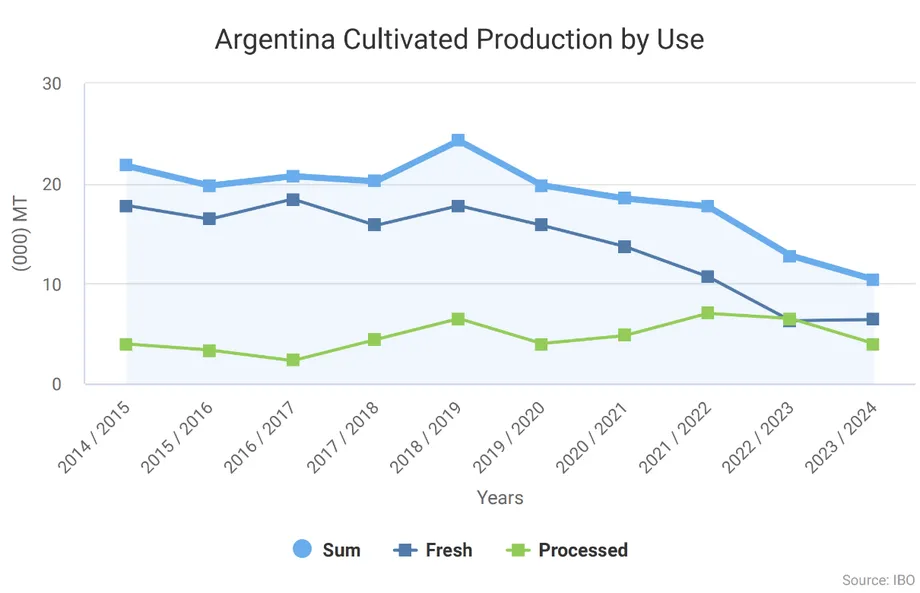

The 2023 Argentine blueberry export campaign recorded a significant increase, with total exports rising by almost 20% compared to the previous year. During the 2022 season, Argentina exported 10,224 metric tons (MT) of blueberries, including 6,336 MT fresh and 3,888 MT frozen, while approximately 4,000 MT were destined for the domestic market.

Fresh Blueberry Exports on the Rise

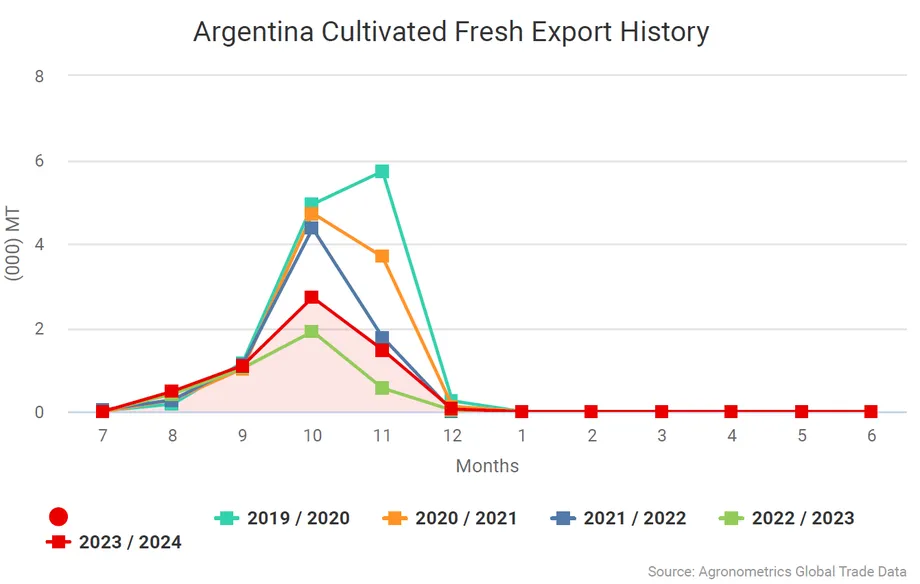

One of the most noteworthy outcomes of the 2023 campaign was the substantial increase in fresh blueberry exports, which grew by 50% compared to the previous year. This surge was primarily driven by reduced volumes of Peruvian blueberries during Argentina's peak season, providing a competitive advantage to Argentine exporters. By using air transport, Argentina was able to respond promptly to markets, ensuring reliability and predictability.

Key Export Markets

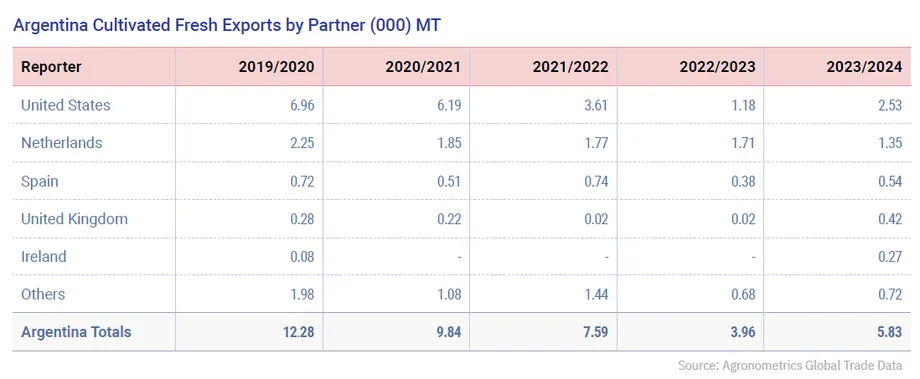

The European Union remains the primary market for fresh Argentine blueberries, accounting for 50% of the total export volume (3,145 MT). This consistent demand highlights the quality and reliability of Argentine blueberries in the European market. Additionally, exports to North America (United States and Canada) saw a significant increase of 121% compared to the previous year, representing 45% of the total exported volume (2,717 MT).

Organic Production and Market Trends

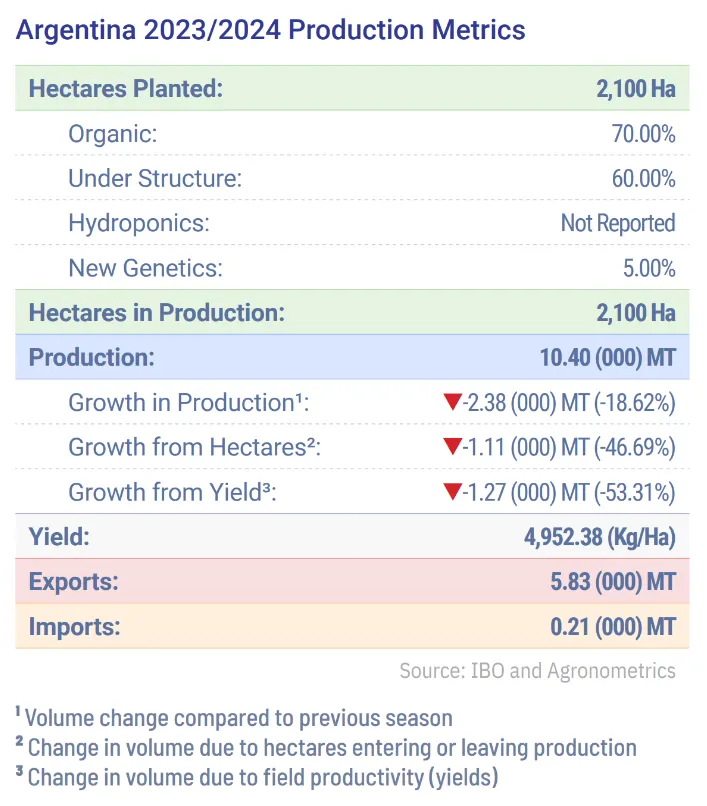

Another highlight of this campaign was the volume of organic blueberry production, which reached almost 50% of the total. Europe is the main destination for organic blueberries, absorbing 92% of Argentina's total organic exports. Within Europe, Germany and the United Kingdom showed the most significant growth, with increases of 445% and 125%, respectively. Some companies have achieved 100% organic production, reflecting a growing trend toward sustainable production models.

Logistics and Transport

This campaign was characterized by a high volume of air shipments, which accounted for 90% of the total. This shift towards air transport was driven by market demands, ensuring the timely delivery of fresh products to meet consumer expectations.

Commercial Strategy

Over the past five years, the national blueberry sector in Argentina has adopted a triple-impact business model. This approach emphasizes not only the taste and quality of the product but also the production methods. As part of this strategy, a due diligence system has been developed, focusing on dignified working conditions and promoting schooling.

Currently, 50% of production is certified under these standards. This commitment allows Argentina to position itself in more demanding markets and access niche markets that seek and value sustainable and ethical production processes.

The Impact of Peru

Argentina may have been the first producer country to feel the impact of Peru’s rise as a blueberry exporter. As one of the pioneers of South American production at the turn of the millennium, with early harvests ahead of Chile and a privileged position in foreign markets in September and early October, Argentina’s timing advantage has been eroded by Peru’s growth. This has forced Argentina to improve its competitiveness through various means.

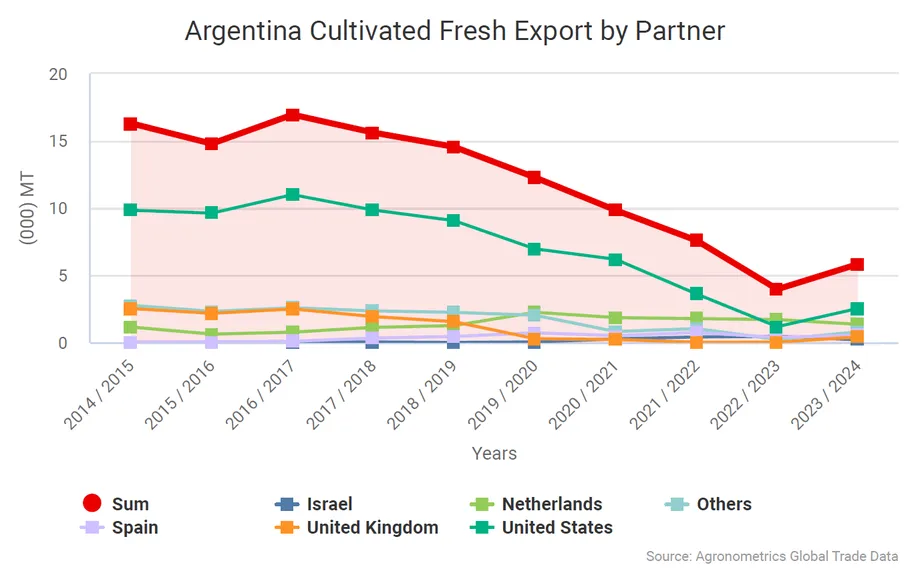

Between 2016 and 2022, Argentina's annual fresh blueberry exports declined by 74%, dropping to 4,280 MT. However, in 2023, fresh blueberry exports increased by more than half, reaching 6,336 MT, as reported by the Argentine Blueberry Committee (ABC).

This increase was a direct response to the shortage of Peruvian blueberries in global markets during Argentina's peak period, with overseas sales beginning in August, peaking in October, and continuing into December with limited volumes. Unlike other supplier countries that capitalized on these market opportunities, the average Argentine price for the season remained largely unchanged.

This likely reflects the strategic shift by many producers, who had initially planned to allocate their fruit for processing or the domestic market (with less stringent storage requirements) but ultimately shipped the same fruit abroad as fresh produce.

Changing Markets

In recent years, the share of shipments to the United States (a traditional market) has been declining, even falling below that of the Netherlands in 2022. However, last year the United States returned to the top spot with a 43% share (compared to 30% in 2022).

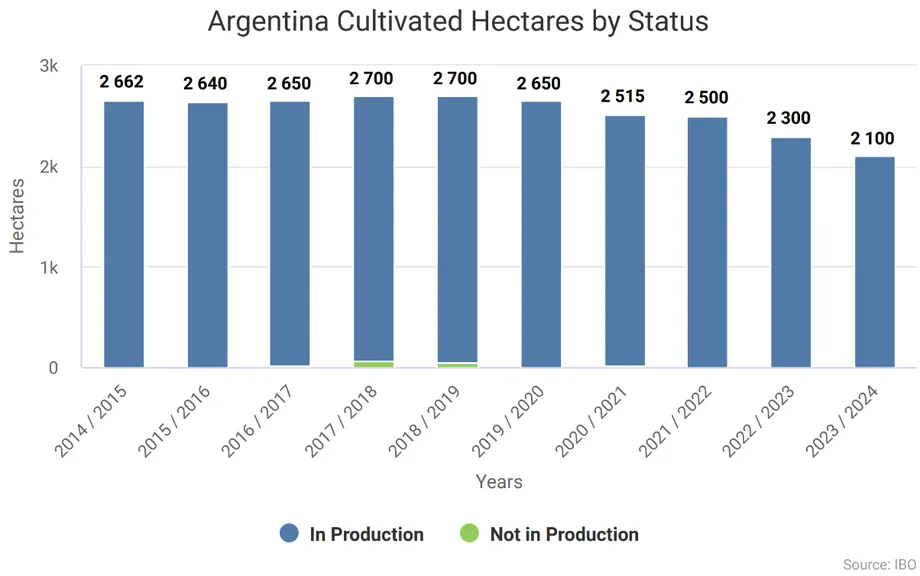

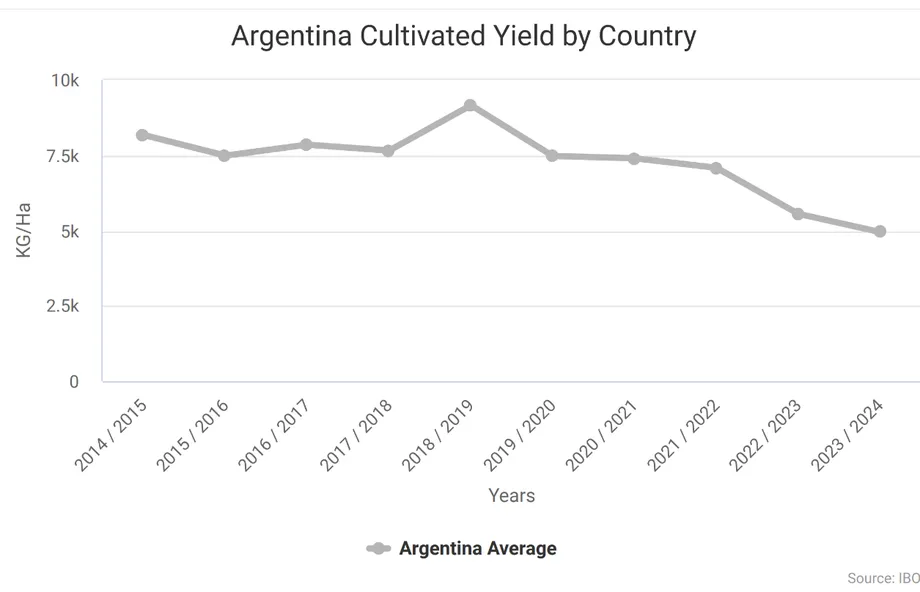

It is worth noting that the overall decline in Argentine blueberry exports, observed on the trend line, masks improvements in yield and operational efficiency in the country. Over the past decade, the area dedicated to this crop has been significantly reduced, with several high-profile exits in recent years.

Necessary Innovations

The industry's relatively small operations have embraced technology and vertical integration. With a climatic trend toward rainfall and hail events, most blueberry orchards are now cultivated under protected systems. Most Argentine producers seal export containers directly at their packing facilities, but not all have kept pace with the rapid operational changes required for survival.

Due to the strategic shift toward fresh produce, the 2023 numbers for frozen blueberries decreased, but not significantly (-12%). The existing infrastructure for processing is predominantly located in Buenos Aires, which represents a portion of Argentina's production, while most production is grown in the Northeast (Corrientes, Entre Ríos) and Northwest (Salta, Tucumán, Catamarca).

Following a 32% increase in the previous year for the volume of fresh blueberries sold in the domestic market, the rise in exports offset some of this momentum, with a minimal decline of approximately 2.5%.

By Sea or by Air?

For several years, the industry has been trying to reduce costs by increasing the share of sea shipments, but these efforts have been hindered by the pandemic and disruptions in maritime services, a problem felt particularly towards the end of the 2021 season.

Even with improved logistical services for both air and sea transport, some exporters have opted to ship fruit exclusively by air to seize niche opportunities in very specific markets that can be reached quickly, preserving product shelf life; Israel, the United Arab Emirates, and Southeast Asia are prime examples of this strategy. This approach was observed before the El Niño year and became more prominent in 2023 due to the shortage of Peruvian production, accounting for 90% of shipments.

New Varieties

The adoption of new varieties has been another strategy to enhance the competitiveness of Argentine growers. A U.S.-based nursery introduced new cultivars to the country in the 1990s, contributing to a boom about 14 years ago, and is now aggressively launching new lines. Additionally, a major Australian breeder, in collaboration with an Argentine partner, harvested its first commercial crop with new genetics in 2022, expressing plans to scale up production over time.

Read more

Continue reading more abstracts from the 2024 IBO Report or download the full report: