Since 2019, Italian Berry has been documenting the evolution of the berry sector, when the main urgency was to foster real awareness of the category’s potential within the distribution chain. At the time, while in the UK berries (including strawberries) were already the top-selling fruit category, in Italy they were still met with skepticism by retailers.

Has the packaging size issue been resolved?

One of the main obstacles to the sector's growth was the rigid approach to packaging sizes: in 2019, 86% of blueberries were sold in the classic 125-gram punnet. As early as January 2020, Italian Berry had already pointed out the limits of this choice in an article titled: “Why 125g is the wrong format for blueberries”.

At the time, packaging was both a cause and a symptom of the blueberry’s underdeveloped potential, despite being the leading product in the category.

Five years later, we can say that this issue has largely been resolved. During the roundtable “Berry Trend”, moderated by Raffaella Quadretti at the Berry Area of Macfrut 2025, representatives of the large-scale retail trade presented numerous examples showing that the issue has been acknowledged and overcome: today, larger formats – such as 500g buckets – are widely available on store shelves, and Coop declared that 60% of its sales are now in packages of 250 grams or more.

Blueberries on sale at Coop (Italy) in the 250g format (May 2025)

Blueberries on sale at Coop (Italy) in the 250g format (May 2025)

Increasingly relevant

The economic relevance of berries for large-scale retail is also becoming increasingly evident. At Coop, berries generate a sales volume equal to that of kiwifruit, while at the Italbrix group (which includes Italmark, Family Market, and Italgros Cash & Carry), in the October–November 2024 season, berries even outperformed bananas in terms of value.

However, one crucial issue remains unresolved: segmentation. This refers to the strategy of offering differentiated products to meet diverse needs and consumption occasions.

Italian Berry began addressing the issue in 2020, quoting Philip Kotler: “Market segmentation is the division of a market into distinct subsets of customers, where any subset may conceivably be selected as a market target to be reached with a distinct marketing mix.”

Today, just like six years ago

Even back then, we identified five well-established segments in more advanced markets: standard, premium, organic, local, and discount. Today, a new segment is emerging: the “snack” or “on-the-go” category, designed for out-of-home and between-meal consumption.

In preparation for the Berry Trend 2025 event, Italian Berry launched a provocation in the form of an analysis: “Blueberries are all the same” – without a question mark.

Data from the Berry Observatory revealed a still polarized situation: 89% of SKUs on the Italian market in 2024 were classified as “standard”. The remaining 11% was almost evenly divided among premium, zero-residue, and organic lines. This marks a decline from the 2021–2023 period, when non-standard SKUs accounted for 13.4% of the assortment – a clear sign of regression rather than progress in terms of diversification.

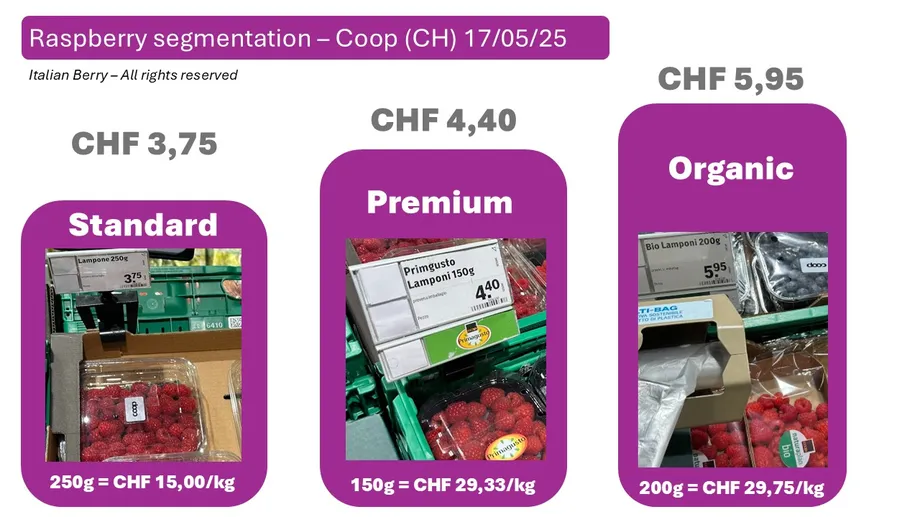

Raspberry segmentation in Coop (Switzerland) on 17/05/2025

Raspberry segmentation in Coop (Switzerland) on 17/05/2025

Segments yet to be explored

Our point of view was – and still is – that a non-segmented offer overlooks a wide range of needs and consumption moments, leaving concrete opportunities untapped. We were open to being proven wrong, at least in terms of stated intentions. Yet, from the Berry Trend roundtable, a deafening silence emerged: despite the moderator’s direct prompts, the issue of segmentation was left out of the discussion.

It’s a lack of awareness reminiscent of the attitude toward packaging sizes a few years ago. That’s why we look to the future with cautious optimism: our hope is that, in 2030, the title of the roundtable could be “How segmentation doubled the blueberry market.”

One final chapter remains to be opened: pricing and margins – a topic that deserves its own dedicated analysis.

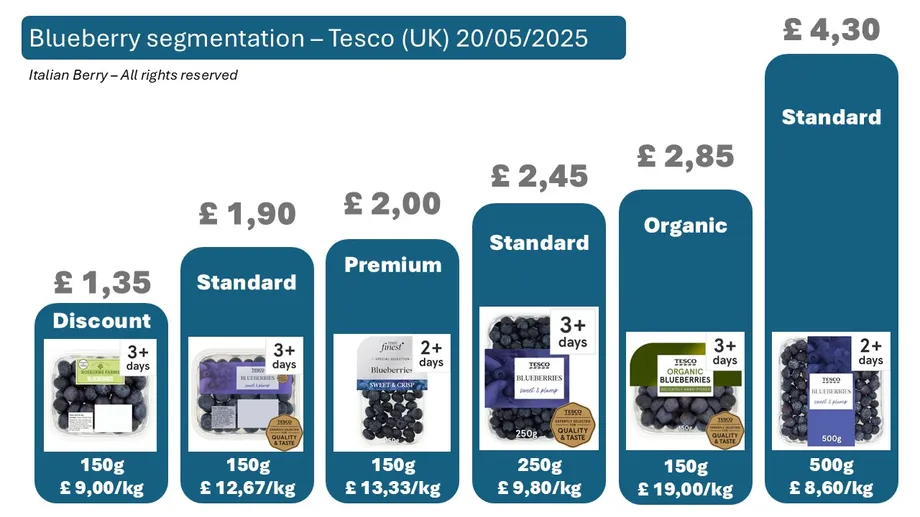

Tesco UK has been focusing on blueberry segments for years

Tesco UK has been focusing on blueberry segments for years