In France, blueberry consumption is growing rapidly and orchards are multiplying. The industry needs data and guidance to correctly plan new plantations and meet consumer expectations.

Since 2021, CTIFL has been studying blueberry quality parameters and analyzing the criteria that influence consumer acceptance or rejection.

Wild blueberry vs cultivated blueberry

Blueberries are increasingly appreciated both for their taste and for their health benefits. Consumed in various forms (fresh, cooked, dried, juice, etc.), this berry is winning over an ever-growing number of consumers. Blueberries belong to the Ericaceae family.

The European wild species Vaccinium myrtillus differs from the North American cultivated varieties Vaccinium corymbosum.

The wild blueberry is a creeping shrub ranging from 20 to 60 cm in height, while cultivated varieties can reach up to 2 meters. Flowering occurs in spring with small bell-shaped flowers, white or pink in color. Fruiting takes place in summer, from June to September, depending on the variety and growing region.

The fruit is covered with a light bloom that gives it a matte appearance. Cultivation requires acidic soil (pH between 4 and 5.5), well-drained and rich in organic matter, as well as a sunny exposure. Sensitive to drought, it needs controlled irrigation. It is very hardy and tolerates winter cold well, but late frosts can damage flowers.

A booming global market

The global blueberry market is expanding strongly. With about 296,000 tons produced (see article "The berry market continues to grow," p. 15), the United States is among the main producers, followed by Canada, which dominates wild blueberry production (160,000 t).

Since the 2010s, Latin America has acquired a growing role: Peru produces 290,000 t, Chile 100,000 t and Mexico 70,000 t, offering counter-seasonal supply compared to the northern hemisphere. Morocco (60,000 t) is also establishing itself in the market. In Europe, the main producers are Poland, Spain and Portugal.

The situation in France

In France, production remains modest, at about 2,000 tons, concentrated in the regions of Auvergne-Rhône-Alpes, Bourgogne-Franche-Comté, Nouvelle-Aquitaine and Brittany.

Two production models coexist: the traditional harvesting of wild blueberries (in the Vosges, Cévennes and Massif Central) and the cultivation of selected varieties, both in conventional and organic farming.

Consumption has increased significantly over the past decade, driven by interest in healthier eating and the growing presence of the product on store shelves. To meet demand, France imports a significant share of the blueberries consumed, mainly from Spain, Morocco, Peru and Chile.

Nutritional value and health benefits

Blueberries are composed of 84% water and are low in calories (57 kcal/100 g). They are a good source of fiber, vitamin C and vitamin K1.

However, it is mainly their polyphenols — in particular anthocyanins, pigments with antioxidant properties — that give them their well-known health benefits. These compounds are associated with cell protection, slowing aging, improving blood circulation and preventing cardiovascular diseases [1, 2, 3].

Some studies also suggest a positive effect on memory, cognitive functions and reducing the risk of type 2 diabetes, thanks to a moderate impact on blood sugar [4, 5, 6, 7].

The CTIFL study

Organoleptic and nutritional qualities are important factors to consider when selecting suitable plant material for French production. Consumers are increasingly attentive to diet, particularly product origin, taste and health benefits [8].

Since 2021, CTIFL has been conducting research on flavor quality and health compounds present in blueberries. Reference values and associated variability for the main quality parameters have been determined.

Furthermore, in 2023 and 2024, two consumer studies highlighted preference criteria, making it possible to identify two distinct consumer profiles with different expectations.

Four years of analysis on more than 70 batches

Over four years, more than 70 batches of blueberries were analyzed using descriptive methods, through sensory analysis and physico-chemical measurements. The plant material examined included 34 varieties.

Samples came from commercial batches, niche products, young plantations or established orchards. Some batches were taken from the varietal collection of the CTIFL La Morinière center, which also studies their agronomic characteristics.

Sensory quality and consumer preferences of cultivated blueberries

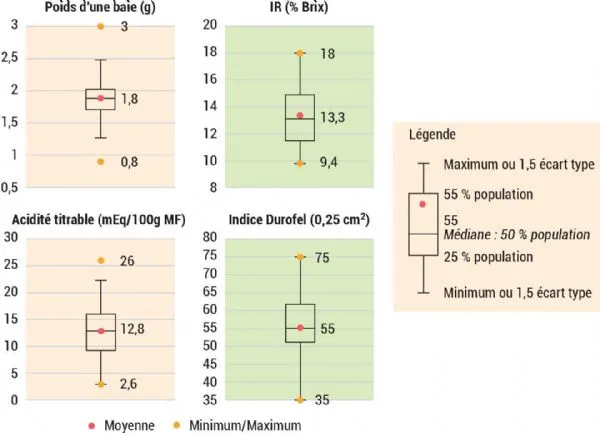

Blueberries are almost never graded: a single batch can contain berries of very different sizes. The average weight of a berry is 1.8 g, but it can range from 0.8 g to 3 g.

Color shows very little variation among varieties at maturity: shades of blue are hard to distinguish, while purplish berries indicate immaturity. Color is the main harvest criterion.

The amount of bloom is a typical varietal trait and also varies. The refractometric index (RI) varies significantly: from 9.4% to 18% Brix. Average acidity is 12.8 meq/100 g of fresh matter, with a range between 2.5 and 26 meq/100 g.

Figure 1: Average, minimum, maximum and median values for weight (g), RI (% Brix), titratable acidity (meq/100 g FM) and Durofel index (0.25 cm²).

Figure 1: Average, minimum, maximum and median values for weight (g), RI (% Brix), titratable acidity (meq/100 g FM) and Durofel index (0.25 cm²).

The importance of sensory analysis

RI and acidity values are not directly correlated with taste perception. Mouthfeel results from a complex balance between sugar, acidity, aromas and texture.

Sensory analysis is the tool best suited to assess organoleptic quality. The quantitative descriptive method ensures good objectivity thanks to rigorous panelist training.

Reference sensations are standardized through training sessions. Tastings take place in the CTIFL sensory analysis laboratory.

Each panelist evaluates 10 berries per batch. Samples are assessed using a specific methodology developed from previous studies [9].

Main differentiation parameters

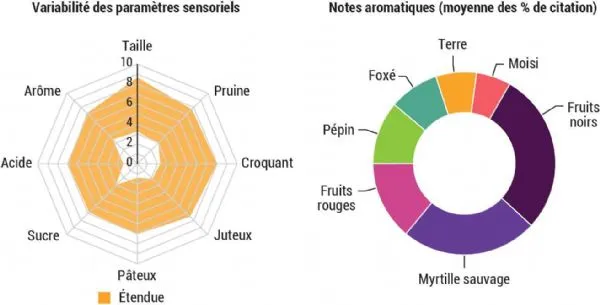

The main parameters differentiating blueberries are related to taste — namely sweet and acidic notes — combined with aroma intensity, and to texture attributes such as crunchiness, juiciness and mealiness (Figure 2).

Figure 2: Variability of organoleptic parameters of 76 batches tasted by the trained panel from 2021 to 2024. Sensory profiles - minimum and maximum intensity and aromatic notes - average percentage citation.

Figure 2: Variability of organoleptic parameters of 76 batches tasted by the trained panel from 2021 to 2024. Sensory profiles - minimum and maximum intensity and aromatic notes - average percentage citation.

Perceived quality during tasting is the result of the interaction between these different parameters. Sugar and acidity are perceived by taste receptors on the tongue [10], while aromas are perceived by olfactory receptors.

The brain integrates all sensory stimuli into a single overall perception. Tasting therefore allows gustatory sensations to be reliably characterized.

Correlation analysis shows that the refractometric index (RI) is more strongly correlated with aroma intensity (correlation coefficient = 0.54) than with direct sugar perception (correlation coefficient = 0.48).

Four classes of sensory quality

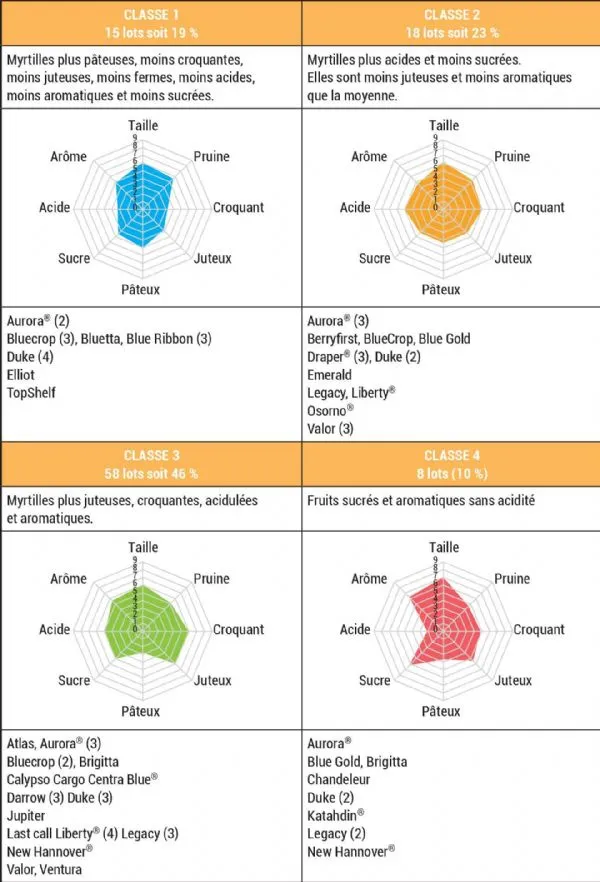

The sensory qualities of the 76 batches analyzed proved extremely variable and were divided into four distinct classes:

Class 1: blueberries more mealy, less crunchy, less juicy, softer, less acidic, low in aroma and sweetness. Includes 15 batches.

Class 2: blueberries more acidic and less sweet, less juicy and less aromatic than average. Includes 18 batches.

Class 3: blueberries juicier, crunchier, with well-perceived acidity and pronounced aroma. This is the most represented class with 58 batches.

Class 4: blueberries very sweet and very aromatic, but with no perceived acidity. Includes only 8 batches.

Quality is the result of multiple factors

As with all fruit crops, quality is built in the field and must be maintained throughout the marketing stage. It is determined by the interaction between genetics, environmental conditions, and agronomic practices.

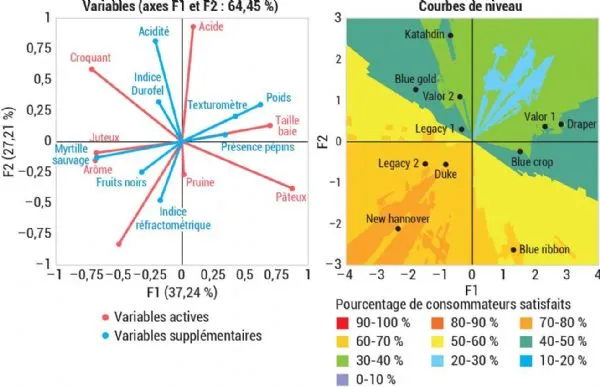

Genetics is not necessarily the main factor influencing the quality of cultivated blueberries. The study highlights significant variations within the same batch and across different batches of the same variety (Figure 3).

Figure 3: Correlation circle and Principal Component Analysis (76 observations divided into 4 classes)

Figure 3: Correlation circle and Principal Component Analysis (76 observations divided into 4 classes)

Some varieties show sensory characteristics that differ significantly depending on the batch analyzed and fall into several quality classes. This is the case, for example, of Duke or Aurora, which appear in all four identified classes.

Part of the variability can be explained by the stage of berry development. Formation and ripening occur asynchronously, over a period ranging from 3 to 5 weeks.

Influence of ripening and storage

Premature harvesting leads to blueberries that are less sweet, more acidic, and with reduced aromatic development.

Storage duration has a greater impact on texture: juiciness decreases, while mealiness increases. In some cases, crunchiness can even improve after a few days of storage.

Consumer preferences

In 2024, a consumer study was conducted involving 147 people who tasted blueberries at home. Each participant sampled eleven batches of blueberries, rating them on a scale from 0 to 10.

The combination of sensory profiles and hedonic test results made it possible to create a preference map.

On this map, preference areas are displayed in color codes: from red (high satisfaction) to blue (low satisfaction) — Figure 4. The redder the area, the greater the number of satisfied consumers.

Figure 4: Blueberry preference map

Figure 4: Blueberry preference map

This analysis made it possible to identify the characteristics of the most appreciated blueberries: sweetness, strong aroma, high juiciness, notes of black fruits and wild blueberry.

The ideal profile turns out to be sweet, aromatic and low in acidity. However, no product satisfied more than 80% of consumers.

Qualitative analysis using the JAR method

The JAR (Just About Right) methodology was used to evaluate consumer perception of quality and to understand which traits influence appreciation positively or negatively.

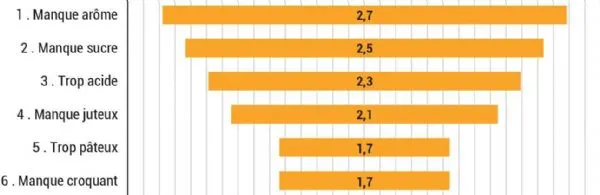

The most penalizing factors in order of impact are: Low aroma, Low sweetness, Excessive acidity, Low juiciness, Lack of crunchiness or excessive mealiness.

Figure 5 shows that taste has a greater impact than texture in determining appreciation.

Figure 5: Criteria with the greatest impact on consumer appreciation

Figure 5: Criteria with the greatest impact on consumer appreciation

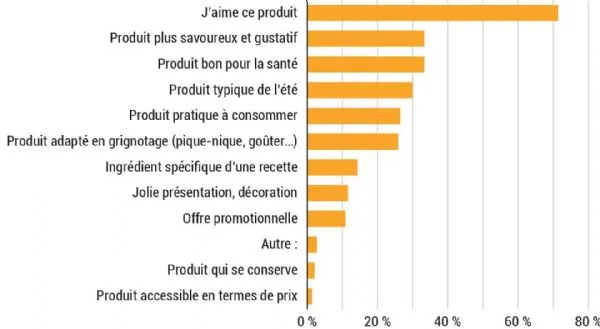

Figure 6: Reasons for blueberry consumption (percentage of consumers – base 147)

Figure 6: Reasons for blueberry consumption (percentage of consumers – base 147)

Two groups of consumers, two different approaches

Consumers were classified into two groups based on their appreciation ratings, in order to analyze how preferences are structured.

The first group values aroma and texture above all. The second group, on the other hand, prioritizes sugar content.

These differences are also reflected in purchase motivations, consumption behaviors and product knowledge.

Group 1: regular and informed consumers

Group 1 represents 52% of respondents. These are blueberry enthusiasts, mainly middle-class, middle-aged women.

These regular consumers prefer to eat blueberries raw and plain, mainly during meals. Their preferences are for crunchy, aromatic and juicy fruit.

Their main motivation for consumption is personal enjoyment: for them, the sensory experience is paramount. They are willing to pay a premium price for a product that meets their expectations.

Group 2: non-experts and new consumers

Group 2 represents 48% of the sample. It consists of non-experts, with families and young professionals particularly well represented.

They consume fewer blueberries and about 10% do not consume them at all. They are not very familiar with the product and are infrequent buyers.

The main preference criterion for this group is a sweet fruit without acidity. Their typical profile is women under 34, with two children, from affluent socio-economic categories.

These results are consistent with the American study by Gilbert et al. [12], which showed that preferences vary according to gender, age and income.

Price as a limiting factor

Blueberries remain an expensive product, chosen mainly by wealthier or middle-income groups. Purchases take place mainly in supermarkets, but large fresh-produce retailers also play a significant role.

Selection criteria at purchase: for blueberry buyers, the main factor is visual appearance. In second place, consumers consider origin. Price is only the third stated criterion.

A high price can deter part of potential buyers. Promotions and discounts are effective tools to boost sales but do not eliminate the perception of a “premium” product.

Pleasure before health

The main reason for blueberry consumption is pleasure, rather than health benefits. Price is perceived as an indicator of quality.

52% of respondents indicated aromas and flavors as the main satisfaction criteria. New varietal selections should not focus exclusively on texture or logistical resistance.

Breeding programs should focus on aromatic quality, which is the main driver of preference, as also confirmed by the recent study by Colantonio et al. [13].

Text and figures source: www.ctifl.fr

Opening image source: Unsplash