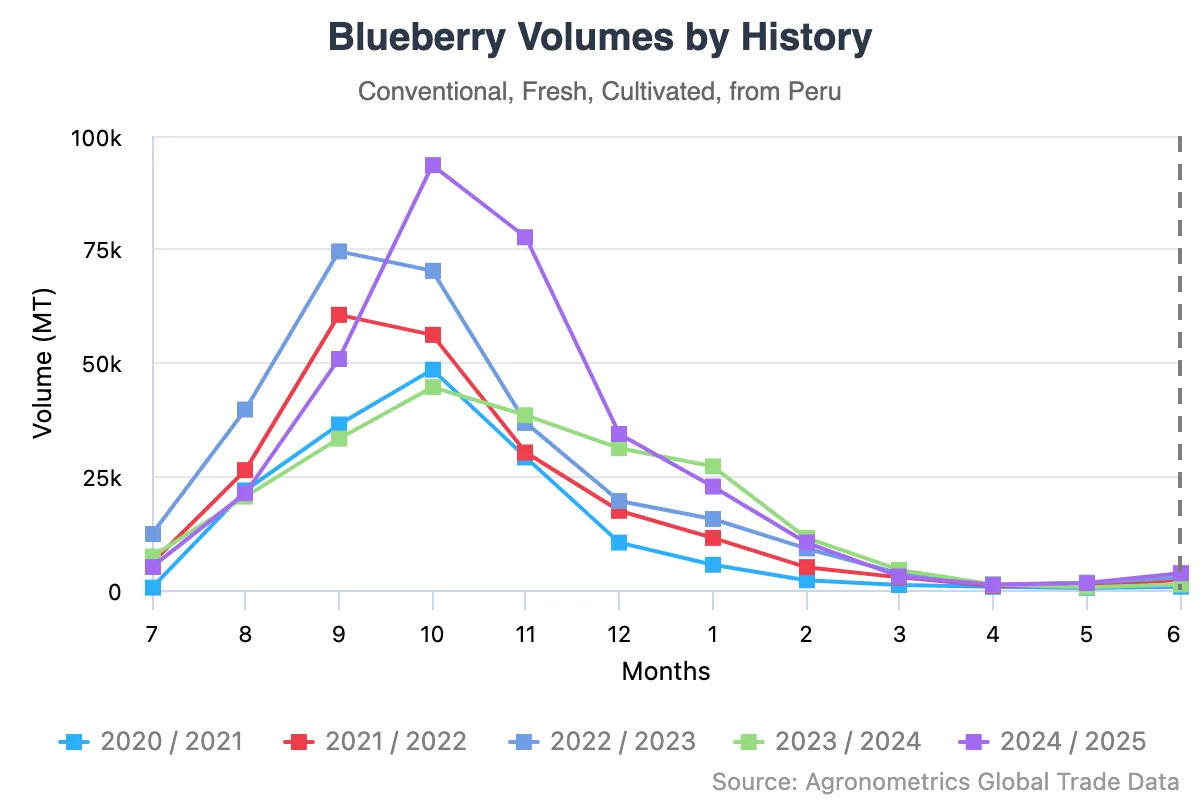

Peru is on track to export over 400,000 tons of blueberries in the 2025/2026 season, a 25% increase over last year.

Since 2016, the sector has grown at an average 30% annually, driven by more planted area, improved varieties, and strong overseas demand.

Rapid expansion challenges

However, this rapid expansion is testing the system.

In 2023, El Niño cut production and exports by over 40%, pushing prices sharply higher.

The 2024 rebound came with its own issues: many growers delayed pruning to let plants recover, compressing the harvest into a shorter period.

As a result, weekly exports during peak season surpassed 24 million kilos for three consecutive weeks, overwhelming trucks, cold storage, ports, containers, and labor.

Adapting with new varieties

Luis Miguel Vegas of Proarándanos warns that unless Peru lengthens its harvest period, logistics could “crash.”

To address this, producers are replacing older workhorse varieties like Ventura and Biloxi with newer, more adaptable ones such as Sekoya Pop and Mágica, which better handle climate variability and stagger fruiting.

These now account for 60% of planted acreage, marking a strategic shift from simply producing more to producing smarter.

Markets and logistics

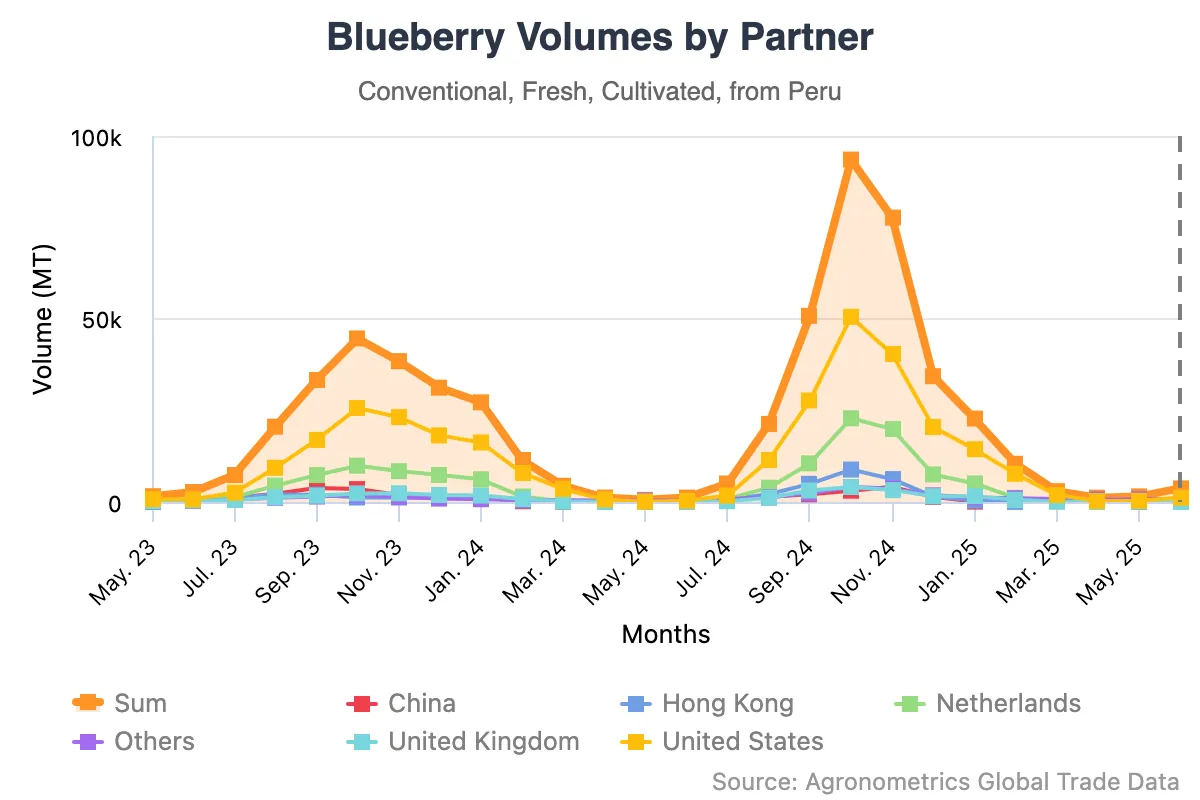

The U.S. remains Peru’s main market, taking over 55% of exports.

But Asia is gaining importance, especially China, boosted by the upcoming Chancay Port, which will cut shipping times by 10 days.

Exporters are also diversifying routes to avoid congested hubs like Callao and unstable ports like Philadelphia, recently hit by strikes.

Risks of oversupply

While production is growing at 30% annually, consumption in major markets like the U.S. is expanding by less than 10%, risking price pressure in the absence of new demand.

Experts stress the need for stronger international marketing, new market development, and building Peru’s country brand.

Without these, even high-quality fruit may struggle to maintain premium prices in oversupplied markets.

Looking ahead

Peru’s blueberry industry stands as a case study in agricultural ambition, rapid growth, and innovation.

The next challenge is ensuring logistics, infrastructure, and global demand keep pace.

As Vegas sums it up: “We’re growing fast. But if we want to stay on top, we need to grow smarter, not just bigger.”

Images and text source: agronometrics.com