The Morocco Berry Conference recently concluded in Agadir, marking a sold-out edition of the event. It brought together over 600 professionals from the "fruit rouges" sector, which in Morocco primarily refers to blueberries, raspberries, and strawberries, in this specific order.

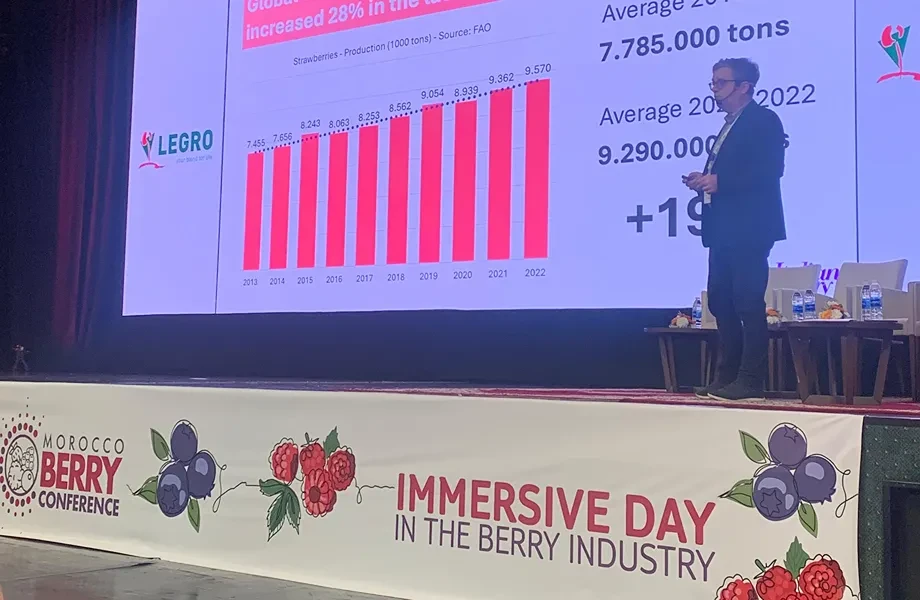

Until 2020, strawberries were the most widespread crop in the category, but since 2021 they have been surpassed by raspberries and then blueberries, according to data presented by Amine Bennani, president of the Moroccan Red Fruit Producers Association.

The sector in Morocco spans nearly 14,000 hectares, with 50% allocated to blueberries and 32% to raspberries. In the 2023/24 season, strawberries accounted for 18% of the total berry production area.

Blueberries lead the category in terms of exports (over 75,000 tons, of which 89% fresh and 11% frozen) and volume growth: exports increased by 33% compared to the 2023/24 season.

While raspberries recorded a 4% decline in exports, strawberries maintained their volumes (-3%) despite a 30% reduction in cultivated area.

Currently, the berry sector in Morocco covers nearly 14,000 hectares, with 50% dedicated to blueberries and 32% to raspberries. Although strawberries remain significant, they represent 18% of the total cultivated area, according to data from the 2023/24 season.

Morocco: berry cultivation areas during the 2023/24 season

Morocco: berry cultivation areas during the 2023/24 season

Blueberries not only dominate in terms of cultivated area but also in exports. With over 75,000 tons exported last season, 89% of which were fresh and 11% frozen, blueberries saw a 33% growth compared to the previous season.

Conversely, raspberry exports fell by 4%, while strawberries maintained their volumes (-3%) despite a substantial 30% reduction in cultivated area.

Varietal landscape

The varietal landscape of Moroccan strawberries is dominated by Spanish varieties, accounting for 93% of the area planted. Three main varieties (Victory, Sabrina, and Florida Fortuna) cover nearly 50% of the planted area. Morocco is also emerging as a plant producer: local nurseries now meet 15-20% of the national demand and export 40 million plants annually.

For raspberries, the main varieties are Yazmin, Adelita, Diamond Jubilee, and Majestic, with Driscoll’s holding the largest market share.

The varietal landscape of blueberries is highly dynamic, with all major companies, groups, and cooperatives developing their own breeding programs.

The main varieties grown include Kirra, Coria, Rocio and Sekoya Pop, which remains the most widely planted. In 2024 alone, an additional 1,500 hectares were added for blueberry cultivation.

Water issues

Despite the strong growth in the areas planted with berries, Morocco is facing significant challenges that threaten the future development of the sector.

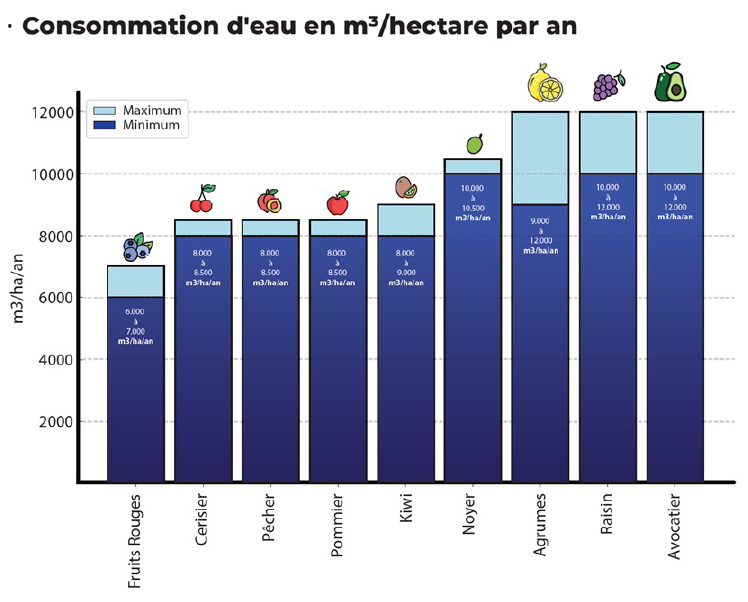

Particularly in the region around Agadir, the scarcity of water resources is becoming a very serious problem. The berry sector boasts higher water efficiency compared to other fruit crops: while red fruits consume between 7,000 and 8,000 cubic meters per hectare annually, other widely cultivated crops such as citrus, table grapes, and avocados consume up to 12,000 cubic meters.

Morocco: water consumption per crop (cubic meters per hectare per year)

Morocco: water consumption per crop (cubic meters per hectare per year)

Additionally, interventions are underway to access deeper water resources and optimize usage through the adoption of agrotextiles for crop coverage. However, the problem is escalating to a point where agricultural use is competing with potable water demands for the population.

Coupled with extreme weather events (such as winds exceeding 100 km/h and temperatures reaching 51°C), this issue has caused shifts in growing seasons and production windows, alongside increased costs for coverage and water resources. In some cases, yields have decreased by 5% to 20%.

Effects of extraordinary climatic phenomena in Morocco during the 2023/24 season

Effects of extraordinary climatic phenomena in Morocco during the 2023/24 season

Labor

In the 2023/24 season, for the first time in Morocco, a significant issue emerged: labor shortages. A production area that expanded rapidly from 10,000 hectares (2020) to 14,000 hectares (2024) highlighted a problem previously considered exclusive to European countries.

Last season, labor shortages had a notable economic impact: it is estimated that 15% of blueberry exports were lost due to a lack of pickers.

The problem is complex: according to operators, the average wage is about €8 per person per day (not sufficient to cover the cost of living in Agadir) but still higher than that offered in Egypt, seen as Morocco’s main external competitor.

On the other hand, there is significant room for improvement in worker productivity: the same Moroccan workers achieve harvesting outputs in Spain that are 3-4 times higher than those achieved in Morocco.

Moreover, the sector lacks the ability to attract young workers, even for part-time jobs, and there is a shortage of temporary housing for laborers coming from other regions.

A raspberry seller at the Agadir market

A raspberry seller at the Agadir market

Outlook

These challenges have not diminished Morocco's appeal, which continues to attract investments and interest from all global players in the berry sector. These include global producers such as Costa, Hortifrut, Driscoll’s, North Bay, Agrovision, and Agroberries, as well as European operators who have relocated their production to Morocco, such as Spain's Royal, Surexport, and SanLucar, the UK's Berry Gardens and Berryworld, and France's Fruits Rouges. Also present are breeders like Fall Creek, which plans to open a nursery in Morocco by 2025, and Planasa.

Currently, only Egypt has the potential to pose a serious external threat to Morocco: particularly in the blueberry segment, it could emerge as a key player by the end of the decade, potentially challenging the growing dominance of Moroccan production. However, with 7,000 hectares of blueberries already in production, catching up will not be immediate for Egypt. Thus, Morocco reasonably retains several more years of growth prospects.