Also in 2025, berries were among the main attractions at Macfrut in Rimini. During the three-day fair, the Berry Area hosted data-driven discussions and debates on various aspects concerning raspberries, blueberries, and strawberries.

The topic of blueberries, in particular, continues to spark much debate, given the record increase in purchases in Italy with a +21% volume growth in 2024 compared to 2023.

Increasingly present in the Italian mass retail sector, blueberries are, as in other European countries, among the leading products in the fruit and vegetable category, and there is a growing need to explore new display solutions—and more.

There are often comparisons with more mature markets, first and foremost the UK, to try to replicate successful insights and models that have enabled this product to achieve significant sales in the UK over the past 10 years.

Berryway was founded in 2018 with a specific strategic focus on sourcing policies and the premium segment, and in this exclusive interview with Italian Berry, it explains the virtuous mechanisms behind the development of the most mature blueberry markets globally.

We first ask Romualdo Riva, general manager of Berryway, what are the mechanisms of a mature and developed blueberry market?

When referring to a mature market, people often think of broad segmentation and strong, impactful displays in key supermarkets, but it’s not only about that.

An impactful display in a US supermarket

An impactful display in a US supermarket

A mature market is also one that can effectively plan and manage supply and inventory, anticipating issues related to already identified climate events or market dynamics. The result is greater stability, avoiding consumer confusion caused by continuous weekly price changes that alter the product’s perceived value.

But isn’t ensuring stable prices in highly variable supply conditions a counterproductive strategy? Isn’t there a risk of empty shelves and warehouses?

Today the blueberry market is global, and the butterfly effect is just around the corner. We’ve seen this over the past two years, when imports from Peru and South Africa were affected by El Niño.

However, through careful planning between retailers, suppliers, and producers, the UK market managed to avoid both major stockouts and skyrocketing prices.

Their model, which applies to other markets as well, is based on setting prices monthly or even seasonally, according to origin and period, thanks to the support of global producers and suppliers.

Barbara Allisio, account manager at Berryway, is responsible for defining the balance between price, quality, and quantity with suppliers and clients. What are the sourcing policies for blueberries in Italy, and what drives them?

This model is barely visible in the Italian market: the previous model still prevails, with strong retail price variability, often linked to weekly dynamics, especially in standard lines.

However, the English model is slowly being adopted for more specific lines, where the same price is maintained over several weeks during a given season.

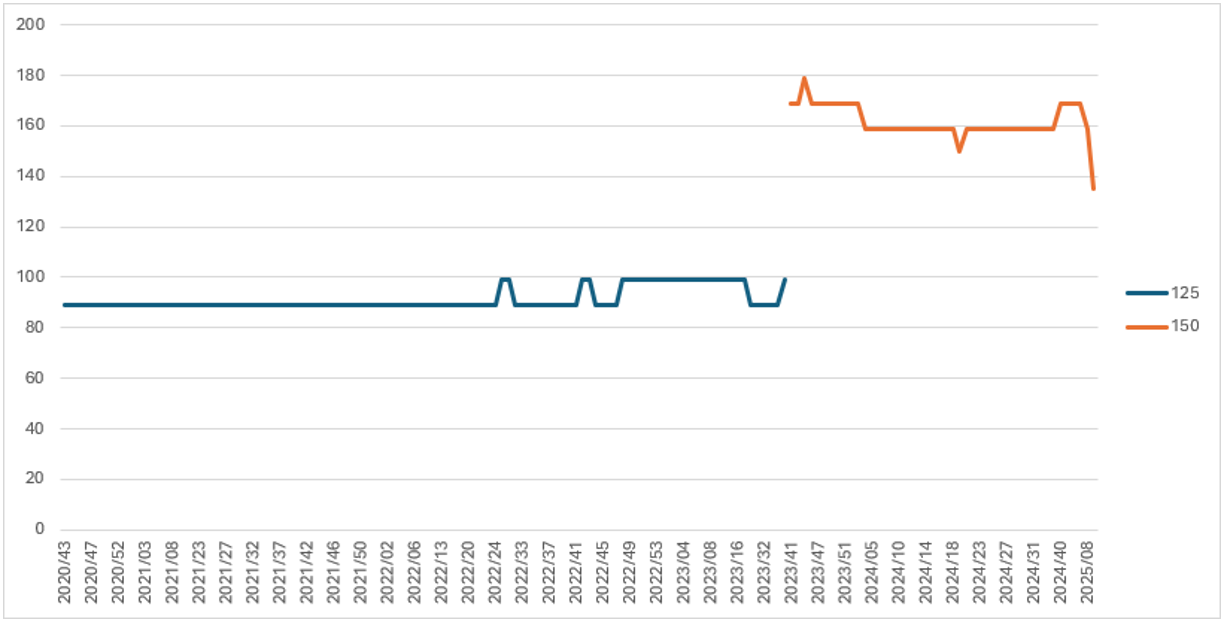

The pricing model of Tesco UK's discount blueberry line over the past five years (2020–2025). Prices are in pence per pack; pack size increased from 125g to 150g in 2024 – Source: Italian Berry Observatory

The pricing model of Tesco UK's discount blueberry line over the past five years (2020–2025). Prices are in pence per pack; pack size increased from 125g to 150g in 2024 – Source: Italian Berry Observatory

What are the weaknesses of the “Italian model,” where planning is often replaced by negotiation?

The current model, with weekly price fluctuations, creates constant pressure on suppliers and consequently on producers, which in the long run can lead to quality and supply issues.

Sure, strong competition and pressure create a short-term advantage for retailers, both economically and in terms of market presence.

But more transparent and stable pricing would foster trust and loyalty, and promotional campaigns would be perceived as more consistent by end consumers.

And what effect would all this have on the Italian consumer?

Increasingly in Italy, the customer who buys blueberries is a repeat buyer, and when they see major price differences from one week to the next without understanding why—due to a lack of communication—they become confused, the perceived value of the product changes, and consumer engagement drops sharply.

It’s clear that stable prices promote consumer trust. But doesn’t that conflict with producers’ interest in following the market and adjusting prices weekly to their advantage? What is the value of programming in a global market where prices are often disconnected from costs?

Global producers are willing and able to support fixed-price programs—this is already happening in other markets. Such management allows them to develop medium- to long-term growth and varietal research programs.

Blueberries have a longer shelf life than other berries on the market, which allows for more precise planning, and highly specialized companies are often able to predict their harvest curves with minimal margin of error.

This new model, shared between suppliers and retailers, would therefore allow for better promotional and logistical planning in retail while avoiding stockouts.

How can we handle the risk that overly rigid programming might penalize the management of unpredictability, which is inherent in agricultural production—including blueberries?

Clearly, structured planning is not a one-size-fits-all solution. Exceptional events such as adverse weather, international crises, or logistical and customs issues will continue to be difficult variables to control.

Nonetheless, this approach could be a step forward toward a more evolved and conscious blueberry market. A market focused on transparency and shared benefits along the supply chain, capable of offering end consumers a fairer and more accessible price. This, in turn, would encourage repeat purchases and more efficient stock management at the point of sale.