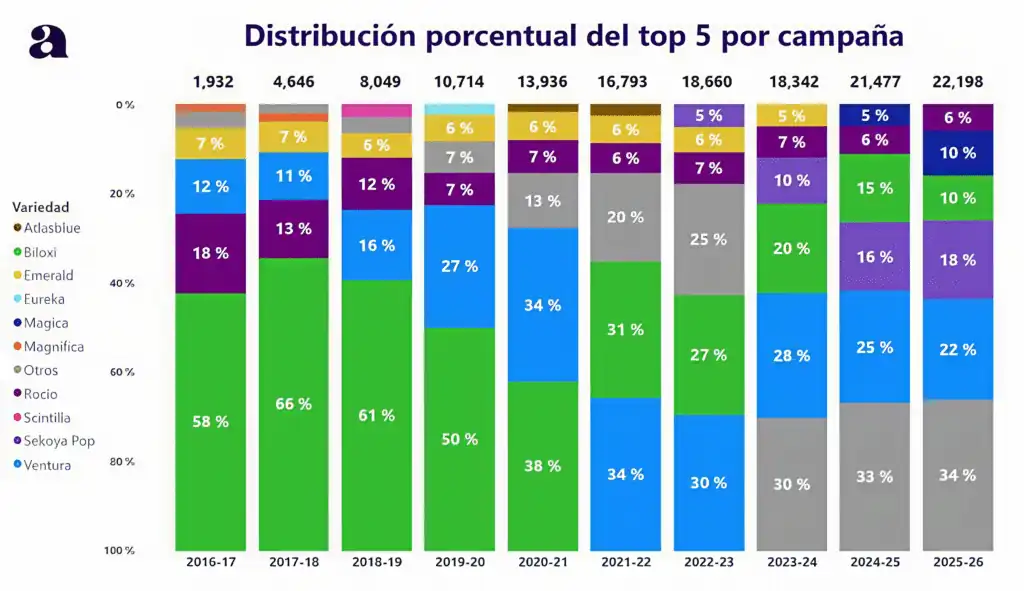

In less than a decade, the Peruvian blueberry varietal matrix has undergone a profound transformation: Ventura and Sekoya Pop have moved from marginal positions to leading the ranking of planted area, while Biloxi has lost ground within the varietal mix.

The new portfolio responds to pressure from destination markets — the United States, Europe and China — which demand fruit with greater firmness, crunchiness and improved post-harvest performance.

Ventura and Sekoya Pop gain ground

In the 2025/26 season, the Peruvian blueberry varietal map confirms a trend the industry has been observing for several seasons: Biloxi no longer dominates planted area, with Ventura and Sekoya Pop now taking the lead.

Both varieties currently top the ranking of planted hectares, followed by a group of cultivars such as Biloxi, Magica, Rocio and Emerald, which complete the core of the portfolio.

The shift is not merely a matter of names, but rather a response to an industry that demands greater firmness, better flavor and increased stability along the logistics chain.

This change in the varietal matrix did not happen overnight. Since 2016, the curve shows a progressive decline in Biloxi’s relative weight and steady growth for Ventura and, more recently, Sekoya Pop.

New varieties and market requirements

New varieties have been selected for their ability to combine productivity with superior organoleptic attributes: crisp texture, high Brix levels and longer post-harvest life.

This translates into a lower risk of softening and dehydration, two of the issues that most penalize returns in distant markets.

Today, the group of leading varieties accounts for the vast majority of hectares in production, providing the country with a more homogeneous base on which to build export programs by window and destination.

However, this concentration also requires more careful agronomic and post-harvest management: focusing on a limited number of cultivars means that any phytosanitary or climatic adaptation issues can have a significant impact on the business.

Biloxi steps aside

For this reason, many companies complement Ventura and Sekoya Pop with a “second tier” of varieties, aiming to diversify risk.

Looking at the evolution since 2016, the data tell a clear story: Biloxi was the backbone of the early development phase of the Peruvian blueberry industry, but its weight in the varietal mix has declined with the introduction of more competitive materials.

Its main weakness lies in firmness and post-harvest life, which are no longer fully aligned with today’s requirements for longer journeys, extended shelf life and consumers who are less tolerant of texture issues.

Biloxi is still present, but it is no longer the “flagship” variety; its role has been redefined into specific niches and in companies where the transition is still underway.

Ventura and Sekoya Pop: the new protagonists

Ventura, by contrast, embodies the new generation of varietal choices. Its expansion in planted area is the result of a combination of factors: good productivity, appealing size for retail and, above all, better performance in terms of quality upon arrival at destination.

In markets that reward sensory experience — not just volume — Ventura offers a solid balance between field yield and reliability along the logistics chain.

This balance has led it to top the ranking of planted hectares, with a share approaching one fifth of national area.

Sekoya Pop represents the most recent wave of varietal renewal. Starting from limited volumes, it has shown rapid growth in planted area in recent seasons, driven by programs that highlight its crisp texture, intense flavors and excellent condition after long-distance transport.

Management and future outlook

Its presence remains lower than Ventura’s, but the pace of growth suggests it will continue to gain space within the varietal matrix, especially among highly technified growers targeting premium markets.

The challenge will be to manage its agronomic specificities correctly and ensure that the perceived quality upgrade translates into sustainable economic returns.

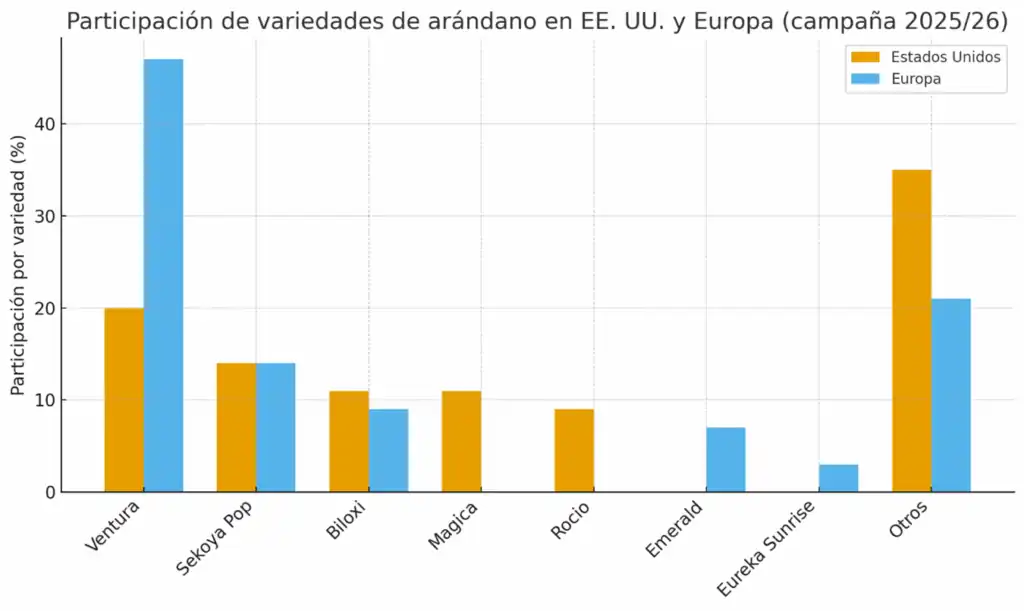

The United States remains the main destination market for Peruvian blueberries, and its demand has driven a significant portion of the varietal renewal.

Programs targeting this market prioritize firmness, bruise resistance, cold-chain stability and sizes suited to the most common clamshell formats.

Market requirements

Varieties such as Ventura and Sekoya Pop meet these requirements more effectively than older materials like Biloxi, helping reduce claims, destination discounts and shelf losses.

In practice, many companies have progressively aligned field planning with the specifications of North American retailers.

In Europe, attention is even more focused on the overall sensory experience. Beyond firmness, the European consumer values a sweet, balanced and consistent flavor, together with an attractive visual appearance: uniform bloom, absence of defects and homogeneous sizing.

The varietal matrix has therefore adapted to meet these standards, with Ventura, Sekoya Pop and other emerging varieties gaining ground in programs aimed at supermarkets willing to recognize a premium price for quality.

Commercial strategy and varieties

Certification requirements (environmental, social, zero-residue or low-residue) also influence varietal choices in certain markets.

In all cases, varietal renewal translates into constant pressure on harvest and post-harvest management.

Companies must refine calendars, agronomic practices and storage protocols to unlock the potential of new varieties without compromising productivity.

Varietal choice is no longer just an agronomic decision, but a true commercial strategy: each variety must effectively align with the requirements of its final destination market.

China and varietal segmentation

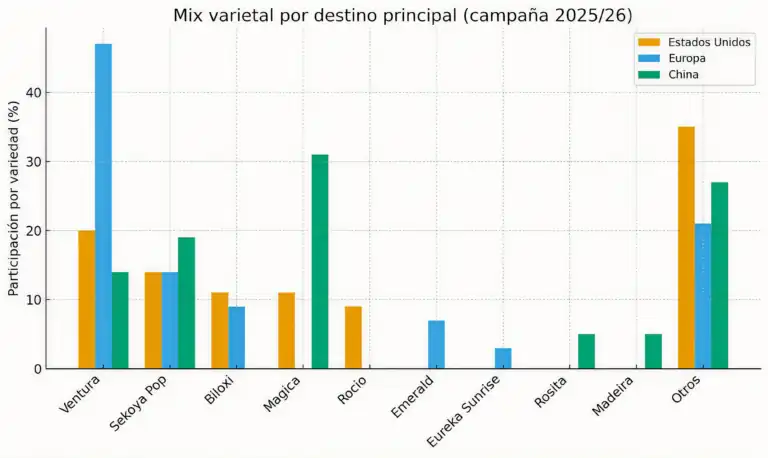

China has consolidated its position as a key destination for Peruvian blueberries, though with a different logic compared to the United States and Europe.

The Chinese market favors large or extra-large fruit, with very crisp texture, visible bloom and flawless visual presentation.

Within this context, the varietal matrix has progressively incorporated materials capable of withstanding long sea shipments, tolerating greater handling and reaching the final consumer in optimal condition.

Varieties such as Sekoya Pop and other next-generation materials find in China an ideal context to showcase their strengths in terms of firmness and post-harvest life.

Responding to premium markets

The ability to maintain “crunch” after weeks in transit is a decisive factor for program profitability.

For this reason, exporters targeting this market tend to allocate their best production, adopting specific management strategies for pruning, crop load and selective harvesting.

At the same time, varietal adaptation to China requires increasingly sophisticated portfolio segmentation.

Not all varieties are suited to all markets: some perform better in specific European windows, others fit more effectively into the North American calendar, while a limited group is designed for the high demands of Asian premium markets.

The challenge for Peru will be to continue refining this segmentation, avoiding excessive dependence on a few varieties and ensuring that renewal maintains a balance between productivity, quality and resilience in the face of climate change.

Source text and images: blueberriesconsulting.com