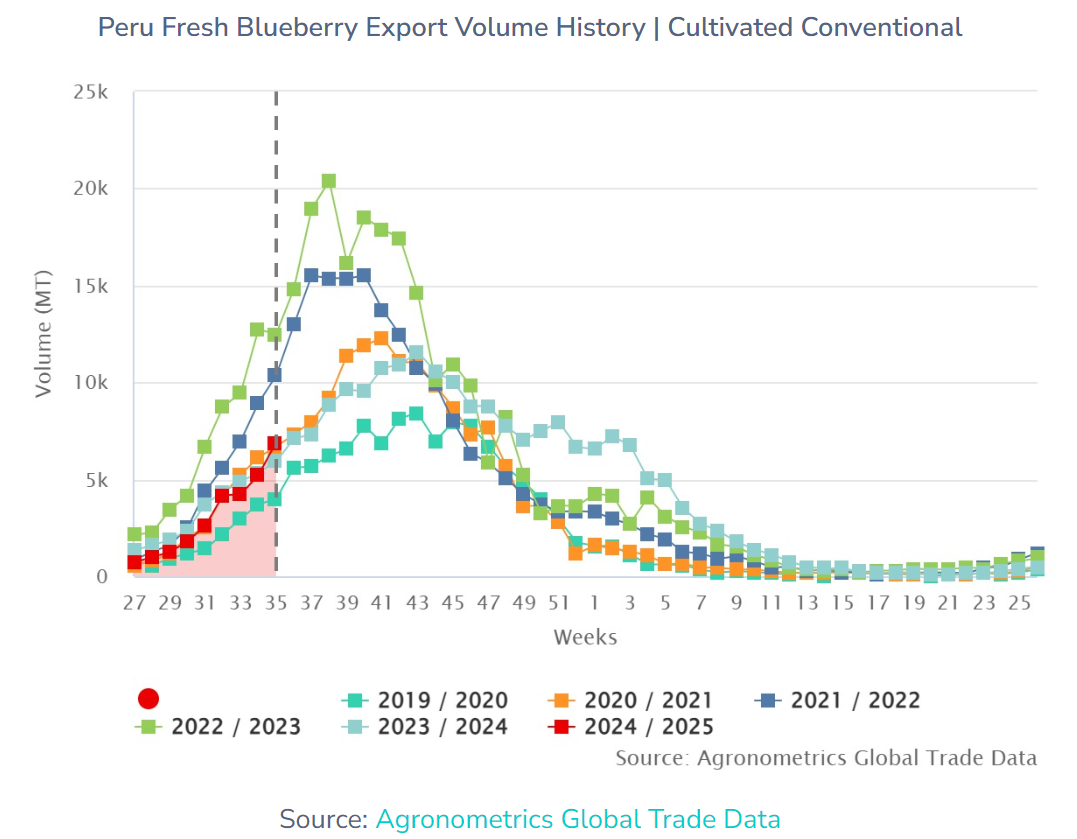

So far in 2024, the global blueberry supply chain has experienced a growing uncertainty due to the slowdown in export volumes from Peru. Since the impact of the El Niño phenomenon in 2023, current climate issues and the drought in the northern part of the country have contributed to export volumes not surpassing last year’s levels up until week 34, resulting in a sluggish season.

The turning point of week 35

However, week 35 marked a turning point in this trend, indicating the beginning of a recovery for the 2024 season. A shift in the slope of the export curve is expected, with peak volumes projected for weeks 43 to 46.

This represents a significant recovery compared to the start of the season and suggests that export volumes are now aligning with the projections made by Proarandanos for the 2024/25 campaign, which are set at 293,841 tons, a 27.67% increase compared to the 230,153 tons of fresh blueberries exported in 2023.

Chart Source: Agronometrics Global Trade Data (Agronometrics users can view this chart with live updates here)

Prices and Future Outlook

It is important to highlight that prices in USD/Kg have remained high and continue to rise compared to previous seasons. However, it is unlikely they will reach the levels seen in 2023, when they were inflated by the significant drop in export volumes due to the effects of El Niño. The global industry’s attention remains focused on Peru’s indicators, as the country continues to lead the world in exports.

Source: Agronometrics