This is an abstract from the 2024 IBO Report. Click here to download the full report

Mexico has seen a decrease in blueberry exports for the first time. Challenged by Peru's expansion into traditional Mexican markets, producers in Central America's largest state are accelerating varietal renewal processes to face market and economic challenges as the industry matures.

Juan José Flores Garcia, General Director of the National Mexican Association of Berry Exporters (Aneberries), stated in a report:

"In this new year of collaboration in the berry industry, my experience has taught me several lessons, the most important being that nothing should be taken for granted in this or any other project; everything is constantly changing."

An Extraordinary Year in Every Sense

This year was extraordinary for Mexican berries. On one hand, the growing global appetite for berries continues, with increasing acceptance among both international and domestic consumers. Locally, there is heightened interest in the health benefits of berries and the perception of them as a 100% Mexican product.

Additionally, the sector has made significant advances in technology, research, and development. Its adaptability has allowed it to tackle extraordinary challenges, underscoring the industry's resilience.

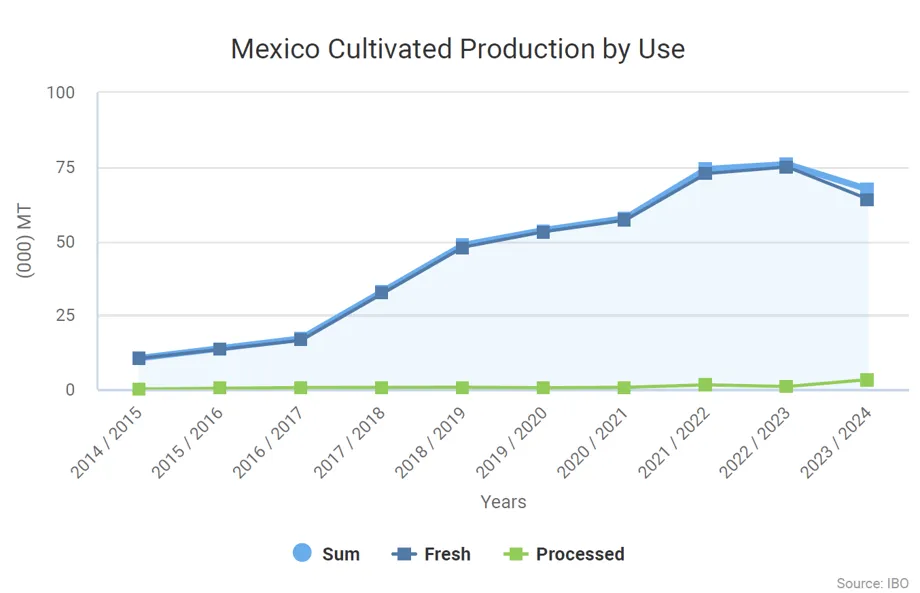

ecreased Exports

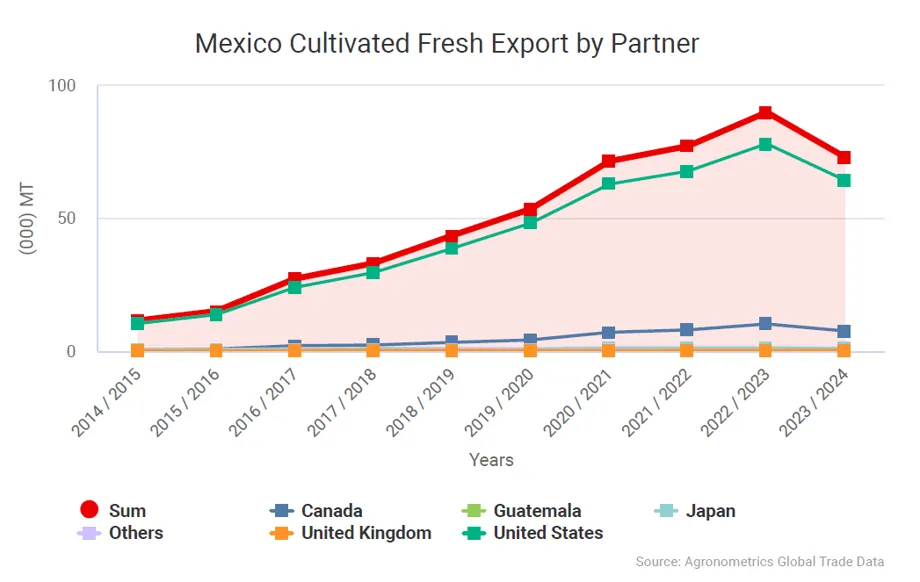

ecreased ExportsAfter over a decade of consistent growth, volumes have decreased. While concerning, this presents an opportunity to address environmental and labor challenges, as well as to push for further advancements in the sector, ensuring its sustainability and unity.

Aneberries has implemented changes in its mission, vision, and values to better align with the industry's evolving needs, embracing change and fostering collaboration across the supply chain.

New Market Windows

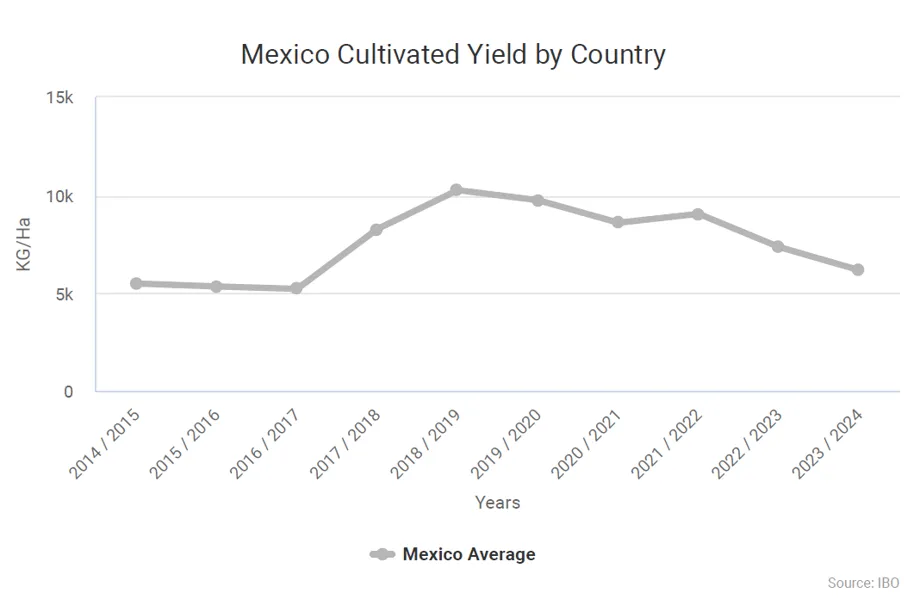

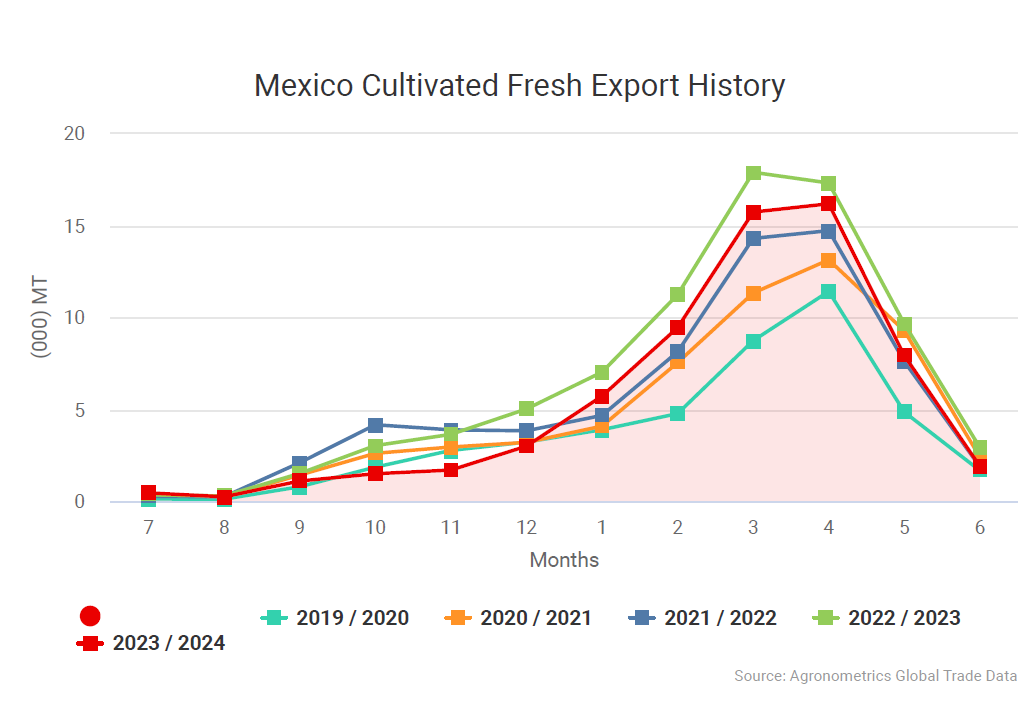

As a natural extension of the U.S., the world's largest market for fresh blueberries, Mexico remains central to the industry. However, challenges like varietal shifts and agronomic adaptations are ongoing. Producers are adjusting harvest periods to avoid competing with Peru, which last year drove exceptionally high prices for certain growers.

In 2023, the sector also faced high temperatures and pest threats, such as thrips, causing plant stress and even deaths, particularly in Sinaloa, where losses ranged between 3-4% in some farms.

Challenges of a Mature Economy

High interest rates in Mexico make local investments more challenging. This is compounded by a strong peso, which reduces export returns. Additionally, new labor laws require agricultural employers to provide healthcare, schooling, and childcare services if unavailable locally, raising operational challenges.

These factors, along with structural changes and lower yields during the transition to new varieties, have impacted Mexico's blueberry exports.

The End of Open Varieties

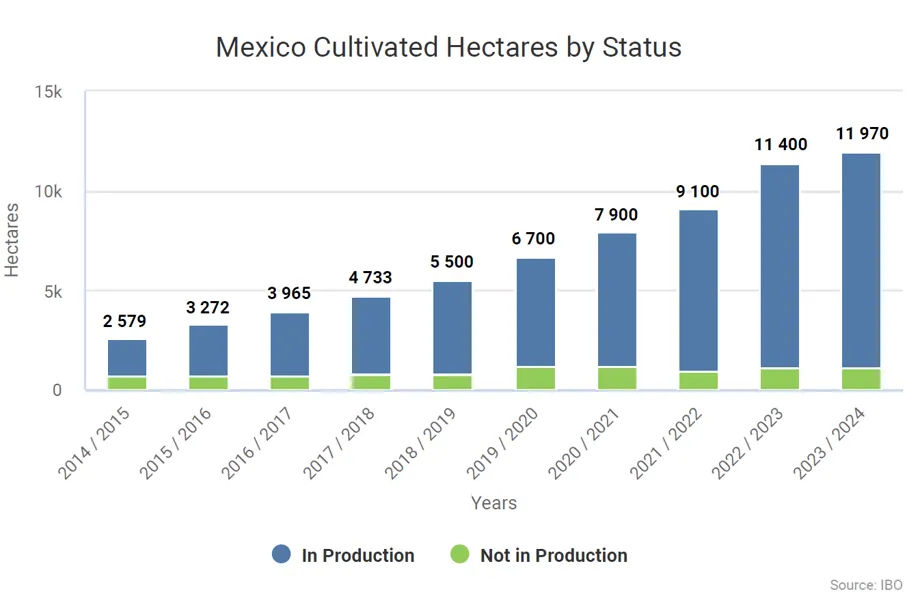

The composition of Mexico's blueberry varieties has shifted, with 70% of cultivated hectares now dedicated to proprietary varieties. Leading global breeding companies are actively involved in varietal conversions and new plantings.

For instance, one early-maturing U.S. variety now occupies an estimated 15% of cultivated hectares, up from 5%. Meanwhile, the open variety "Biloxi" has dropped from over one-third to 20% in recent years.

Internal Market Expansion

The U.S. remains Mexico's primary export market, accounting for 88% of total exports in 2023. However, the domestic market is growing, supported by initiatives encouraging local consumption. Despite this growth, per capita consumption remains low at approximately 70 g per person.

High-quality patented genetics are being introduced in local supermarkets to enhance consumer experiences and drive internal demand.

Read more

Continue reading more abstracts from the 2024 IBO Report or download the full report: