There are still only timid signs that Italian retailers are taking seriously the possibility of segmenting the blueberry market. Is it really worth offering consumers products with different characteristics for every need? This will be one of the topics addressed during the events scheduled in the Berry Area at Macfrut 2025 (6–8 May).

It actually seems as though the 6.8 million Italian households that buy blueberries only care about price, and that the only way to expand the offer is by varying pack size.

The weight format factor

From this point of view, we can’t complain: in 2024, the Italian Berry Retail Monitor recorded no fewer than 13 different pack sizes—ranging from 100 to 1,000 grams—on sale in physical stores and e-commerce channels of major Italian retailers.

In theory, the offer is therefore broad and capable of meeting different consumption needs. However, analysis of actual shelf presence reveals a much more homogeneous reality: 62% of SKUs are concentrated in the 125-gram pack, followed by 21% in the 250-gram pack. All other formats combined account for less than 18%.

Premium blueberries for sale on Shopee (Indonesia)

Premium blueberries for sale on Shopee (Indonesia)

The 500-gram pack is particularly underrepresented, covering just 5% of the Italian retail offer. Yet this size could better match the consumption habits of families with children or regular consumers, offering value and reducing the frequency of purchases. The failure to capitalize on this pack size suggests that the offer remains highly standardized, with little effort made to reach new customer segments or build loyalty among existing ones.

Segmentation, a long way to go

The most significant gap compared to international standards emerges in the qualitative segmentation of the offer. We classified as “standard” a full 89% of blueberry lines on the Italian market in 2024. The remaining 11% is split between premium, zero-residue, and organic products, in nearly equal shares. This limited range of variants restricts choices for more discerning consumers and penalizes producers investing in quality, sustainability, or varietal innovation.

What’s more, between 2021 and 2023, non-standard lines represented 13.4% of the offer, indicating that 2024 marked a step backward in diversification rather than a step forward. This trend runs counter to what’s happening globally, where segmentation is increasingly seen as a strategic tool to enhance product value and capture growing niches.

In the global panel monitored by Italian Berry, which tracks 14 e-commerce banners in America, Europe, and Asia, the share of standard blueberries dropped from 60.9% in 2021 to 55.5% in 2024. At the same time, organic blueberries reached 20.4% of the offer and premium ones 14.6%, indicating that international retailers are focusing on enhancing the product’s distinctive features—from taste and origin to growing methods and branding.

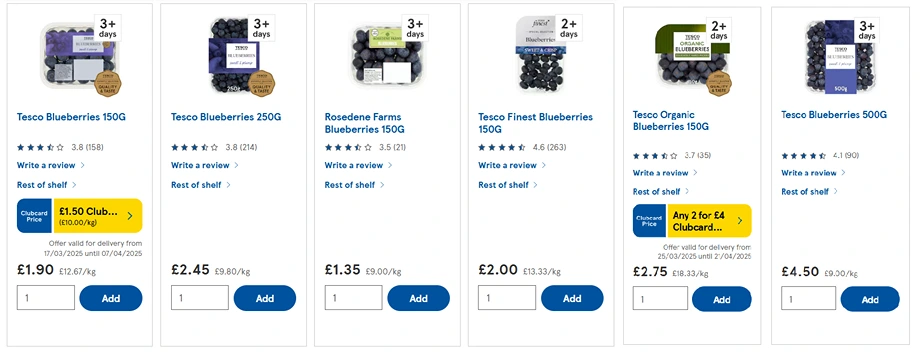

Blueberry segmentation by British retailer Tesco (26/03/2025)

Blueberry segmentation by British retailer Tesco (26/03/2025)

It’s clear that segmentation is not a stylistic exercise but a real opportunity for differentiation and growth. In a mature market, where berry consumption tends to stabilize, pushing innovation and variety in the offer is the only way to avoid price wars and add value across the entire supply chain.

There are unexplored areas still to be developed: think of local blueberries, new and patented varieties, communication of nutritional properties, and storytelling about the sustainability of agricultural businesses. All of these can help build value and transform blueberries from a commodity into an identity product capable of speaking to different audiences seeking mindful consumption experiences.

Berry AreaThis article is part of a series dedicated to our new communication project in co-operation with Macfrut 2025. The content is in support of the event which will take place May 6-8, 2025 in Rimini Expo Centre, where the Berry Area stands as a reference point for all those seeking innovative solutions for the production and marketing of berries. 👉 Learn more about the Berry Area at this link. |