Berries and Blueberries: The Diamond Category. If there is a category that has been showing for many years now a consistent pattern of boosting sales, profitability, and frequency of consumer visits to supermarkets is “berries”.

In the US, berries represent more sales value than apples and bananas put together but with a much lower market penetration (54% for blueberries as compared to 82% for bananas, the most popular fruit in that market).

Insight Partners recently released a report showing that from 2023 to 2031 the expected average yearly growth of global blueberry sales will be 7,3% reaching US$ 27,8 billion (circa €25,7 miliardi) in 2031 (currently around US$ 16 billion – circa €14,8 miliardi).

It is obvious that berries and particularly blueberries have been experiencing a strong momentum in the last 10 years.

Competition and segmentation

With strong demand comes strong competition and an increasingly segmented and sophisticated consumer.

According to IBO (International Blueberry Organization), supply and demand are becoming increasingly sophisticated. Supply is growing and becoming more consolidated while rapidly improving in quality.

Demand is becoming more segmented due to the supermarket tactics to respond to different consumer needs (premium quality, value for money, family size, convenience, etc.) with suitable products.

Brand development strategies (local and global) from vertically integrated companies like Hortifrut’s Naturipe, Agrovision’s Fruitist or Joywinmau’s Joyvio (which are further segmented within the umbrella brand), but also from supermarkets own-labels, is already a driving force for rearrangement of the berry category on supermarket shelves.

Consistency and “hit he mark” are the key words here to sustain the confidence of consumers with the brands (avoiding a “OMG… Not another soft blueberry!” comment).

Prices and climate impact

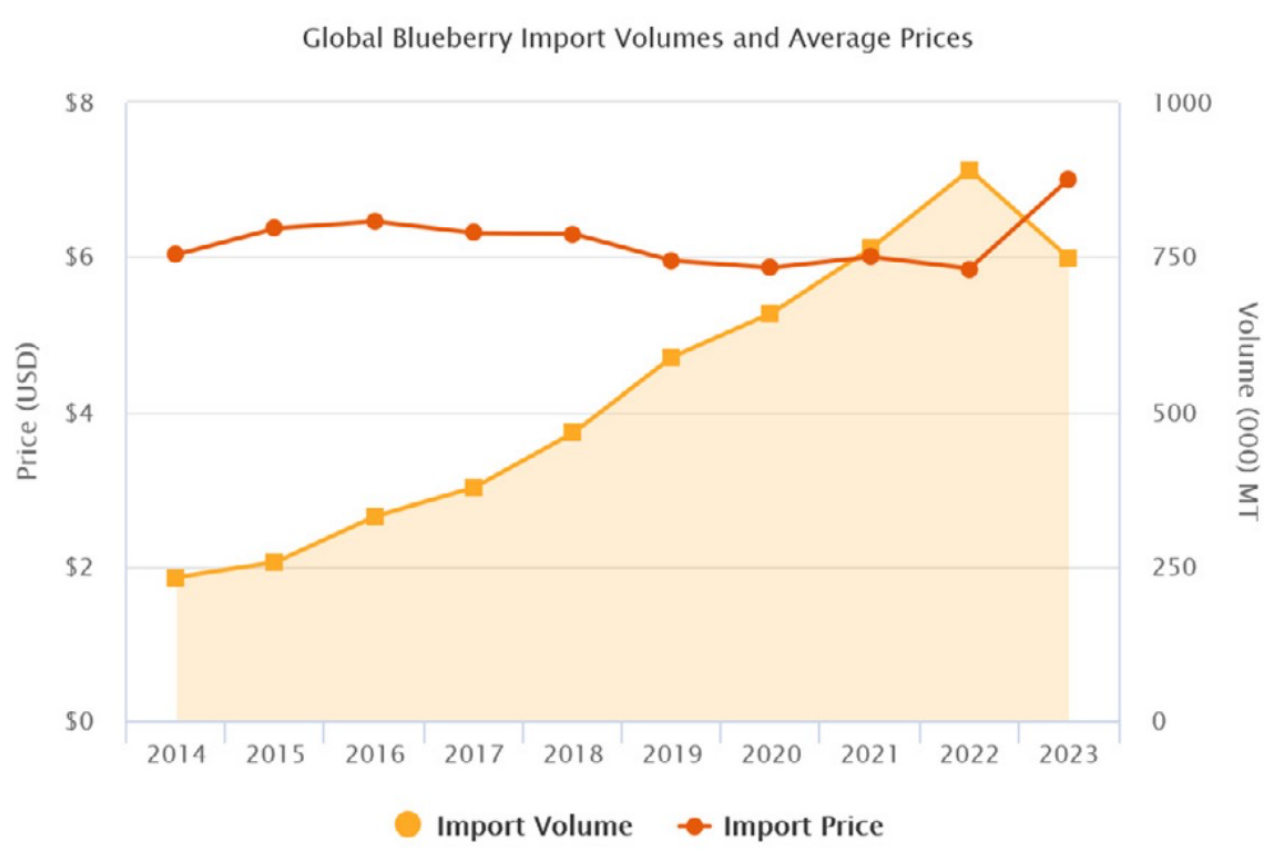

Zoom out: stable prices, zoom in: huge variation. Even though global aggregated prices are exposed to significant variation according to markets, packaging, qualities, logistic costs, etc., these have remained apparently stable except for season 2023-24 which was seriously affected by the strong impact of the Peruvian supply shortage due to the El Nino climate phenomena, driving prices upwards. This can be observed in Graph 1.

Graph 1. Source: IBO Global Report 2024.

Graph 1. Source: IBO Global Report 2024.

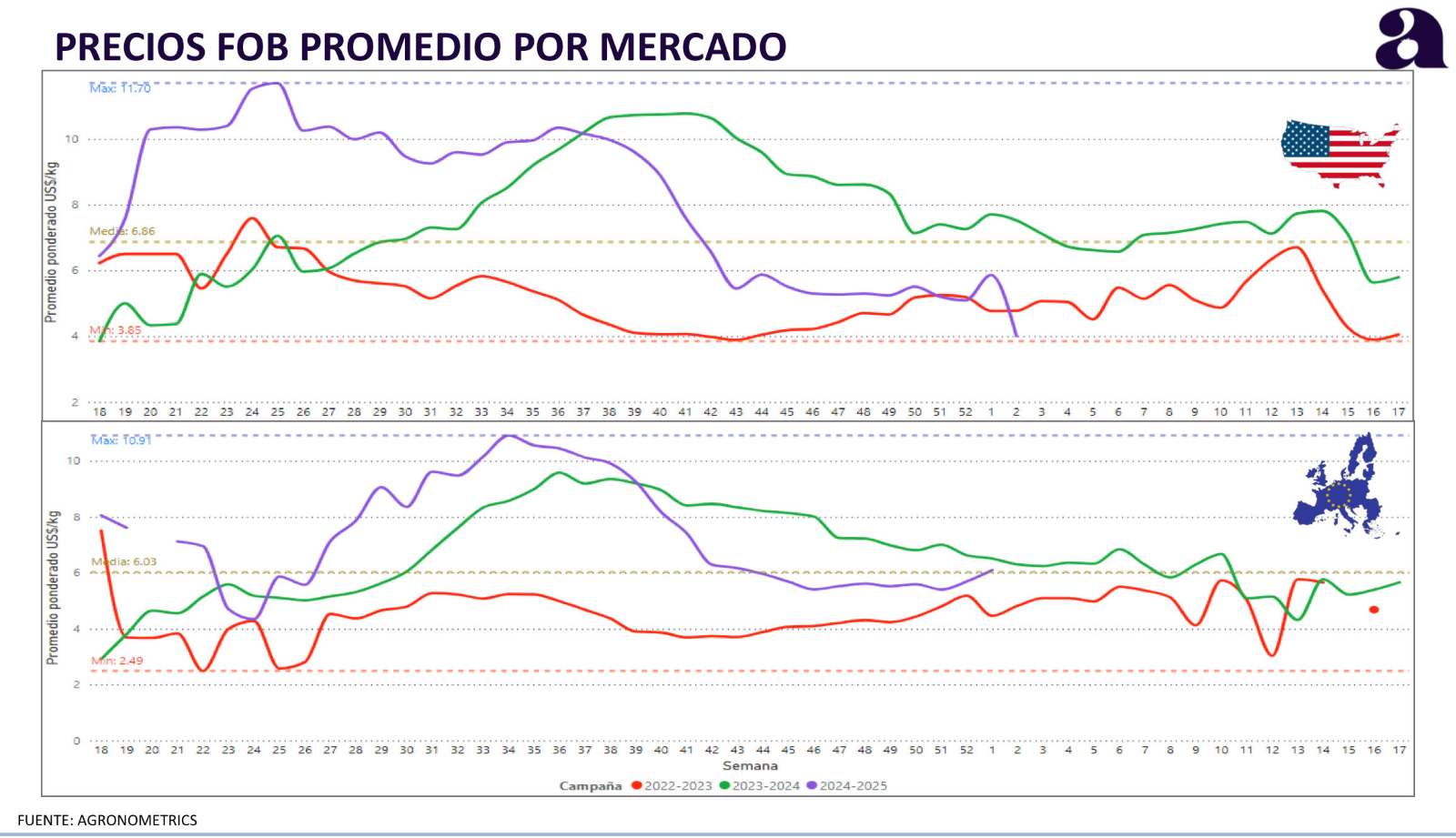

Price differences can be as much as three times for the same week of two consecutive seasons (observe weeks 39 to 43 from Peru to the US and Europe).

Source: Peruvian Blueberry Committee (extracted from Agronometrics).

Source: Peruvian Blueberry Committee (extracted from Agronometrics).

Supply chain and future outlook

The message here is that for the berry category to keep its positive momentum, retailers (and service providers) ought to re-think and re-design a supply chain aiming at a solid, constant, and reliable in volumes, timing and consistent in quality.

General climate change (global warming) and specific climate phenomena (Chergui winds in Morocco, El Nino in the Peruvian Coast, DANA in Spain, and many others) have and will keep affecting the stability of supply.

Current geopolitical and economic uncertainty (price and military wars) add another level of noise on the quest for the optimum supply formula. Increasing labor costs and in some areas labor shortages are putting even more pressure on growers.

A remainder here: growers are the fundamental pillar of the industry, regardless its size. No reasonable return to growers, no berries, no chain, no category.

A brave new world

A Brave New World. So, how should the industry face this new scenario, or I’d rather say transition?

It is my guess that in the search for stability of supply, retailers, which are the main outlet for berries and blueberries, should balance the following: (1) a constant supply throughout the year to minimize probability of shortages which are very expensive for everybody as well as annoying.

How to do this? (2) Diversifying the sourcing matrix designing and achieving a balance between overseas-local sourcing, small-big growers/exporters, standard-premium quality, private-own label, small-large packaging convenient-recyclable packaging, etc.

Sourcing and purchasing teams will have to put all their expertise and energy into solving this strategic puzzle thinking not only in the last link in the chain and its profitability (retailers themselves), but more than ever in the long-term stability of the whole supply chain.

At the end, berries and blueberries specifically are on its way to get closer to bananas, apples, and grapes in terms of penetration potential. Let’s not stop this positive momentum of berries and blueberries but rather accelerate it.

Sourcing and purchasing managers will have to balance profitability, operational flow and a inescapable care for the grower base.

Fernando Martino