This is an abstract from the 2024 IBO Report. Click here to download the full report

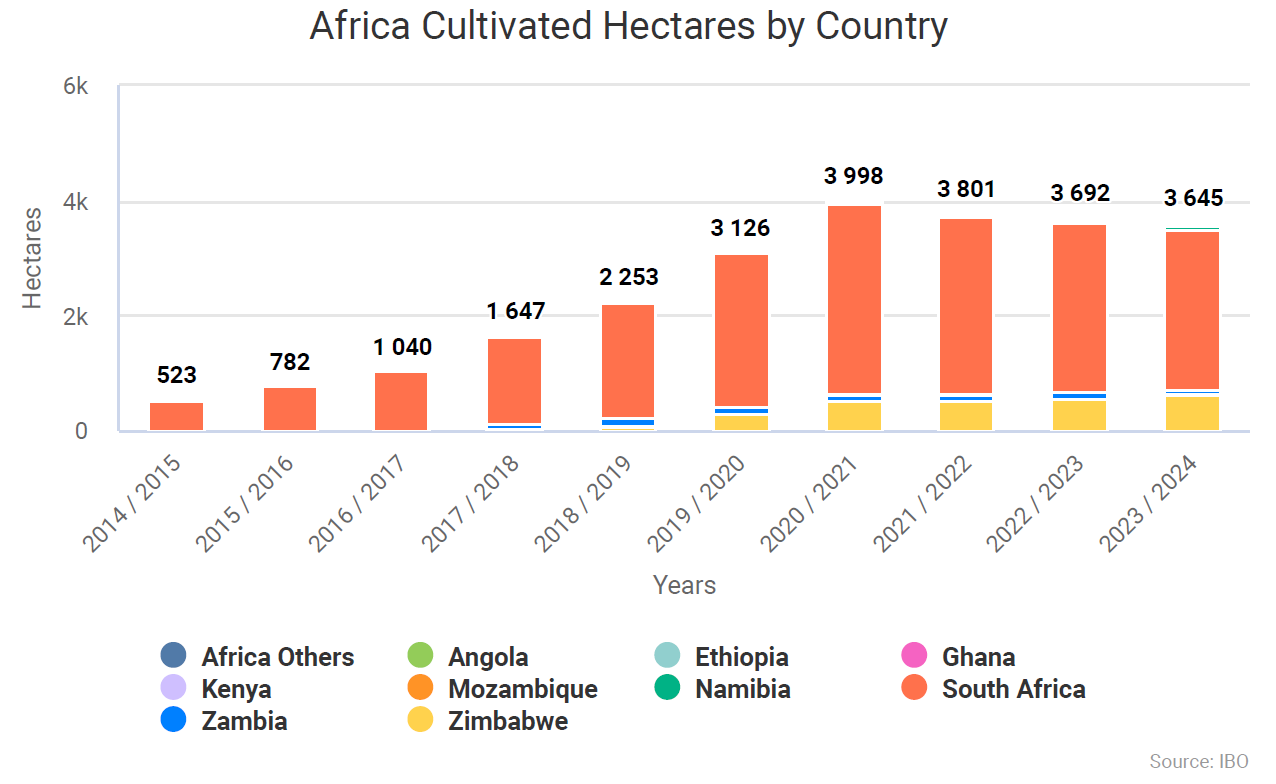

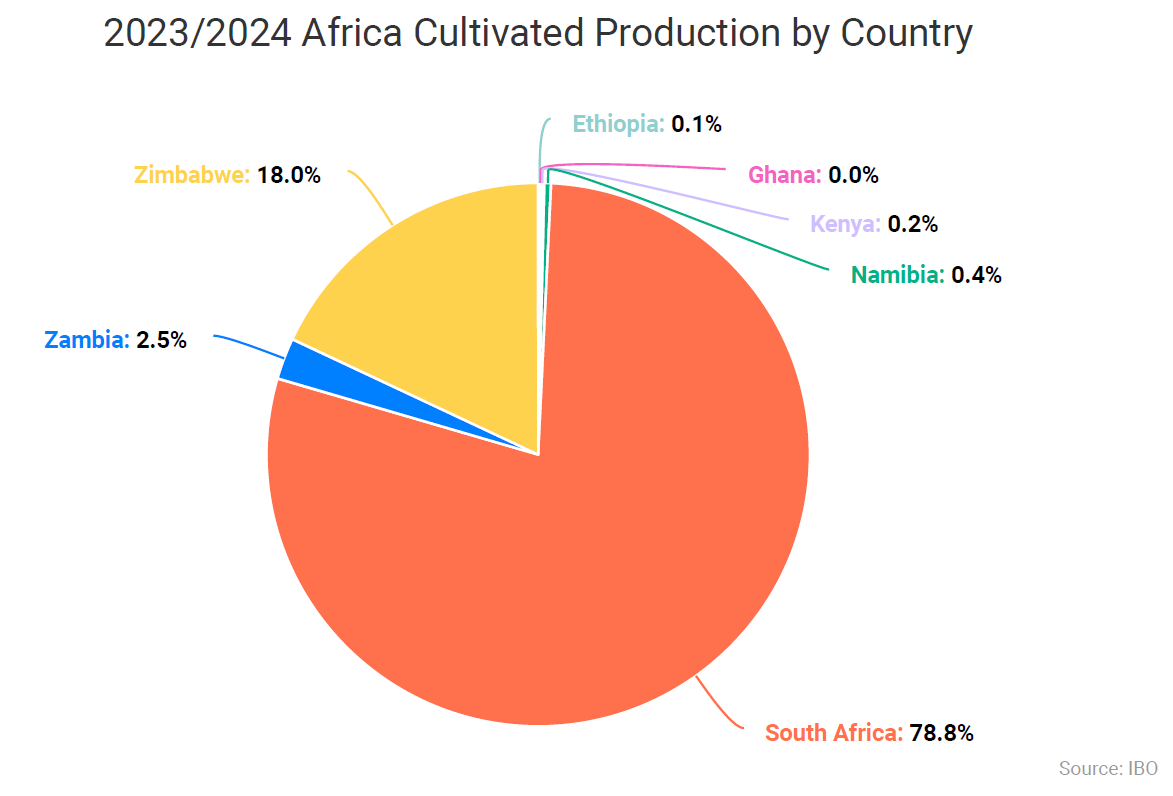

Early ripening and high yields are key factors for the growing blueberry industries in countries north of the Republic of South Africa, with Zimbabwe as the main player.

Over the past eight years, Zimbabwe has developed a strong network of expertise and infrastructure, fostering an industry that is gaining increasing visibility, especially in European markets. Namibia and Zambia, on the other hand, are still in the early stages of their growth journey but offer specific advantages.

In all these regions, investments have been made by South African producers or companies with a strong presence in South Africa, expanding northward toward the equator to diversify offerings and optimize production windows. This approach mirrors the Chilean model applied to Peru and other Latin American countries in recent decades.

Zimbabwe

Zimbabwe is one of the most appreciated countries by blueberry sector operators interested in emerging industries with consolidated production. A major international player stated that Zimbabwe produces one of the most consistent quality fruits within its entire global network.

However, strong demand for plantation expansion is hindered by limited access to capital, as the country has high sovereign risk, high-interest rates, and banks reluctant to grant loans beyond three years.

"The berries we produce are of high quality, the market demands them, the production window is ideal, production costs are among the lowest in the world, and our climate is excellent. However, expansion will not be possible without long-term financing or foreign direct investments that can overcome the country's perceived risk," says a producer.

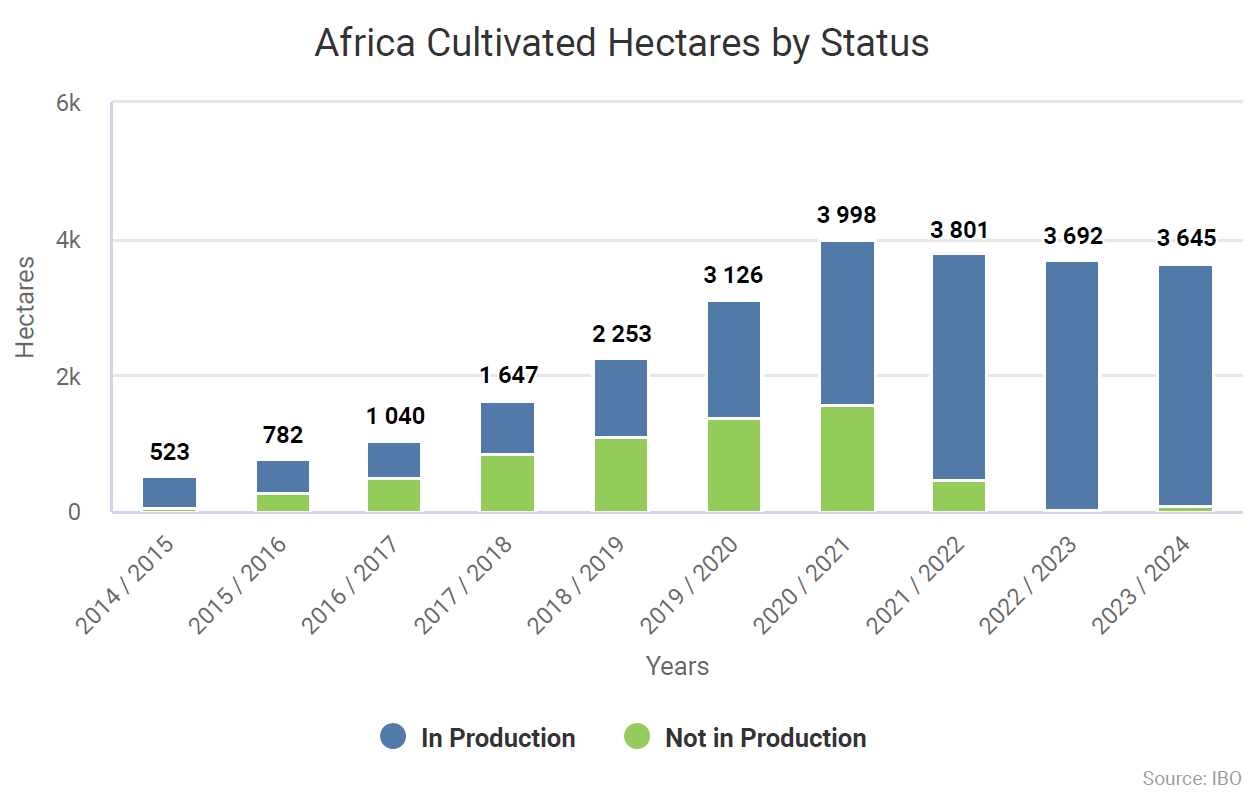

Most plantations are within a 100 km radius of the capital Harare, and open-field cultivation prevails, unlike South Africa, where 60% of production is on substrate pots. There are fewer than a handful of projects in Zimbabwe with more than five years of activity, meaning many fields are still young and will offer significant volume growth as they mature.

However, due to financing difficulties, short- and medium-term growth will depend mainly on existing fields rather than new plantations.

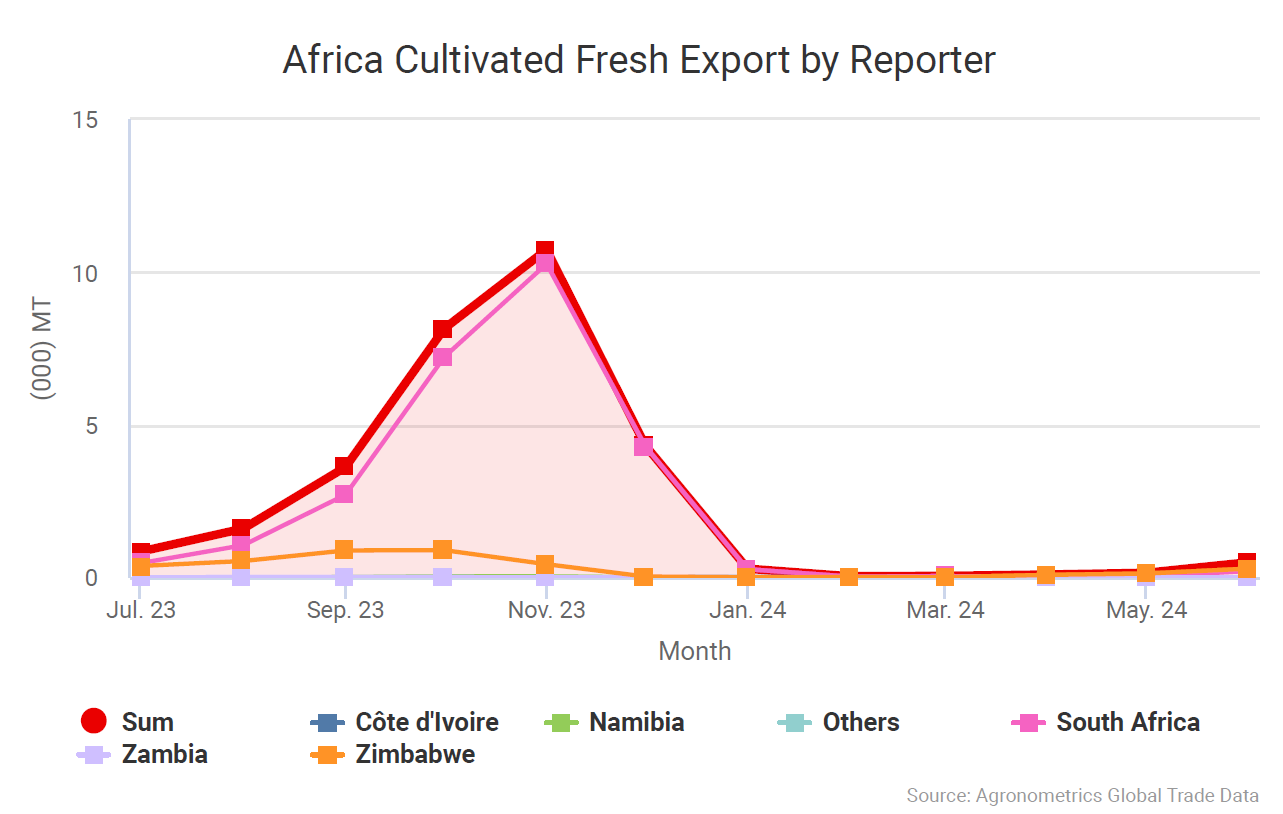

Historically, Zimbabwe's blueberry season starts in mid-to-late May, with the first volumes available as early as late March. The peak occurs in August, and harvesting typically ends by mid-October. However, in 2023, the season extended into November, both to address the supply shortage from Peru and due to a delayed harvest.

In general, the industry aims to complete 90% of the harvest by the end of September to avoid yield drops in October when supply from Peru and South Africa is abundant. Zimbabwe's humid and occasionally hail-prone weather also incentivizes completing harvests before October.

In 2023, however, harvesting continued five weeks beyond the norm, ending in late November despite hail recorded in the 43rd week.

Additionally, the share of airfreight exports increased from the usual 15-18% to 46% in 2023, with foreign buyers often willing to bear the additional costs to secure supplies.

Early supplies of Zimbabwean blueberries depend on global supply levels, especially from Spain and Morocco. Zimbabwe can also meet the South African market's demand in April and May, serving wealthier customers. The industry has also successfully exported to Middle Eastern and Far Eastern markets such as Malaysia, Hong Kong, Singapore, Vietnam, and Indonesia.

Zimbabwean producers use next-generation varieties, mainly Australian, representing most of the production. Local projects collaborate with international partners for the commercialization of the berries.

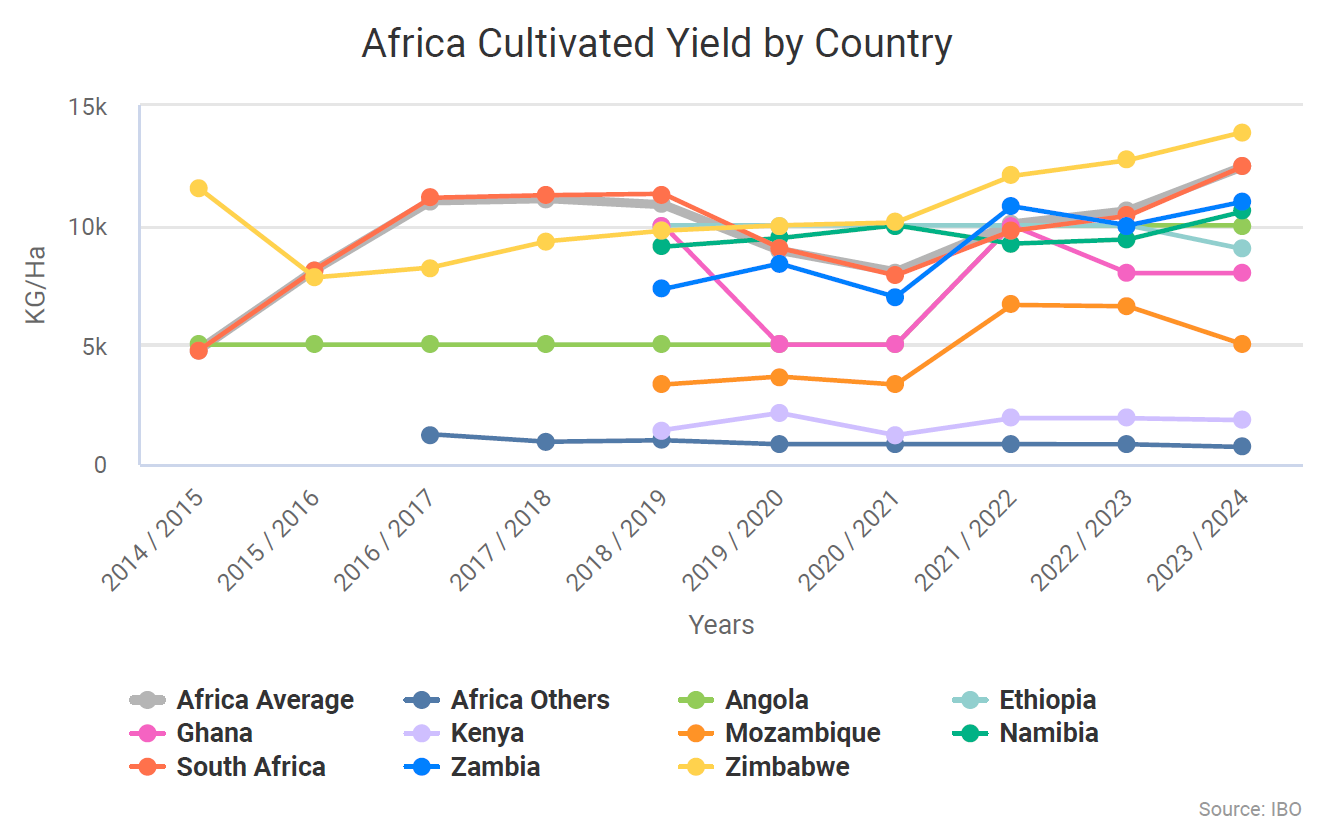

Zimbabwe benefits from excellent climatic conditions and local expertise, with experienced producers in other intensive crops such as mangetout and sugar snap peas. Young fields are expected to reach yields of at least 20 tons per hectare by their third year.

Substrate planting experiments are also underway in the eastern Harare area, which could ensure even higher yields. However, financing difficulties are pushing many producers toward the more affordable option of open-field plantations.

Cold chain infrastructure is adequate, but logistical issues, such as those at South African ports, pose a challenge. Producers are seeking varieties with a shelf life of over 35-40 days to improve fruit preservation.

An additional challenge is the unstable power supply and rising electricity costs, which are driving producers to invest in solar panels for energy self-sufficiency, aligning with the sustainable practices demanded by retailers.

Namibia

The nascent blueberry industry in Namibia, where most production is concentrated in the north near the border with Angola, faced a disastrous 2023/24 season due to weather issues. Coastal areas of the country are known for frost, which is why the main projects in the north – the most established near Rundu and others in Divundu and the Caprivi Strip – are all inland, in areas historically less prone to frost.

Producers favor these areas for better water access and abundant labor, despite better logistical conditions offered by coastal locations.

However, after 30 years without a true frost in inland northern Namibia, a severe event occurred that, according to a producer, "practically destroyed most of the crop." In 2023, production volumes were expected to rise but instead saw a significant decline.

Despite this event, significant projects are underway in both northern and southern Namibia, which should lead to a substantial increase in exports in the coming years.

The production window in northern Namibia is very similar to Zimbabwe's, with the first fruits available by late May or the first week of June, a peak in August, and a conclusion by the second week of September.

Harvesting generally ends in early October when tropical storms can affect quality. This earliness has attracted international investments from South Africa, the United States, Germany, and likely other countries.

In the desert region of Aussenkehr, in southern Namibia, known for table grapes, substrate trials with varieties from various global breeding programs are underway. These tests also serve to showcase new cultivars to visiting South African producers.

The latitude of southern Namibia is similar to that of Bloemfontein in South Africa, so harvests occur about a week earlier than in the Western Cape region.

Zambia

In Zambia, some producers and investors are trying their luck, with production potentially starting as early as April. The country is highly fertile but landlocked, posing logistical challenges.

Although it has a strong agricultural tradition, the blueberry industry is still in its infancy, and the country is acquiring the necessary knowledge to grow blueberries and understand their behavior in local microclimates.

Despite the difficulties faced by the industry, some operators believe that Zambia will experience a blueberry boom, thanks to its production window similar to Zimbabwe's and starting from a much lower base than its southern neighbor.

Its earliness and potential have attracted some of the world's leading blueberry industry companies to invest in the country.

Currently, the highest concentration of production is around the capital Lusaka, less than 500 km northwest of Harare, Zimbabwe's capital. Other production areas are in Mkushi and Livingstone.

In July 2020, Zambia became the first African country to gain direct market access to China, with the first shipments made in November of the same year. However, this trade route has stalled, as Zambia did not at the time have access to the South African market, through which blueberries would have had to travel if shipped by sea. /

This requires the use of bonded warehouses, adding costs and complexity. Additionally, one of the country's main operators has taken a cautious approach with China, waiting to ensure shipments were of the highest quality and in sufficient volumes.

Zambia's ability to leverage access to the Chinese market became more feasible after finally gaining access to South Africa, although, at the time of writing, it is not yet known if this has led to actual exports to China.

Other Origins

Further north, trials are underway in equatorial states such as Uganda and Kenya, where there is potential for production from March to May. With evergreen, low-chill varieties, it is also possible to schedule a double harvest.

This is an abstract from the 2024 IBO Report. Click here to download the full report