This is an abstract from the 2024 IBO Report. Click here to download the full report

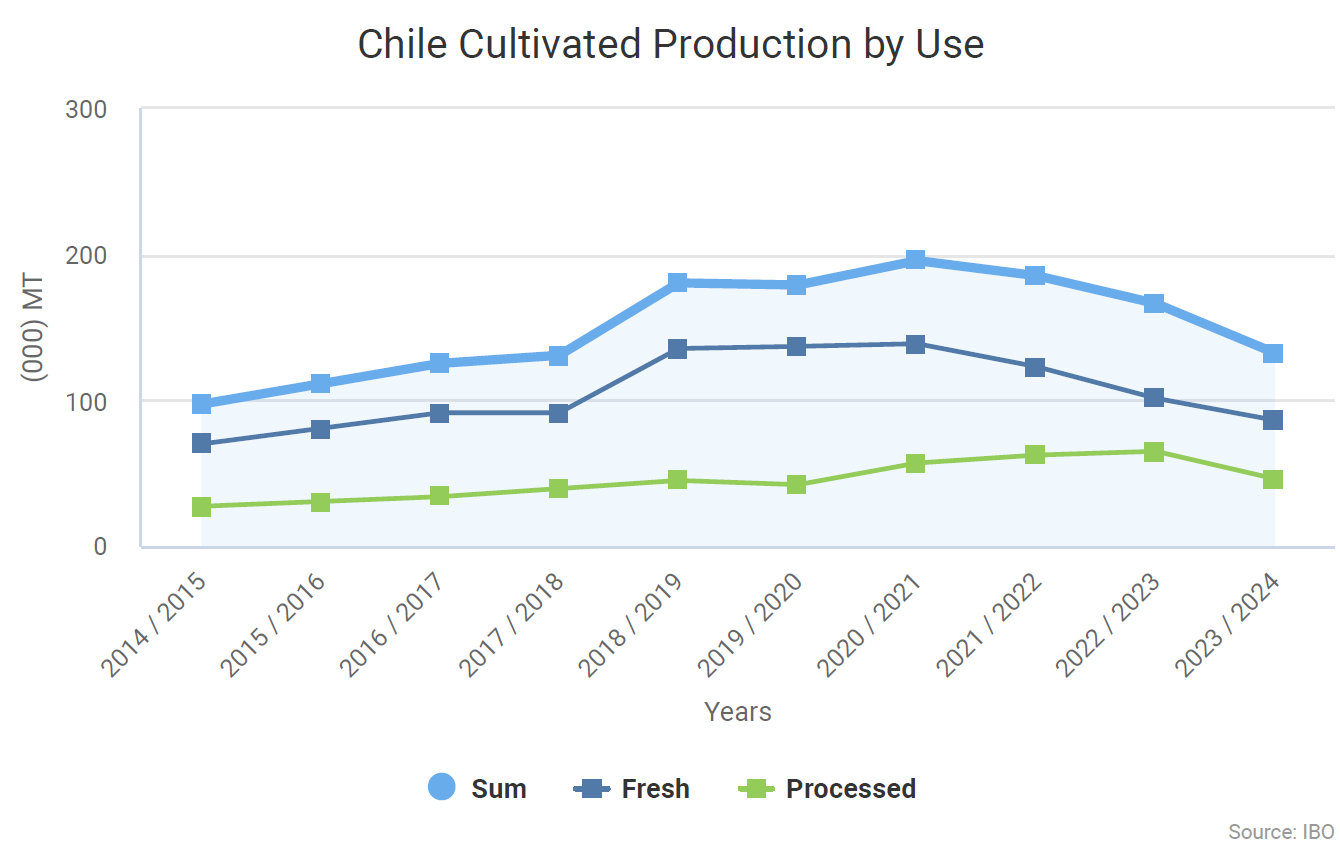

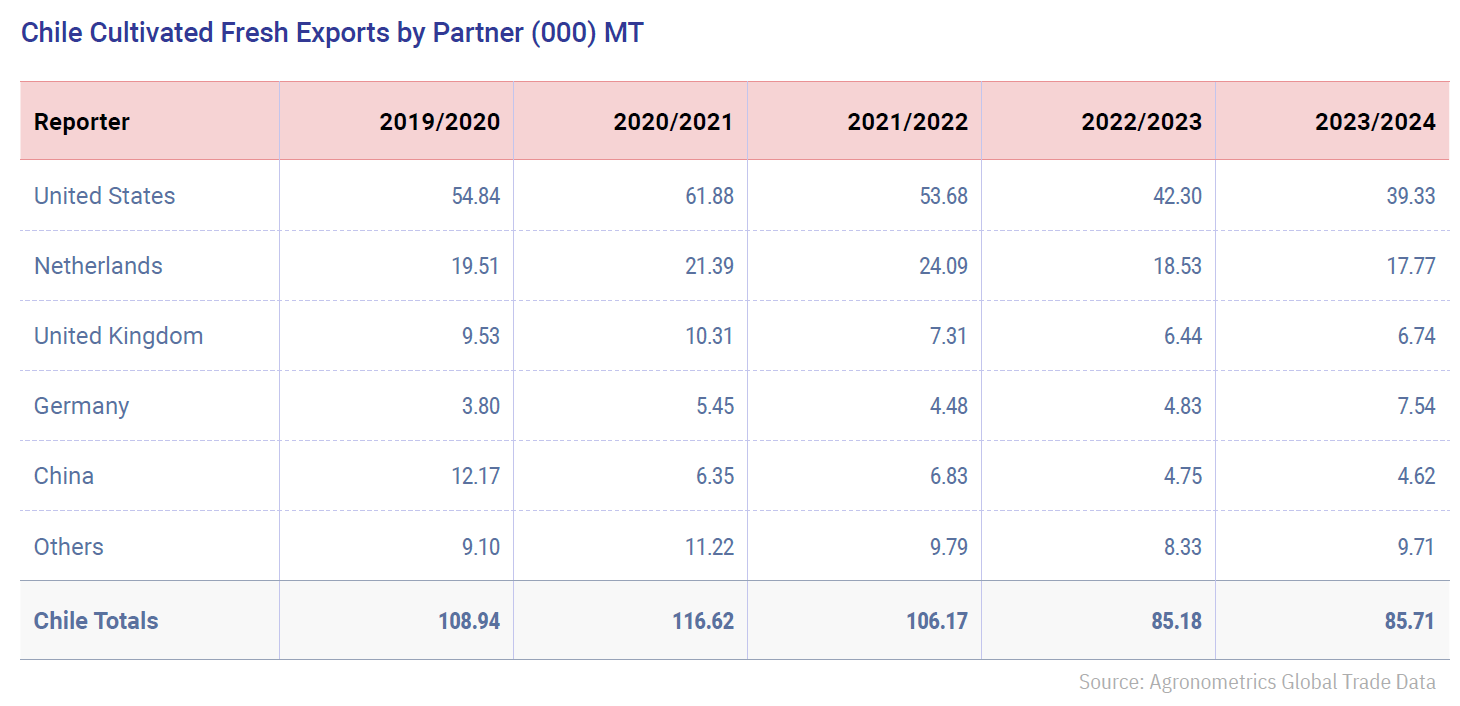

Chilean exports of fresh blueberries exceeded 86,000 tons in the 2023-2024 season, representing an increase over the initial estimate and a shift in the adjusted trend for Chilean supply in recent years.

2023/24 Season Overview

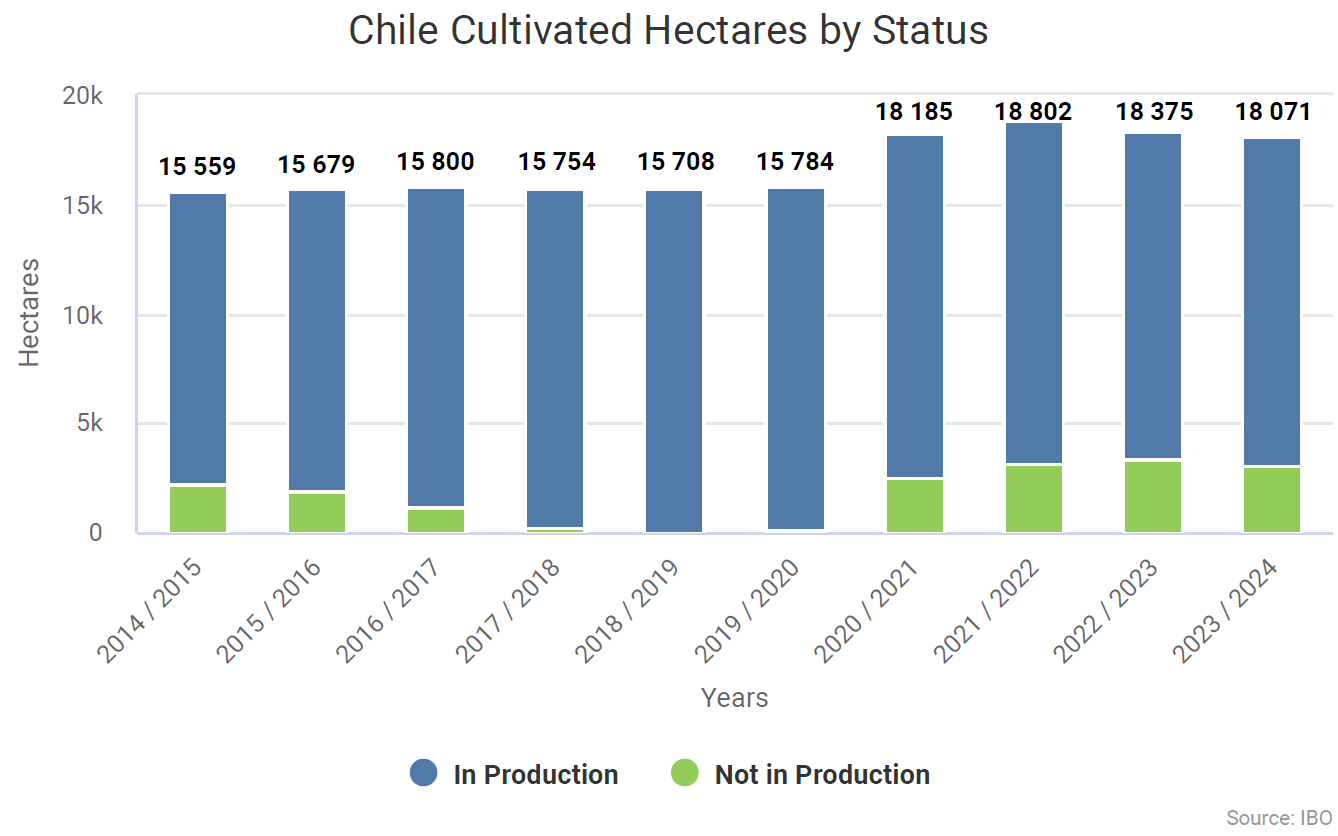

The initial estimate anticipated a further decline, primarily due to the balance between uprooted and newly planted hectares, as well as the migration of orchards no longer suitable for the fresh market to the frozen industry.

However, the supply situation in the market created opportunities for Chilean exporters, allowing exports to exceed initial estimates, highlighting the importance of Chilean supply for global markets.

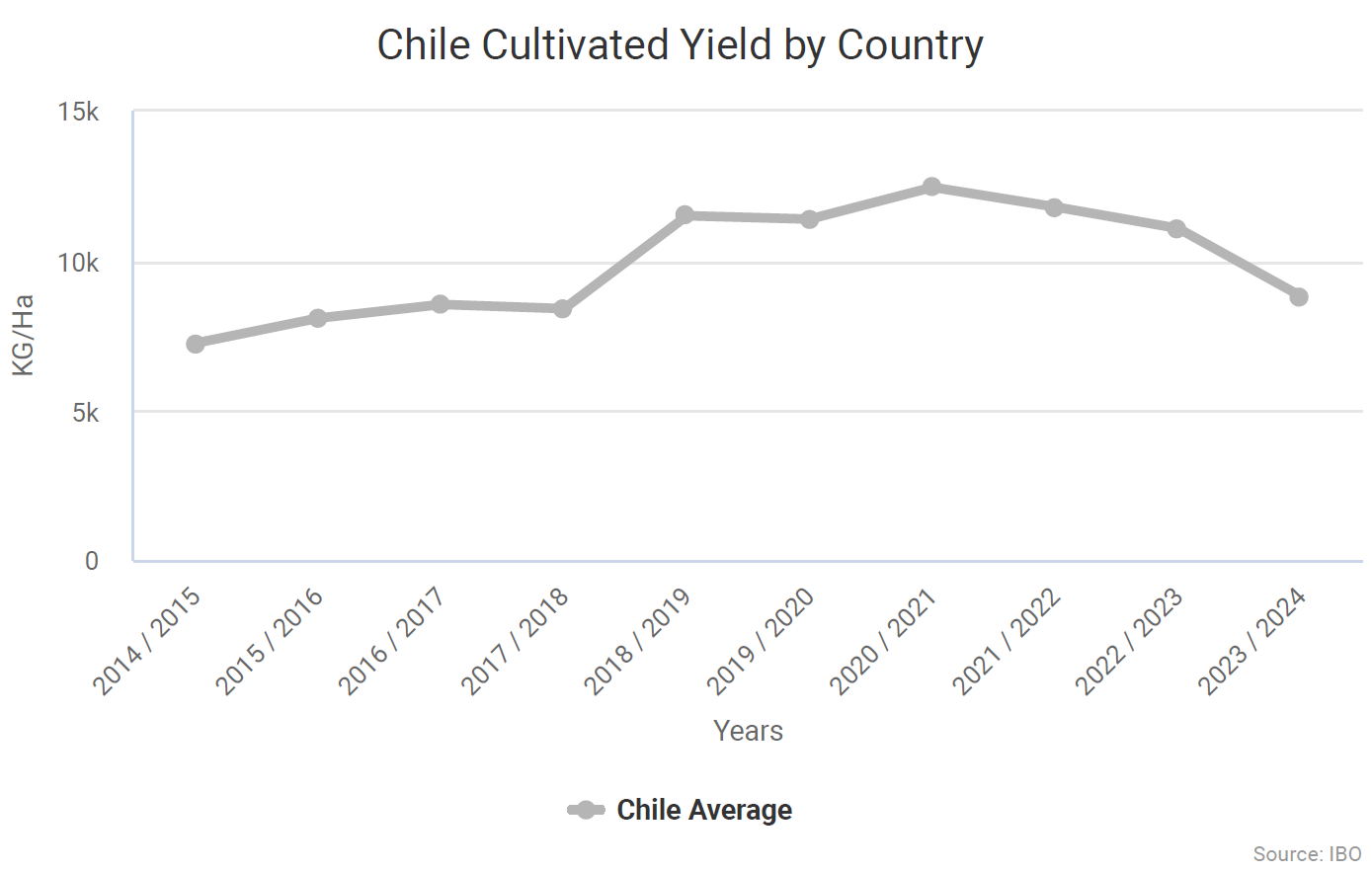

During the early phase of the season, the quality was very high, and the delay in fruit ripening allowed for a steady harvest pace and market arrivals with excellent quality and consistency.

The much-anticipated delayed production from Peru later entered the scene, which, combined with Chile's highly concentrated volume, resulted in aggregate volumes in export markets surpassing those of previous seasons, consequently impacting prices.

The Chilean blueberry industry must continue to consider a well-supplied market with offerings from diverse origins, where firmness and flavor are key factors for participating in this sector.

The Chilean Blueberry Committee continues to work with growers and exporters to promote a competitive supply from Chile. Given the current conditions that demand quality and productivity, the Committee is seeking logistical improvements and new technologies across various parts of the production chain, enabling room for Chilean supply to resume growth.

Chile has years of experience and data to make the best decisions regarding technologies and varieties, with variety replacement already starting to showcase a renewed varietal mix exported from Chile year after year.

For decades, Chile held the position of world leader in blueberry exports before its relatively competition-free market window was compressed by Peru and other countries like Mexico and Morocco.

A Period of Repositioning

The country has faced profitability and market positioning challenges for several years, amidst a slow transition to more performant cultivars that has yet to gain the necessary traction for a global impact and improvement of the industry's fortunes.

This change has been slow due to various factors, including the "fragmented" nature of an industry characterized by many small growers and export companies.

Notably, a Rabobank report highlights a consolidation within the sector on the management side, with the number of export companies decreasing from 190 to 110 over the five years up to 2022-23.

New Investments

Other influential factors include a climate more favorable to Northern Highbush cultivars with medium and high chill requirements, which take longer to transition from planting to commercial yield during the conversion to new varieties (although Southern Highbush cultivars are grown in some areas).

The complex commercial combination of rising costs, labor shortages, lower market prices, and higher interest rates has hindered obtaining loans to invest in new varieties.

In summary, margin compression and distinctive ROI dynamics, coupled with a cautious industry mindset, have contributed to delayed responses to competitive positioning opportunities within the Chilean industry.

In response, medium-sized growers are increasingly receiving loans from export companies to finance the replanting of orchards.

Chile as a Global Growth Driver

Chilean industry and expertise have helped lay the groundwork for the 52-week blueberry supply dynamic the industry experiences today.

Its investors and agronomists (alongside American and Spanish colleagues) were instrumental in developing the Peruvian sector and received some relief from their own issues during the 2023-24 season due to supply shortages from the northern neighbor caused by the El Niño weather phenomenon.

The warm weather did not affect Chilean production as intensely.

Unlike Peru, Chile's fresh blueberry exports decreased marginally (and much less than initially expected) in 2023-24, as exporters sought to capitalize on higher global prices.

Growers who had previously shifted their focus to processing due to low prices opportunistically returned to the fresh market, a predictable outcome given the circumstances.

However, this also undermined serious efforts to improve the reputation of Chilean blueberries.

Read more

Continue reading more abstracts from the 2024 IBO Report or download the full report: