This is an abstract from the 2024 IBO Report. Click here to download the full report

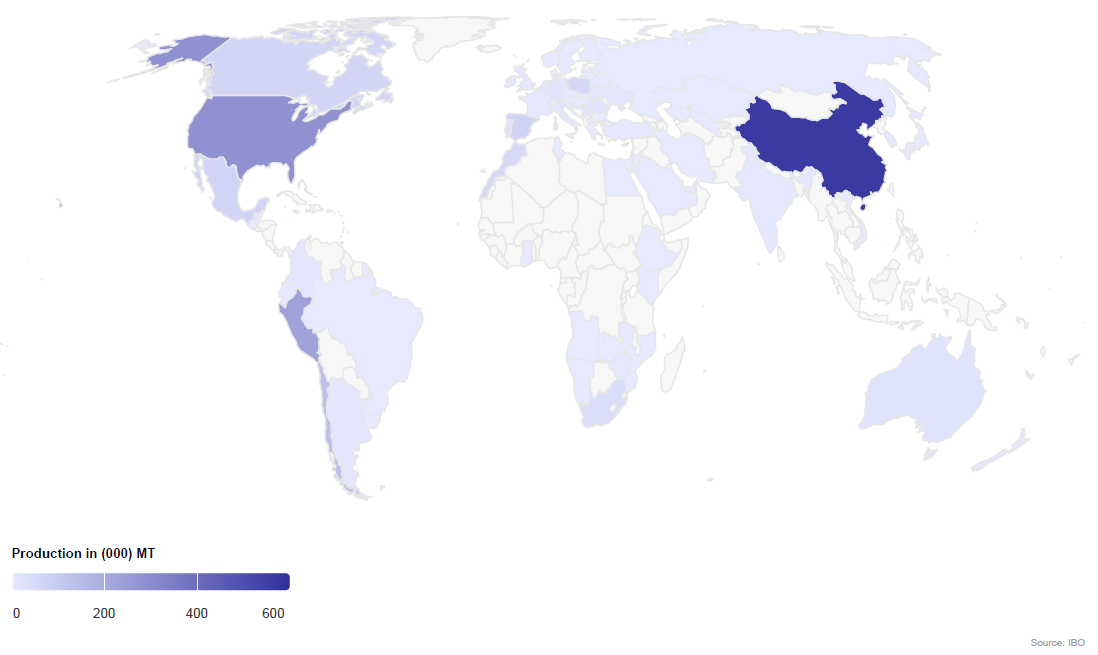

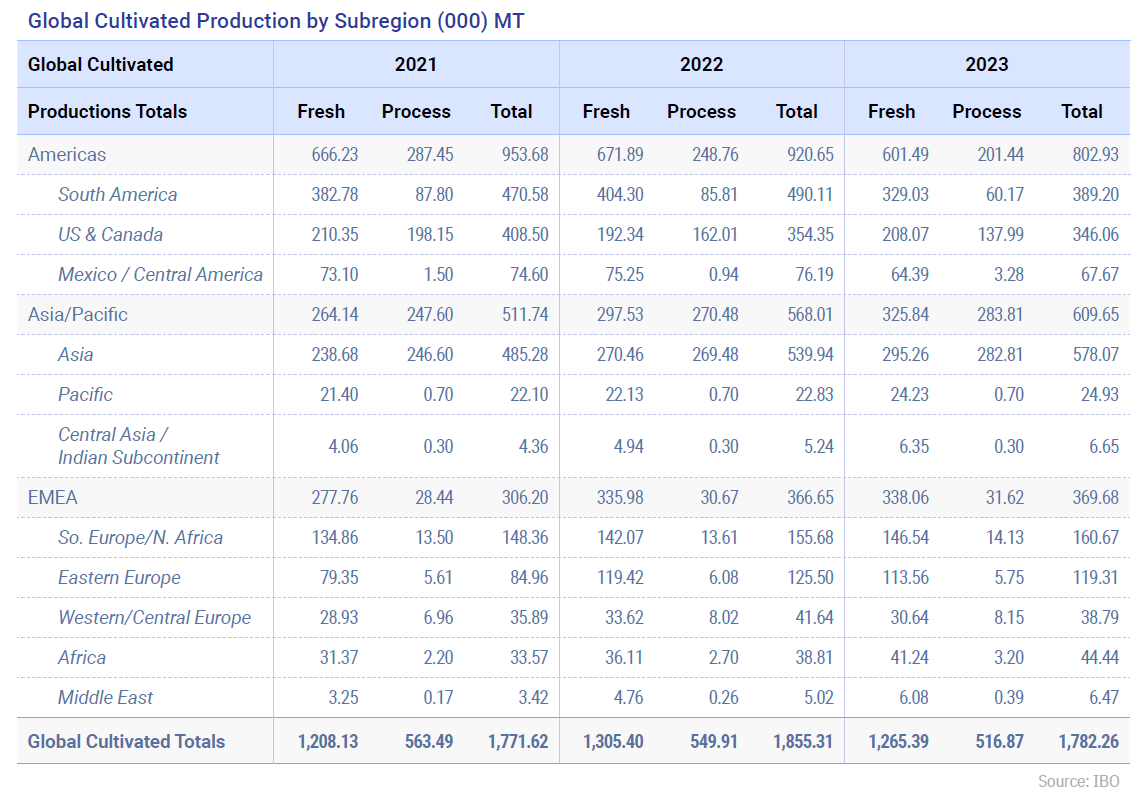

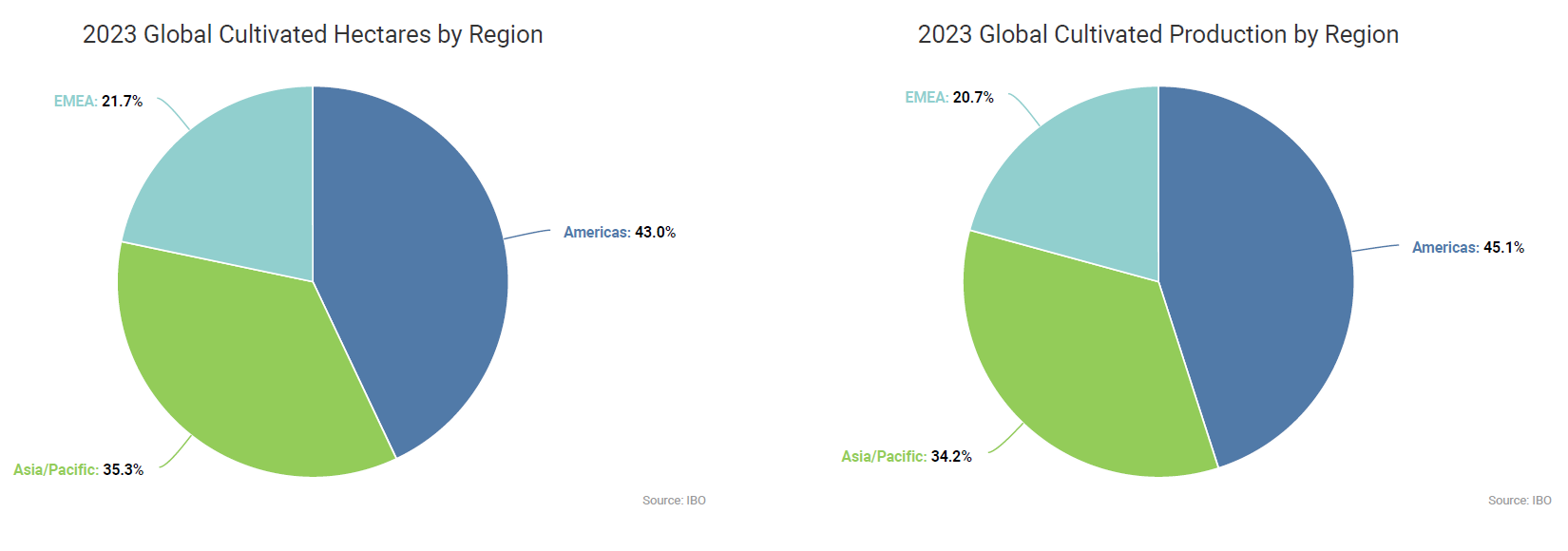

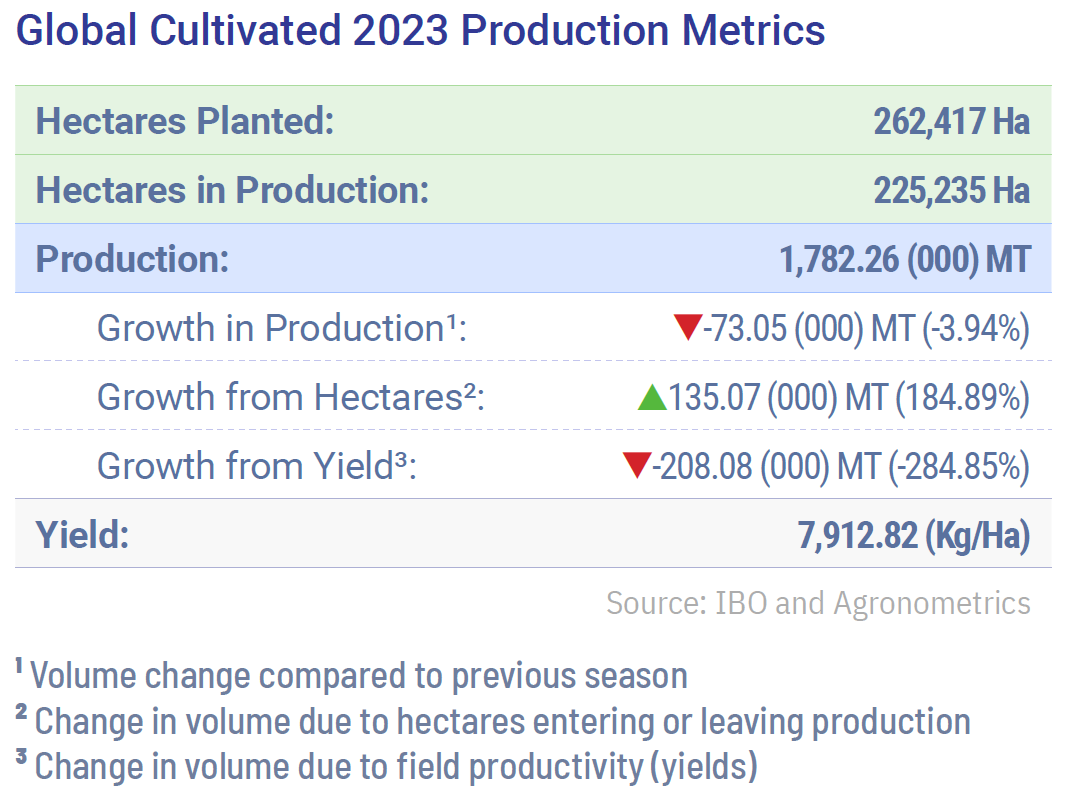

In 2023, global fresh blueberry production declined. The total global production was about 1,302,000 tons, a decrease of approximately 6% compared to the 1,323,000 tons recorded in 2022.

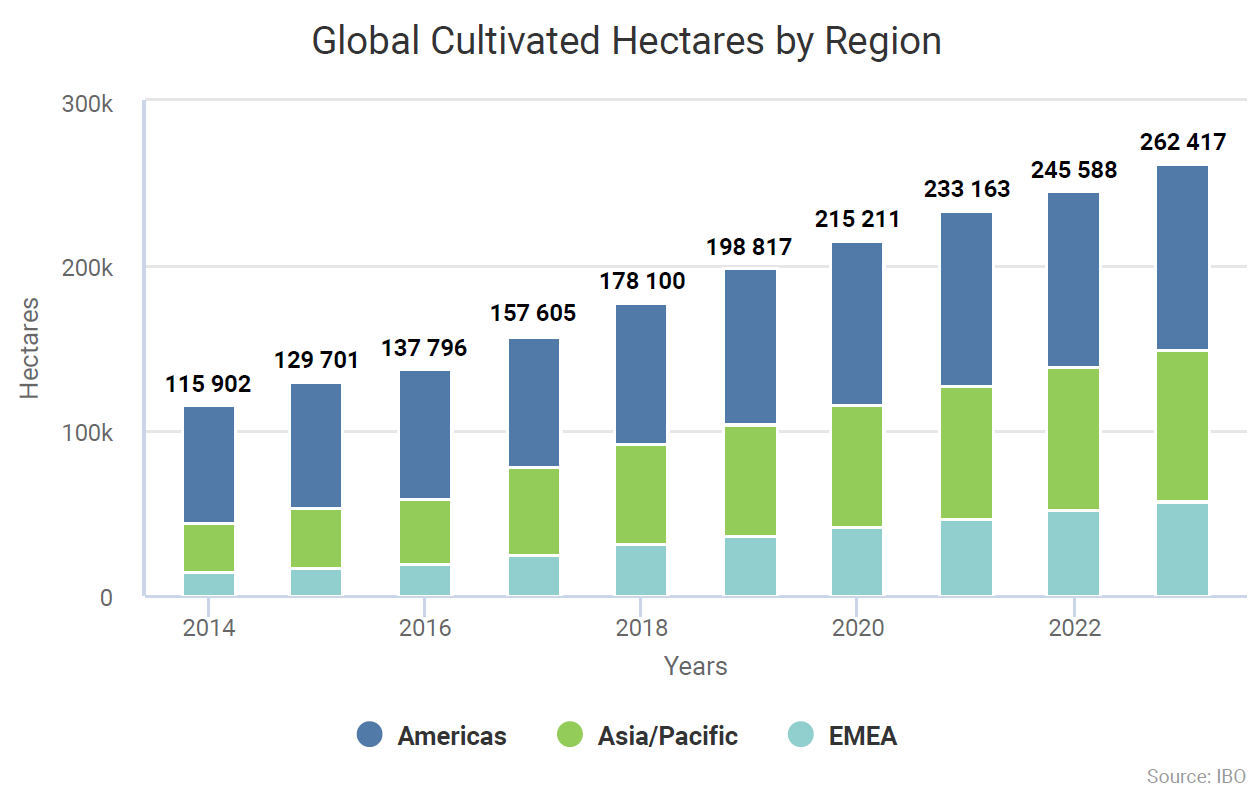

Production trends in the Americas

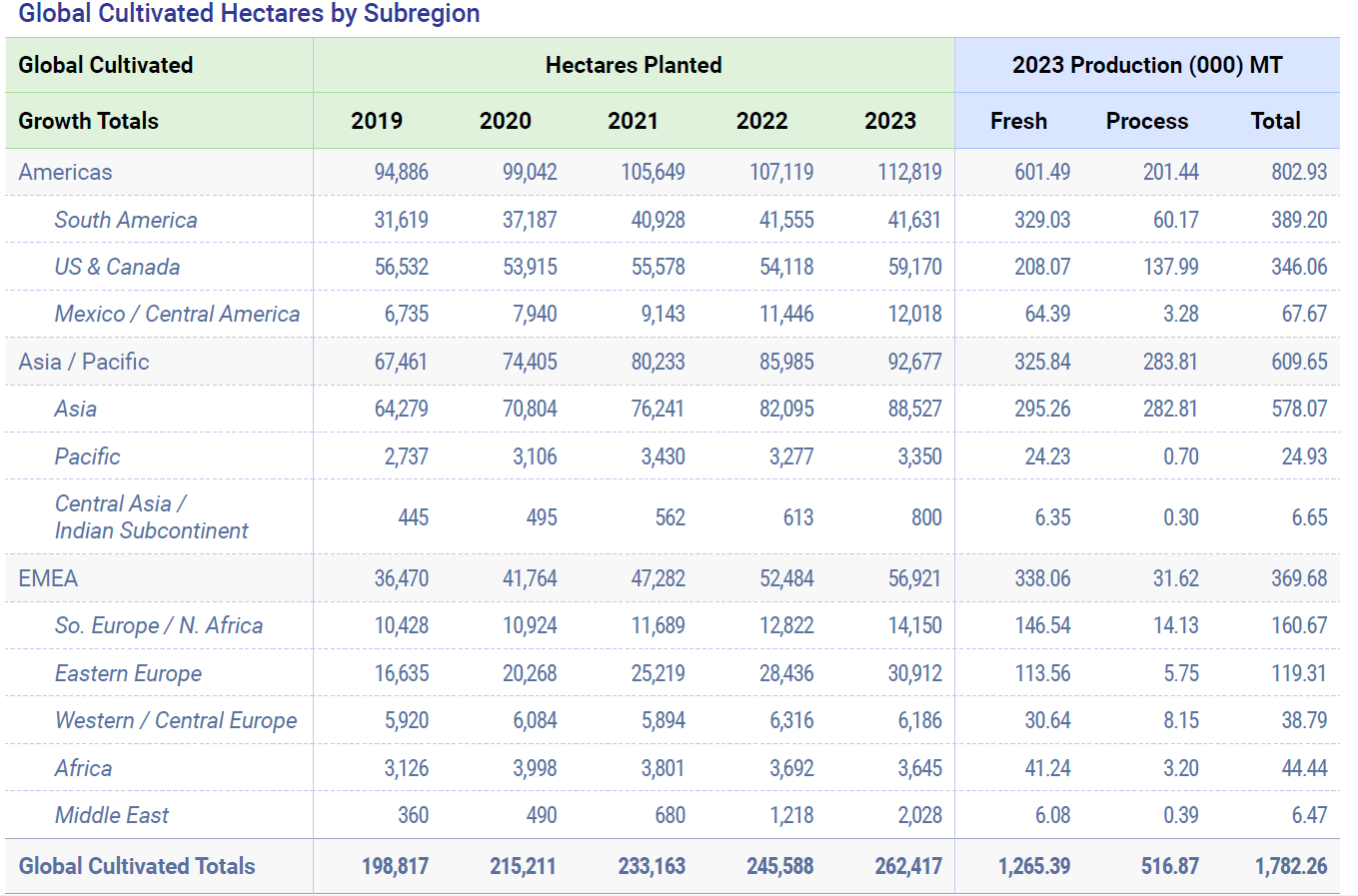

The Americas experienced a significant decline in fresh blueberry production, dropping to 601,000 tons in 2023 from 672,000 tons in 2022, a decrease of about 11%.

This decline was mainly driven by a sharp drop in production in South America, which totaled 329,000 tons, a significant decline from 404,000 tons in 2022.

This sharp decline is attributed to adverse weather conditions, particularly the El Niño phenomenon, which significantly impacted yields in Peru. Despite these challenges, South America remained an important producer.

Mexico and Central America recorded a slight decline, with production reaching 64,000 tons in 2023, compared to 75,000 tons in 2022.

The United States and Canada, on the other hand, saw an increase of approximately 8.3%.

Growth in the Asia/Pacific region

The Asia/Pacific region showed strong growth in fresh blueberry production, increasing to 324,000 tons in 2023 from 297,000 tons in 2022, an increase of about 9%.

Asia, driven by the significant contribution of China, continued to be the main driver of this growth.

The Pacific subregion also recorded a slight increase, reaching a production of 24,000 tons.

Situation in the EMEA region

The EMEA region showed solid growth in 2023, with fresh blueberry production rising to 376,000 tons compared to 353,000 tons in 2022, an increase of approximately 6.5%.

Southern Europe and North Africa led this growth, reaching a production of 164,000 tons.

Africa recorded a significant increase, contributing 44,000 tons.

Eastern Europe showed a modest increase, with production reaching 131,000 tons, compared to 134,000 tons in 2022.

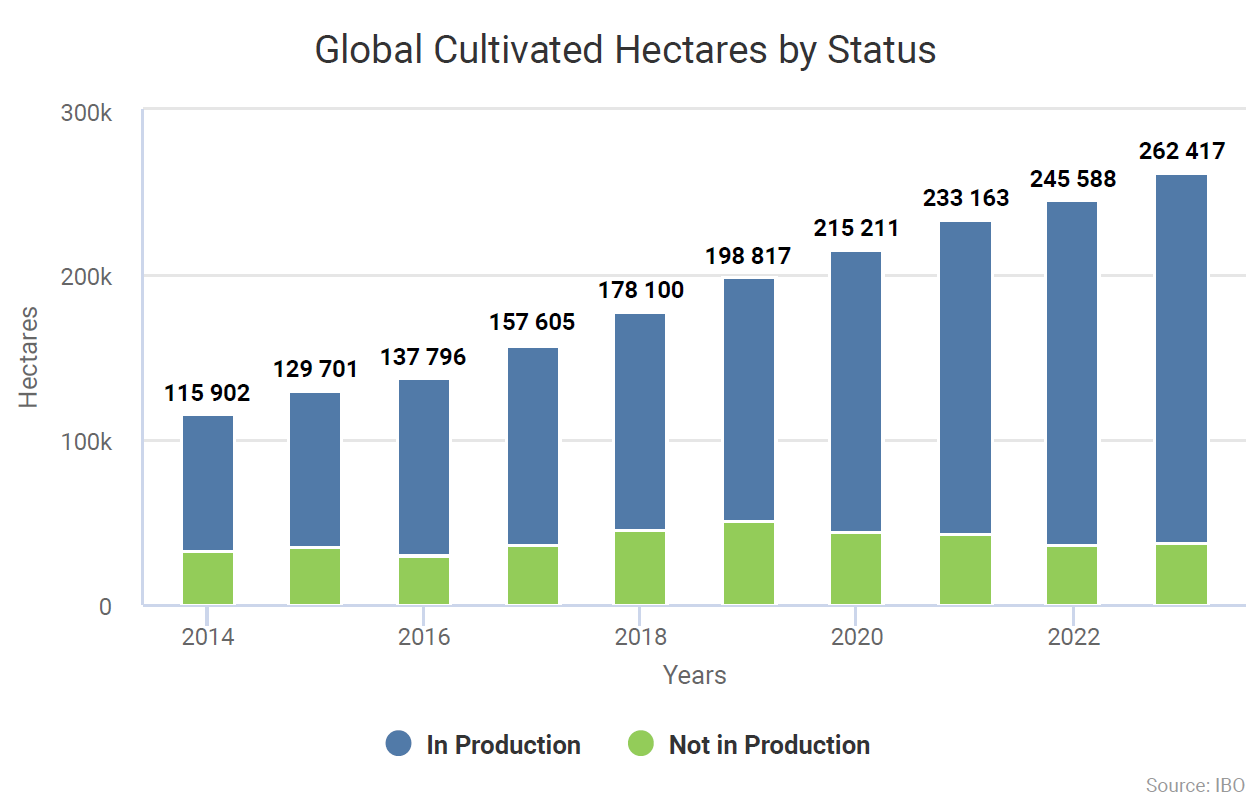

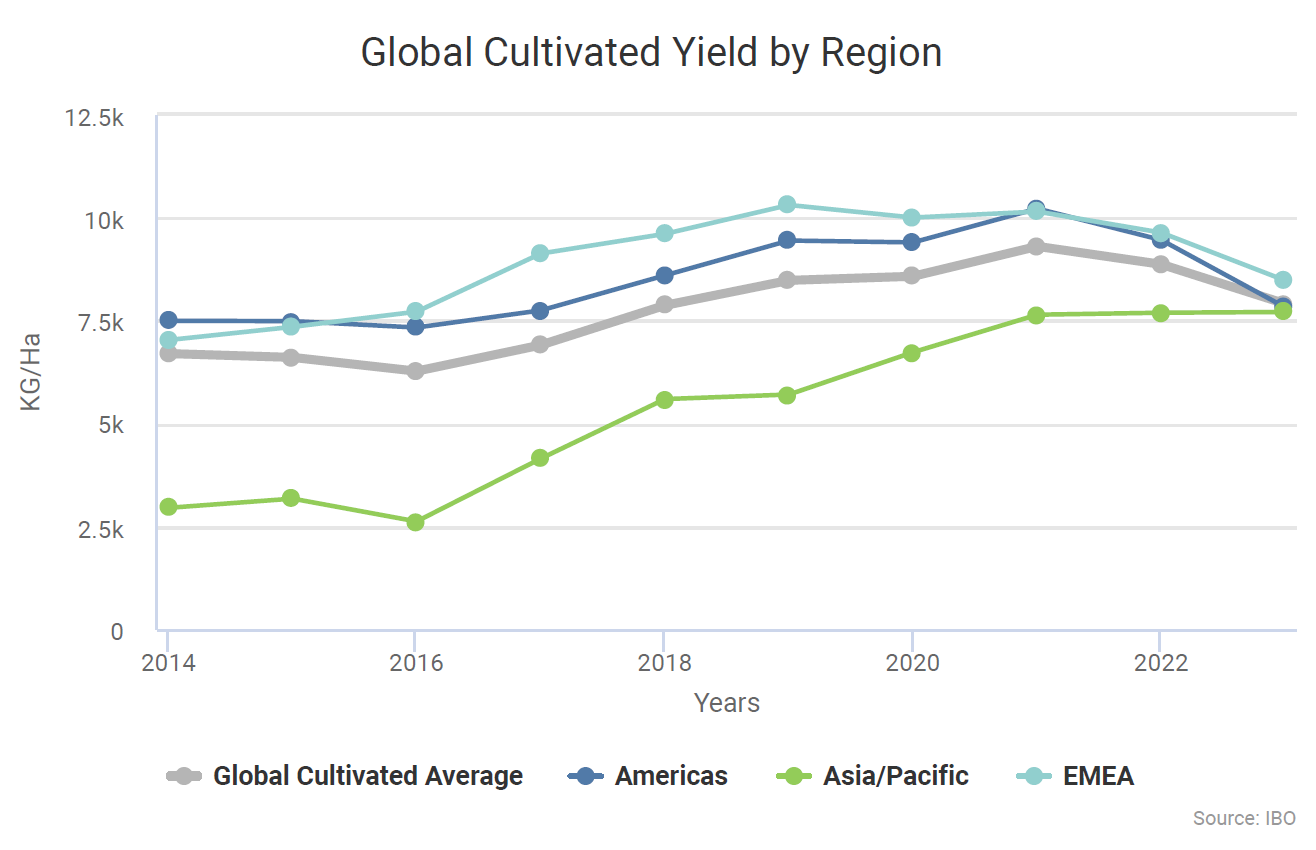

Future prospects of the sector

Despite a decline in global production in 2023, the continued expansion of fresh blueberry consumption is an encouraging sign.

Established regions like Peru have faced significant challenges, but emerging regions such as Africa and the Indian subcontinent are gradually increasing their presence in the global market.

This diversification and resilience in consumption patterns highlight the potential for future growth and greater stability in the blueberry sector.

Read more

Continue reading more abstracts from the 2024 IBO Report or download the full report: