Macfrut 2025 will be an opportunity to present visitors with some exclusive data on the price/quality positioning of the main Italian retail chains. The analysis will be based on data from the Italian Berry Retail Monitor, which has been collecting data on the assortment of berries in large-scale distribution (GDO) since 2020 through direct visits to stores.

In 2024, 3,910 observations were conducted with repeated visits to 241 different stores, covering 12 cities in Northern Italy on a rotating basis, with a total of 48 weekly visits. The most significant retail chains were visited in each city, considering different formats within the same group, including convenience stores, supermarkets, discount stores, and hypermarkets.

To ensure sufficient significance, the analysis presented at Macfrut has been limited to the most widespread retail chains: Aldi, Carrefour Market, Conad, Conad City, Conad Superstore, Coop, Dpiù, Esselunga, Eurospar, Eurospin, Il Gigante, IN's, Ipercoop, Lidl, MD, Pam, Penny, Rossetto, Spazio Conad (listed in alphabetical order). More than 200 evaluations were conducted for each chain during the analyzed period.

Measuring Assortment Competitiveness

The competitiveness of an assortment is measured by its ability to offer consumers an attractive price/quality ratio.

To assess the competitiveness of Italian GDO chains, Italian Berry has developed a price/quality index for each product. The index also takes into account different segments (standard, organic, premium, zero residue).

The analysis presented at Macfrut will be based on data on visual quality, measured on a scale from 0 to 3. Specifically, the scale is as follows: 3 = no significant defects; 2 = healthy product but not in ideal condition (not fresh, wilted, shriveled, dull, without bloom); 1 = presence of damaged berries and juice; 0 = presence of rotten berries and mold.

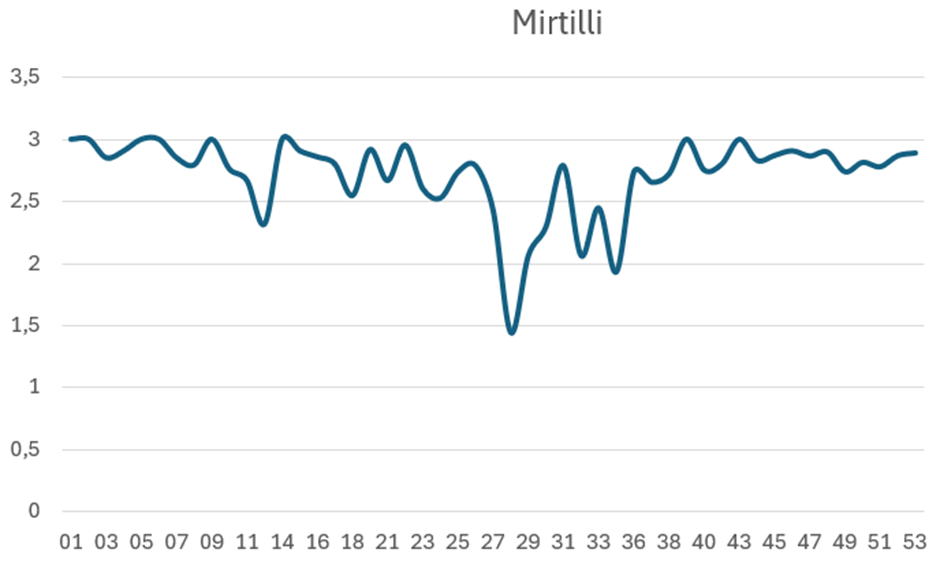

Weekly trend of quality (0-3) of the blueberry assortment in Italian GDO (2024)

For example, in 2024, blueberry quality experienced a decline precisely during the peak season of Italian blueberries (June-August). The downward trend in quality is also evident as the Chilean (weeks 1-12) and Spanish (weeks 13-25) seasons progress, with an upward repositioning starting with the Peruvian season from September.

Price Positioning by Retail Chain

Quality data will be cross-referenced with competitive positioning data, calculated based on the price of each chain compared to competitors.

This will allow for the presentation of a price strategy map for each product category within the berries segment, covering the major Italian retailers.

Price/Quality Index Trends by Retail Chain

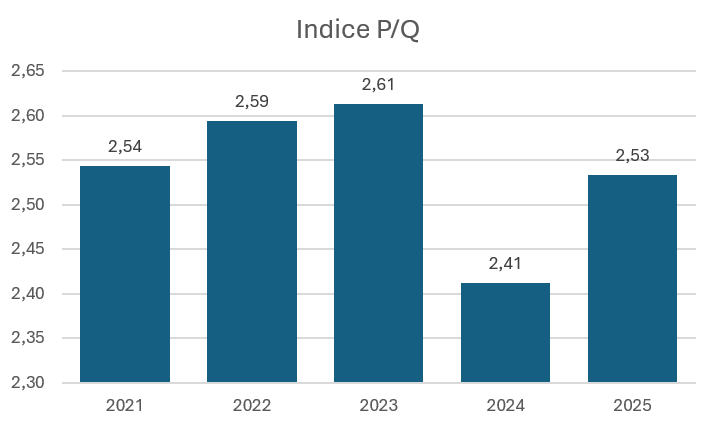

By combining quality and price data, the competitive landscape of the berry category in Italy is analyzed based on the price/quality index of the leading retail chains.

In 2023, this index reached its highest average compared to the previous two years, with relatively low variability, suggesting a general improvement in ratings. The 2024 data, however, showed the highest dispersion, with significant fluctuations between minimum and maximum values, highlighting the difficulty of interpreting a season affected by various challenges in product quality and availability. The data collected so far in 2025 indicate a recovery compared to the decline observed in 2024.

Some chains exhibited greater stability, while others recorded significant fluctuations. The most notable changes in evaluations occurred between 2023 and 2024. In 2025, some chains appear to have recovered, while others continue to show a downward trend.

The complete data by product and retail chain will be presented at Macfrut 2025 as part of the event program taking place in the Berry Area, the pavilion dedicated to the berry supply chain.

Berry AreaThis article is part of a series dedicated to Berry Area in co-operation with Macfrut 2025. This content is in support of the event which will take place May 6-8, 2025 in Rimini Expo Centre, where the Berry Area stands as a reference point for all those seeking innovative solutions for the production and marketing of berries. 👉 Learn more about the Berry Area at this link. |