This is an abstract from the 2024 IBO Report. Click here to download the full report

Colombia

Colombia may not yet be a significant player in the global blueberry industry, but its proximity to the United States, growing domestic demand, and ability to produce blueberries almost year-round have made it an emerging industry of interest for several years.

This is particularly relevant considering Colombia's recent success in exporting other fruit crops such as avocados, limes, and physalis/goldenberries. Additionally, the operational and logistical models of the highly competitive cut flower industry provide both a reference and experienced horticultural operators.

The blueberry export industry in Colombia has yet to register significant growth, mainly due to the inability of supply to meet growing domestic demand, as well as the slow pace of new plantations.

To understand how strong the domestic market is, in 2023 imports increased 29-fold compared to the previous year, reaching 352 tons, primarily from Peru and to a lesser extent from Chile.

The significant increase follows a drop in import volumes the previous year but is still almost three times the annual record set in 2021. Moreover, in the first two months of 2024, Colombian imports increased by 136%, reaching 130 tons, quickly surpassing all of 2021's imports.

This is even more remarkable considering it immediately follows the peak months of domestic production (November and December) and coincides with record exports of 99 tons in January 2024, just shy of the 100 tons exported in December 2020.

These numbers are not significant at a global export level and, for comparison, are far below Argentina, which has also seen a decline in exports over the last decade.

However, domestic sales volumes are growing strongly. While many Colombians buy fruit at open markets, where it is unlikely to find high-quality blueberry varieties, some sources have reported an increase in premium blueberry sales in certain supermarkets.

“I see differentiation in Colombia and Ecuador. Supermarkets are now willing to pay for a much higher-quality product, something I’ve never seen before,” a source said.

About 95% of the national volume of blueberries in Colombia is consumed locally, mainly fresh, but there is also a growing industrial processing market, with an increasing number of processed foods including blueberries as an ingredient.

Colombia's export prospects depend on implementing a systemic approach for its main market, the United States, with some growers currently undergoing monitoring and testing to achieve this.

Currently, protocol options for shipping to the United States include methyl bromide treatment upon arrival, which is less preferred, or cold treatment during transit for 14 days. In 2023, a breakthrough occurred when industry representatives announced the approval of a systemic approach by the United States, though it is expected to take two years to implement.

This could reduce the time from harvest to arrival in Florida ports to seven days. However, road transportation within Colombia is expensive, and combined with maritime shipping costs, the difference compared to air transport is less pronounced than in other growing regions.

Last year, market access to Canada was achieved, with the first trial shipments sent in early 2024. There are also small signs of export diversification to countries like Thailand, Saudi Arabia, Panama, and Curaçao.

The availability of plant material, particularly proprietary varieties, further hinders the ability to bridge the internal supply gap. As in many nascent industries, Biloxi is the predominant variety, followed by Emerald, Legacy, and Victoria, cultivars losing popularity among retailers.

Growers would prefer to plant other varieties, but there are long waiting lists at nurseries to obtain more recent genetic material. Companies affiliated with major blueberry firms or breeders from the United States, Chile, Spain, and Australia are producing limited quantities of proprietary genetics and conducting trials.

Over the past year, no more than 30 hectares of new blueberries have been planted, mainly with Emerald and Legacy varieties, but nurseries forecast an increase in orders over the next 12 months.

Although blueberry cultivation in Colombia dates back to the 1980s, significant growth only began in the late 2000s. Unlike the development of the sector in Peru, which leveraged low-chill genetics along the coast, international investments in Colombia have planted at altitudes between 2,600 and 3,000 meters above sea level, using the "high-altitude tropical blueberries" branding.

The cultivation systems resemble the no-chill evergreen production of central Mexico but without seasonality. Production has three annual peaks: the first and largest in November-December, followed by May-June and September.

Most of the production is concentrated in the highland plateaus of Boyacá and Cundinamarca, north of the capital Bogotá, where minimal variations in daylight hours throughout the year allow for pruning targeted to the needs of farm managers.

However, it is a complex region for production, with cold, rainy nights and hot days. While open-field cultivation is the standard for most crops in Colombia, those growing in protected systems prefer macro-tunnels similar to those used in Mexico rather than greenhouses, which still represent part of the production.

The rest of the plantations are divided between the department of Antioquia – where a recent census revealed a cultivated area smaller than previous estimates – and the south of the country near the Ecuadorian border.

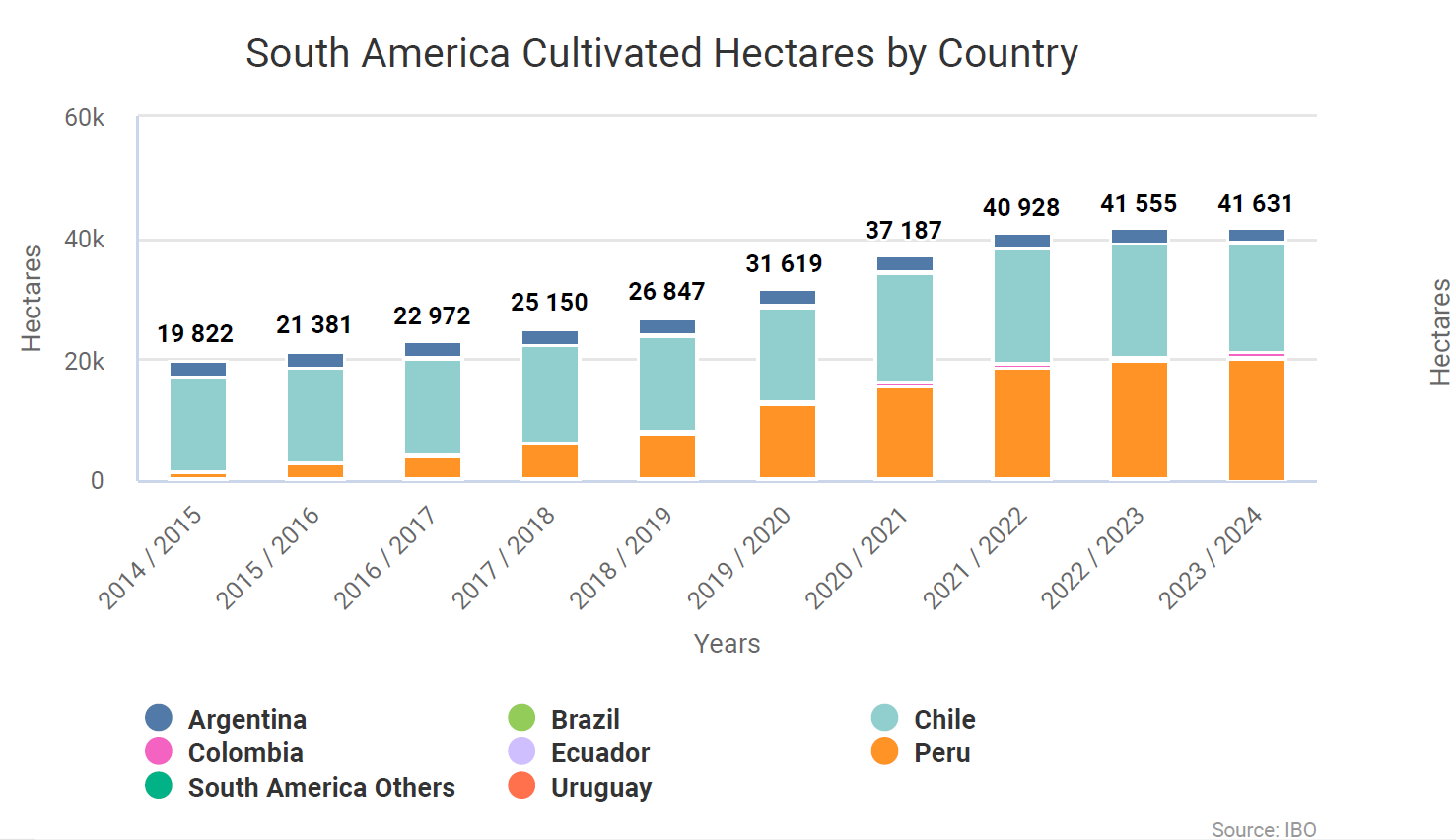

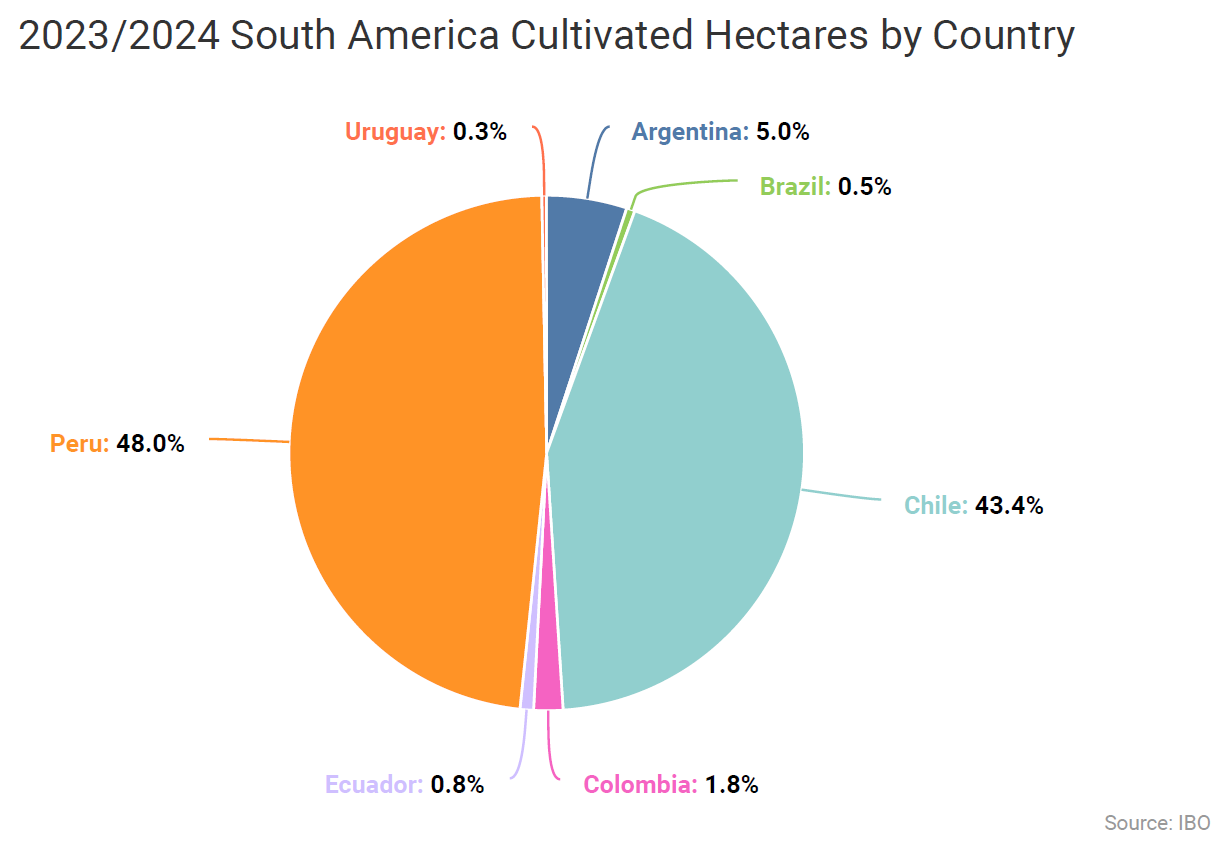

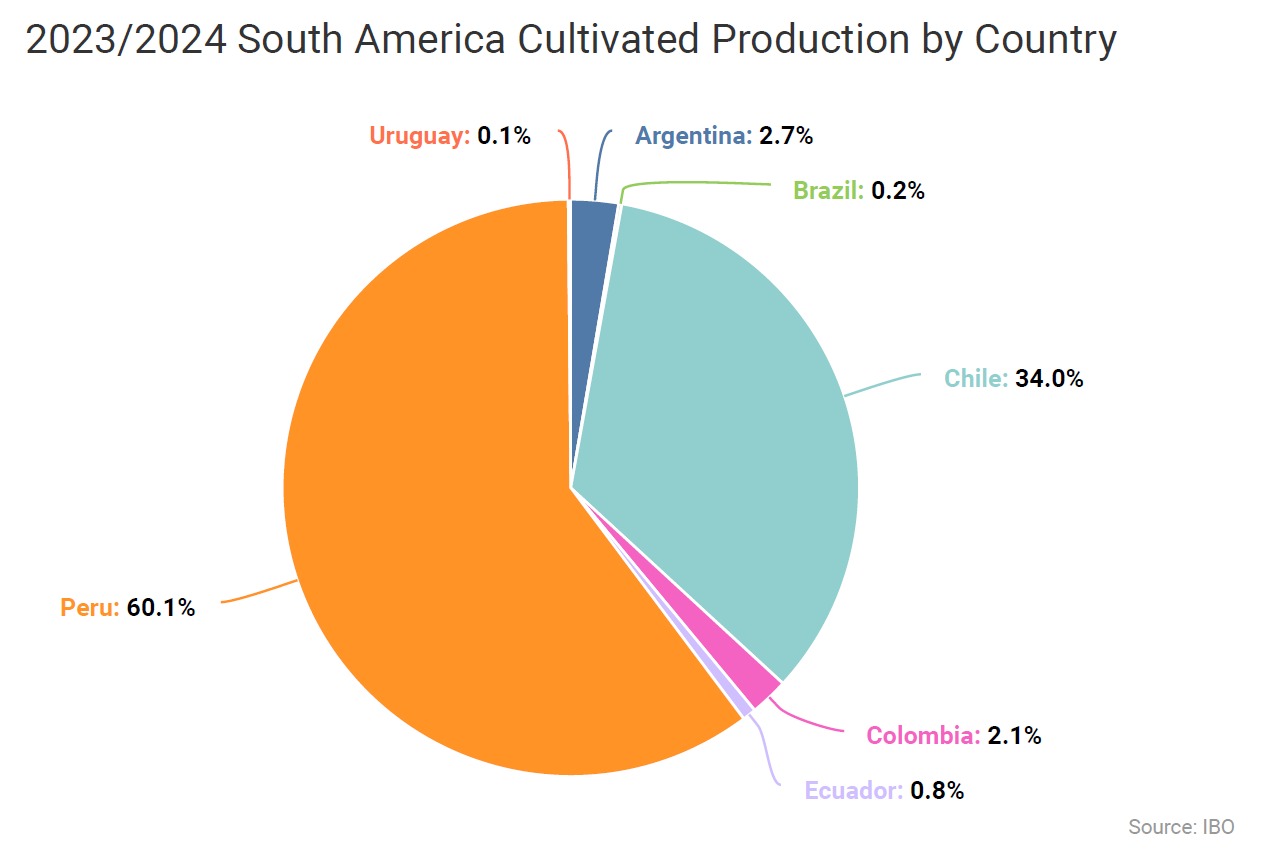

Blueberry plantations in Colombia have grown about tenfold since 2016, with an industry today larger than longstanding South American producers like Uruguay, but still much smaller than Argentina.

It is estimated that there are around 600 growers in the country, but only three with farms larger than 20 hectares. The largest of these growers accounted for the highest share of the emerging export program, focusing primarily on the United States.

New domestic and foreign investments foresee larger plantations over the next two years, including a joint venture with proprietary Australian varieties to reach 50 hectares planted within two to three years, alongside initiatives supported by the United States and Chile.

Ecuador

The blueberry industry in Ecuador is much younger, having started in 2015, with production distributed along the Andes in various locations on both sides of the equator. There are also experimental plantations in coastal areas like Santa Elena, Manabí, and El Oro, the latter two more often associated with the world-leading banana sector.

As in Colombia, Ecuador is capable of producing blueberries year-round and has a nascent export industry, though most production is sold domestically.

Approximately 95% of Ecuador's blueberry plantations are currently concentrated in the Andes, and most of these plantations are still very young. Ecuadorian and multinational companies are conducting trials and tests with new varieties to meet the demands of foreign markets.

The varietal mix consists of about one-third Biloxi, 27% Atlas Blue, and 13% Emerald, with other varieties planted, including Apolo, Stellar, Presto, Jewel, Legacy, Star, Eureka, and Dazzle.

Read more

Continue reading more abstracts from the 2024 IBO Report or download the full report: